As part of access to credit Prime Minister announced 2 interest subvention for all GST registered MSMEs on fresh or incremental loans. Interest Subvention Scheme for Incremental credit to MSMEs 2018 will be implemented over 2018-19 and 2019-20.

Free Import Of Room Car Freshners In 2021 Coding Chapter 33 Policies

Interest Subvention Scheme for MSMEs.

Interest subvention scheme for msme 2020. The Interest Subvention Scheme for Incremental credit to MSMEs 2018 which offers 2 per cent interest subvention for all GST registered MSMEs on. The scheme provides an interest relief of 2 per annum to. Interest Subvention Scheme for Incremental credit to MSMEs 2018 will be implemented over 2018-19 and 2019-20.

Ministry of MSME MoMSME has decided that a new scheme viz. 2 interest subvention for all GST registered MSMEs on fresh or incremental loans. Interest subvention on MSME loans extended till end of March 2021.

2020 and in the meantime settle claims based on internal concurrent auditor certificate. The interest subvention scheme was first announced in November 2018 for scheduled commercial banks and was to be under effect until the end of FY2020 spanning two financial years FY2018-19 and. 2020 1101 IST.

Government of India Ministry of Micro Small and Medium Enterprises MSMEs had announced the Interest Subvention Scheme for MSMEs 2018 on November 2 2018 for Scheduled Commercial Banks. Salient Features of the Scheme. The scheme for MSME Interest Subvention Scheme for Incremental credit to MSMEs 2018 has to be implemented from 2018-19 and 2019-20 as has been decided by The Ministry of MSME.

Two a much improved search well at least we think so but you be the judge. Interest Subvention Scheme for MSMEs. Eligibility for Coverage i All MSMEs who meet the following criteria shall be eligible as beneficiaries under the Scheme.

The government of India had launched Interest Subvention Scheme for Micro small and medium enterprises MSMEs in November 2018. Salient Features of the Scheme. Initially announced for just two years 2018-19 and 2019-20 the Interest Subvention Scheme has been extended to the financial year 2020-21.

Interest Subvention Scheme for Incremental credit to MSMEs 2018 will be implemented over 2018-19 and 2019-20. Ministry of MSME MoMSME has decided that a new scheme viz. Rajasthan government extends 5 subsidy scheme on agri-loans from Bhoomi Vikas Banks 26 May 2021 0629 PM IST.

One in addition to the default site the refurbished site also has all the information bifurcated functionwise. This is in an attempt to offset the low business volumes that may have resulted from the mobility and trade restrictions due to the pandemic. The Reserve Bank of India RBI has issued a notification extending the validity of the Interest Subvention Scheme for MSMEs 2018 till 31 st March 2021.

RBI extends the Interest Subvention Scheme for MSME Loans for FY 2020-2021. This notification was issued on 7 th October 2020. As part of access to credit Prime Minister announced 2 interest subvention for all GST registered MSMEs on fresh or incremental loans.

The two most important features of the site are. Purpose of the Interest Subvention Scheme for MSME. 4 Key Changes and Its Impact.

The interest benefit shall be limited to the interest paid by the. The two per cent interest subvention scheme for micro small and medium enterprises MSMEs on loans extended by co. April 14 2015 Dear All Welcome to the refurbished site of the Reserve Bank of India.

Chief Minister Ashok Gehlot has approved the proposal by the Cooperative Department under which a five per cent subsidy on interest given to farmers on repayment of regular instalment of long-term loans from Primary Cooperative Bhoomi Vikas Banks has been. Ease of Doing Business for MSMEs. Salient Features of the Scheme.

Interest Subvention Scheme for Incremental credit to MSMEs 2018 will be implemented over 2018-19 and 2019-20. The interest subvention scheme for incremental credit to MSMEs 2018 offers 2 interest subvention for all GST registered MSMEs. Ministry of MSME MoMSME has decided that a new scheme viz.

Under the scheme all the GST registered MSMEs were eligible to acquire 2 interest subvention on fresh or incremental loans. Gadkari asks India Inc to clear MSME. Under this scheme all the MSME units working in Haryana as on or before March 15 2020 will be eligible to 100 percent interest benefit on loans availed for payment of the wages of employees or other expenses upto a maximum of Rs 20000 per employee for a period of six months.

The purpose of introducing this Scheme for MSME is to encourage for increasing productivity for manufacturing. As part of access to credit Prime Minister announced 2 interest subvention for all GST registered MSMEs on fresh or incremental loans. Government of India has since decided to include Co-operative Banks also as Eligible Lending Institutions effective from March 3 2020.

The government had announced the scheme on November 2 2018 to offer interest relief on loans to the extent of Rs 1 during FY19 and FY20. Amount of Interest Relief Claimed MSME Manufacturing MSME Service sector Trading Activities Total MSME Manufacturing.

Pin By Gk Thoughts On Indian Knowledge Evangelism Social Services Small Business

Interest Subvention Scheme For Msme Co Operative Banks Enterslice

Sitharaman S Relief Measures For Msme Sector Deccan Herald

Cabinet Decisions Street Vendor Credit Facility Knowledge

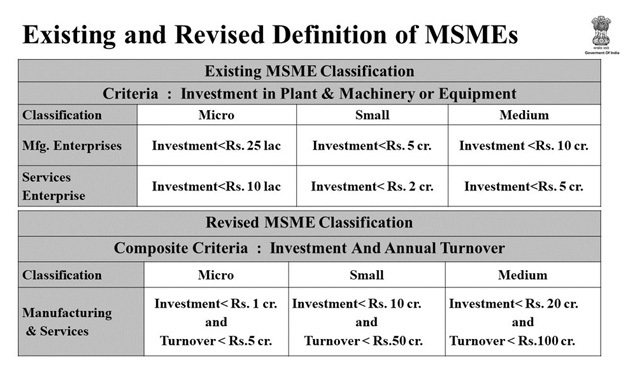

Atmanirbhar Bharat Package New Definition And Credit To Msmes

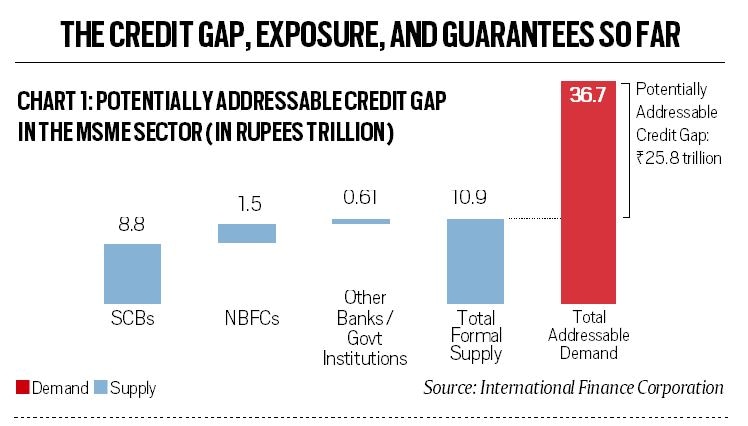

Msme 2 0 A Policy Prescription For Inclusive Economic Growth Policy Circle

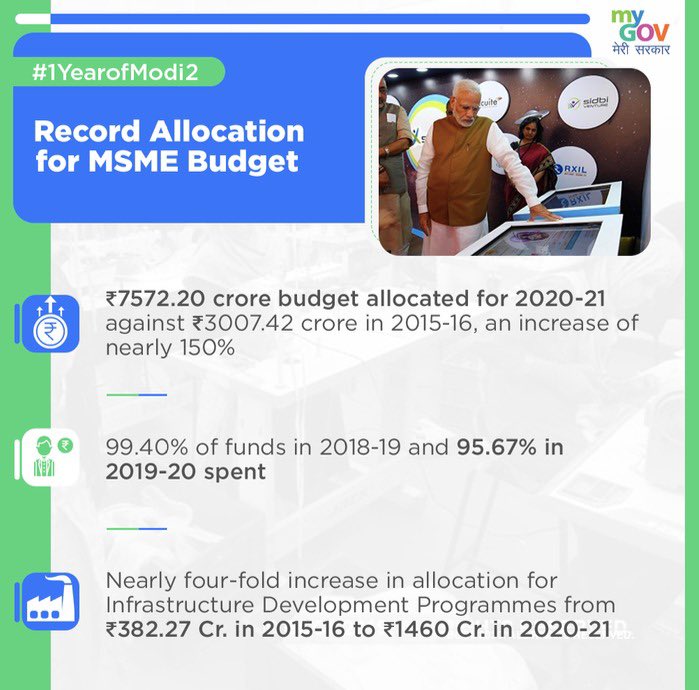

G Kishan Reddy On Twitter By Allocating 7572 20cr In 2020 21 Budget Nearly 150 Increase As Compared To 2015 16 Providing Credit Upto 2cr Under Cgtf Interest Subvention Of 2 Upto 1cr To Msmes We

2 Min Shots Interest Subvention To Msme Current Affairs 2020 In Hindi Tiktok Youtube

What Are The Measures Taken For Msmes Amidst Covid 19 Pandemic

Atmanirbhar Bharat Package New Definition And Credit To Msmes

Banks Asked To Provide Bill Discounting Facility To Msmes Against Payments Due From Large Corporates Facility Bills Large

Pin On Vacancy Admit Card Result Answer Key Exam Analysis

Msmes Success Post Covid Government Plans And Initiatives

Sanju Verma On Twitter I Think By Far Change In Definition Of Msmes Will Have Most Far Reaching Salubrious Impact On Msmes In Medium To Long Term As It Will Lead To Greater Investment In Fixed

Msme Loan Interest Subvention Extended Till 31 03 2021 Chamber Of Startups

Banks Sanction 50 Per Cent Of Targeted Rs 3 Lakh Crore In Liquidity Support To Msmes In 2020 Small And Medium Enterprises Supportive Loan