Withdrawal from Account 2 to. Malaysians can withdraw their EPF fund when they reach fifty 50 years old from Account 2.

Epf Withdrawal Rules 2021 Partial And Full Moneychai

You were able to withdraw the 100 EPF corpus amount after the retirement at the age of 55.

How much can i withdraw from epf at age 50. Withdraw via i-Akaun plan ahead for your retirement. Minimum transferred amount is RM 100000. However an individual can apply for an early pension at the age of 50 years as well.

How to withdraw EPF money Malaysia. But the pension amount would be lower than the regular pension. EPFO allows withdrawal of 90 of the EPF corpus 1 year before retirement provided the person is not less than 54 years old.

This means that if you retire at age 58 youd be able to withdraw 90 by age 57. A member can withdraw the full amount from their Akaun 2 when they turn 50. Age 55 Years Investment Application can be made anytime.

Application through i-Akaun Member. The accumulated EPF corpus can be defined as the balance that has been gathered by the employees contributions which is 12 of his basic salary the employers contribution which is 367 out of a contribution of 12 the employer contributes 833 to the Employees Pension Scheme and the remaining 367 to the Employees Provident Fund. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50.

The Employees Provident Fund EPF has enhanced and simplified its policies to enable members aged 55 and 60 to make partial withdrawals of any amount at any time from next January. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. But the withdrawal must be made within one year of retirement superannuation whichever is later.

Subscribers can also withdraw hisher pension before meeting the age of 58 and that is known as reduced pension. Although the EPF corpus can be withdrawn only after retirement early retirement is not considered until the person reaches 55 years of age. The Employees Provident Fund EPF.

Required to retain minimum of RM100000 in Akaun 55. Withdrawal from Account 2. An employee can also withdraw 90 of the PF accumulation both employee and employer contribution after 54 years of age.

An EPFO member can withdraw upto 90 of the EPF amount at any time after attaining of the age of 54 years or within one year of his actual retirement on superannuation whichever is later. 8 rows KUALA LUMPUR 3 November 2016. In such cases the pension value is reduced to a rate of 4 per year until the employee reaches the age of 58 years.

This is opposed to the Age 55 and Age 60 withdrawal policies that allow members to withdraw a minimum of RM2000 once every 30 days. Registered onafter 1 Aug 1998. Transfer of withdrawal amount from Akaun 55 is only allowed to the appointed FMIs.

In such a case the monthly pension received at the age of 50 years of age will be lower than the pension that an individual will be eligible for at the age of 58 years of age explains Gupta. When one reaches the age of 50 years old he or she is allowed to withdraw all. This withdrawal rule was beneficial for those employees who prefers early retirement.

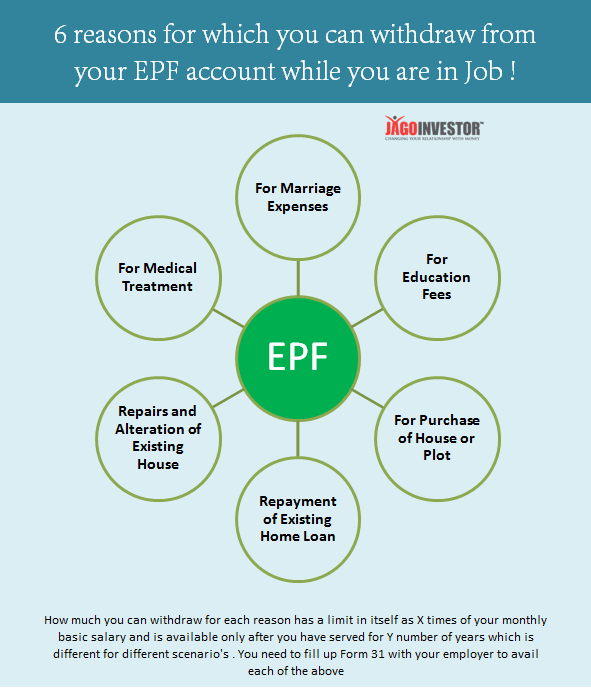

How To Withdraw EPF Money Reaching 50 Years Old. Nevertheless it is encouraged that members do not withdraw their savings in Akaun 2 at age 50 because once they withdraw it entirely its gone and they do not earn their annual dividends. A physically handicapped member can withdraw from his EPF kitty for purchasing equipment required to minimize his hardships.

The EPF assures members that no such steps on raising the withdrawal age. An EPF pension scheme member can withdraw early pension if he or she has attained the age of 50 but is less than 58 years old and if they have made an active pension contribution in EPF for 10 years or more. The account holder can request online for partial withdrawal.

Age 50 withdrawal. This can be done at 50 years of age if heshe has already retired at this age. Till today the minimum retirement age limit for EPF withdrawal was 55 years.

Takes note of the World Banks suggestion to gradually raise the age when members can make full withdrawal of Accounts 1 and 2 of their EPF retirement savings from 55 to 65.

Tax On Epf Withdrawal Rule Tax Flow Chart Paying Taxes

Epf Withdrawal Process How To Withdraw Pf Online Updated

Employee Provident Fund Epf Epf Eligibility Balance Claim Status

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Epf Withdrawal Taxation New Tds Tax Deducted At Source Rules Tax Deducted At Source Tax Help Financial Management

Epf Withdrawal Rules When Can You Partially Withdraw Your Pf Money

Epf Withdrawal Process How To Withdraw Pf Online Updated

Epf Withdrawal Process How To Withdraw Pf Online Updated

What You Must Know About Epf Rediff Com Get Ahead

How Much Can We Withdraw From A Employee Provident Fund Epf During This Crisis Quora

15 Benefits Of Having Epf Account

Premature Withdrawal From Epf Account Here S All You Need To Know The Financial Express

Epf Withdrawal When You Are Leaving India And Going Abroad Planmoneytax

How To View Epf Passbook And Track Contributions Interest Transfer Withdrawal

What Happens To Ppf And Epf When You Become An Nri

National Pension Scheme And Atal Pension Yojana Main Differences Pensions National Schemes

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Health Insurance Sec 80d Tax Deduction Fy 2020 21 Ay 2021 22 Income Tax Tax Forms Cash Management