The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from April 1 2016 and became fully effective from April 1 2019. BCBS and the Financial Stability Board FSB to develop a framework for Domestic Systemically Important Banks D-SIBs1 in addition to the Global Systemically Important Financial Institutions G-SIFIs.

European And Japanese G Sib Report Second Quarter Results Yale School Of Management

Strictly speaking the Financial Stability Oversight Council FSOC.

List of domestic systemically important banks (d-sibs). The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from April 1 2016 and became fully effective from April 1 2019. The additional CET1 requirement will be in addition to the. Current Affairs - September 2017.

2 D-SIBs are banks that are assessed to have a significant impact on the stability of the financial system and proper. A starting point for the development of principles for the assessment of D-SIBs is a requirement that all national authorities should undertake an assessment of the degree to which banks are systemically important in a domestic context. The rationale for focusing on the domestic context is outlined in SCO5010.

The Royal Bank of Canada RBC and the Toronto-Dominion Bank TD have also been designated as G-SIBs. A domestic systemically important bank D-SIB is a bank that could disrupt the domestic economy should it fail. SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs.

Every year in August it has to release a list of banks which has been designated as D-SIBs. Domestic Systemically Important Banks D-SIBs in India. The Reserve Bank of India RBI has added HDFC Bank the second largest private sector lender of country in list of Domestic Systemically Important Banks D-SIBs.

Being the Central Bank in India the Reserve bank of India carries out the task of selecting the D-SIBs in the country. SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs. List of Domestic Systemically Important Banks D-SIBs D-SIBs in USA.

National authorities should establish a methodology for assessing the degree to which banks are systemically important in a domestic context. When Systemically Important Banks SIBs were in danger of failure in the past only one. Singapore 30 April 2015.

05 Feb 2020. Bank Negara Malaysia the Bank today issued the policy document on Domestic Systemically Important Banks D-SIB Framework which sets out the Banks assessment methodology to identify D-SIBs in Malaysia and the inaugural list of D-SIBs. HDFC Bank is third bank in country to be added in list of D-SIBs after State Bank of India SBI and ICICI Bank which were added in 2016 and.

The first condition is that a Bank having a size of more than 2 of GDP can be selected as D-SIBs. The banks that have been selected by RBI has to follow a certain framework. The Reserve Bank of India has recently stated that the banks namely State Bank of India ICICI and HDFC Bank are domestic systematically important banks or banks that are too big to fail.

The Hong Kong Monetary Authority HKMA has completed its annual assessment of the list of Domestic Systemically Important Authorized Institutions D-SIBs. For the USA the D-SIB list include those financial institutions not being big enough for G-SIB status but still with high enough domestic systemically importance making them subject to the most stringent annual Stress Test USA-ST by the Federal Reserve. The assessment methodology for a D-SIB should reflect the potential impact of or externality imposed by a banks failure.

RBI uses the BCBS methodology for identifying the D-SIBs. The Monetary Authority of Singapore MAS today published its framework for identifying and supervising domestic systemically important banks D-SIBs in Singapore and the inaugural list of D-SIBs. Canada currently has six D-SIBs.

The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from April 1 2016 and became fully effective from April 1 2019. The additional Common Equity Tier 1 CET1 requirement for D-SIBs has already been phased-in from April 1. 4 Attorney Advertisement Appendix Assessment Methodology Principle 1.

D-SIBs refer to banks whose distress or failure have the potential to cause considerable. The RBI issues framework to deal with these systematic important banks. Known as domestic systemically important banks D-Sibs the seven banks that include Citibank Maybank Standard Chartered and HSBC will come under additional MAS supervisory measures.

Based on the assessment results the list of authorized institutions designated as D-SIBs remains unchanged compared to the list of D-SIBs published by the HKMA on 21 December 2018. This framework requires that D-SIBs are placed in the four buckets based on the systematic importance scores. SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as last year.

SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs.

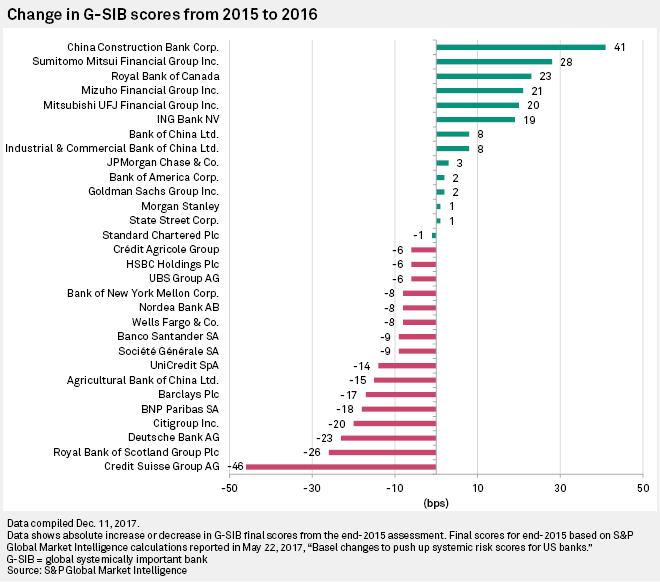

Among World S Systemically Important Banks Jpmorgan Stands Alone S P Global Market Intelligence

Finance Malaysia Blogspot What Is Domestic Systemically Important Banks D Sib

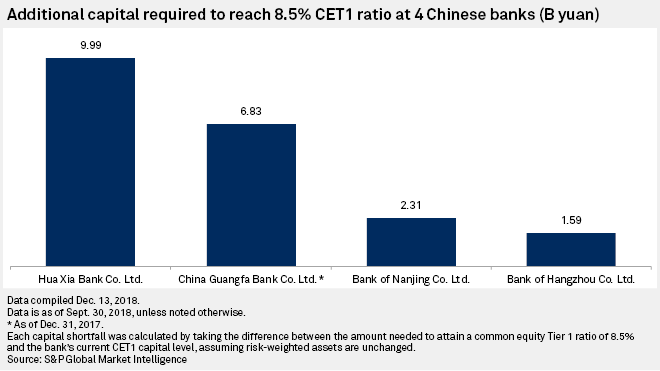

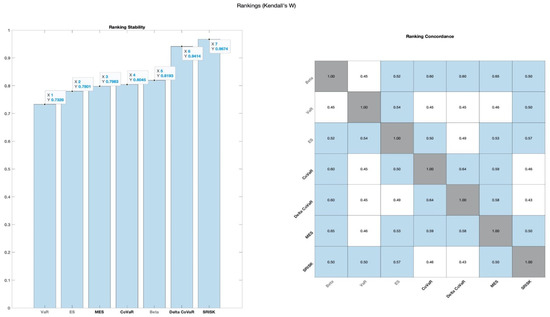

As Local Systemic List Grows At Least 4 Chinese Banks May Need Fresh Capital S P Global Market Intelligence

Buckets Of Chinese D Sibs Download Table

Jrfm Free Full Text Modelling Systemically Important Banks Vis A Vis The Basel Prudential Guidelines Html

China Bank Capital Adequacy Ratios 10 Domestic Systemically Important Banks Say Fitch

First Grade Spelling Words Worksheets First Grade Spelling Worksheets Spelling Words First Grade Spelling Spelling Worksheets

Pdf Domestic Systemically Important Banks A Quantitative Analysis For The Chinese Banking System Semantic Scholar

As Local Systemic List Grows At Least 4 Chinese Banks May Need Fresh Capital S P Global Market Intelligence

As Local Systemic List Grows At Least 4 Chinese Banks May Need Fresh Capital S P Global Market Intelligence

Pdf Domestic Systemically Important Banks A Quantitative Analysis For The Chinese Banking System Semantic Scholar

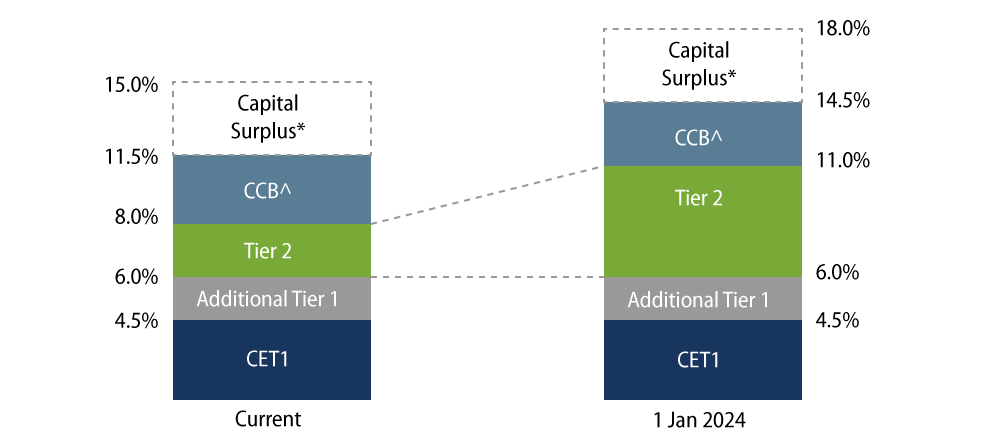

Australia S Regulatory Capital Requirements Increased For Banks Western Asset

Will A Canadian Bank Become A G Sib For 2017 When Would This Matter By Karl Rubach Cfa Linkedin

Pdf Domestic Systemically Important Banks A Quantitative Analysis For The Chinese Banking System Semantic Scholar

Hong Kong Reveals List Of Systemically Important Banks Globalcapital

Pdf Domestic Systemically Important Banks A Quantitative Analysis For The Chinese Banking System Semantic Scholar

Among World S Systemically Important Banks Jpmorgan Stands Alone S P Global Market Intelligence

United States Financial System Stability Assessment In Imf Staff Country Reports Volume 2020 Issue 242 2020