Affordable Care Act Taxes - At a Glance. If you are self-employed and purchase individual health insurance then this expense can be deducted directly on your Form 1040 as an adjustment to income.

The private health insurance rebate is an amount of money the government may contribute towards the cost of your private health insurance premiums.

Does private health reduce tax. Employees benefit when health insurance premiums are deducted tax-free from their salaries without any of the limitations associated with the itemized deduction. In some instances it can even be beneficial from a tax perspective for businesses to take out a business private healthcare plan rather than a personal one. The economists at the University of California at Berkeley who have advised Warren and Sen.

If you have private health insurance the amount of private health insurance rebate you can receive is reduced if your income is more than a certain amount. The health insurance tax credit is available to small businesses that pay at least half the cost of single coverage for their employees. As the rebate is income-tested the size of your rebate will reduce as your income increases and once you earn over the maximum threshold you wont be entitled to any rebate at all.

This chart explains how the health care law affects your tax return. Bernie SandersI-Vt on the creation of a wealth tax call private health insurance costs taxes in. A health insurance tax credit also known as the premium tax credit lowers your monthly insurance payment either through advance payments to your insurer or through your tax refund.

This is because the business would be eligible for tax relief on the costs so far as they relate to employees. Self-employed persons can deduct health insurance above the line on their 2020 Schedule 1 which also eliminates the hassle and limitations of itemizing. You usually pay tax on the cost of the insurance premiums if your employer pays for your medical insurance.

The size of your premium tax credit is based on a sliding scale. Use the Health Care Law and You chart to see how the law will affect you. Under the recently enacted Tax Cuts and Jobs Act taxpayers must continue to report coverage qualify for an exemption or pay the individual shared responsibility payment for tax years 2017 and 2018.

With basic hospital cover John pays 1138 after the Private Health Rebate. With hospital cover Johns annual tax saving is about 237. We will calculate the amount of private health insurance rebate you are entitled to receive when you lodge your tax return.

Because John has private hospital cover he does not have to pay the Medicare Levy Surcharge. The premium tax credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange. Yes though there are significant differences between the treatment of health insurance premiums for tax purposes for persons with individual and group health insurance policies.

Those who have a lower income get a larger. If your business and your plan meet the qualifications you can get a credit of up to 50 of the health insurance premiums you paid for employees but not for yourself as the business owner. Without hospital cover John will pay the Medicare Levy Surcharge at 1375 per year.

You can claim your private health insurance rebate as a. Reduces the cost of health care coverage for 9 million consumers currently receiving financial assistance by ensuring consumers eligible for premium tax credits have at least a couple plans to choose from that wont cost more than 85 of their household income on their Marketplace plan premium per year. Although the Biden Administrations Medicare expansion proposal is devoid of detail it is certain to reduce Americans enrollment in private health insurance coverage and significantly increase.

Check your Income Tax to see how company benefits affect the tax you pay.

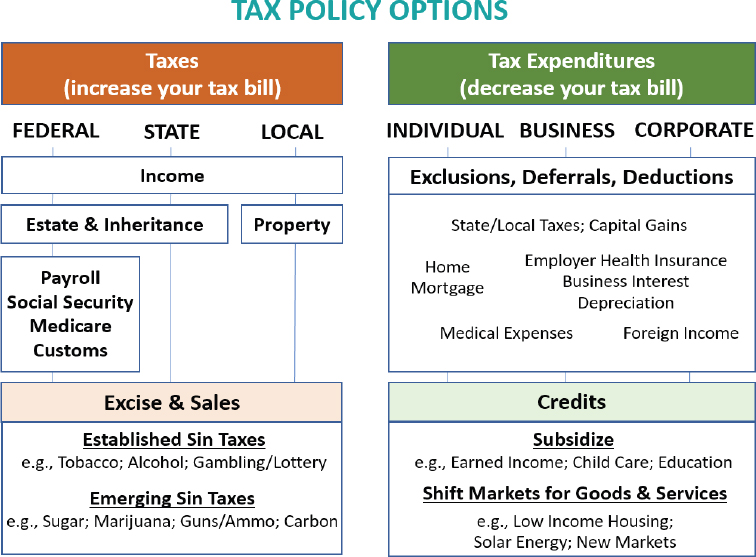

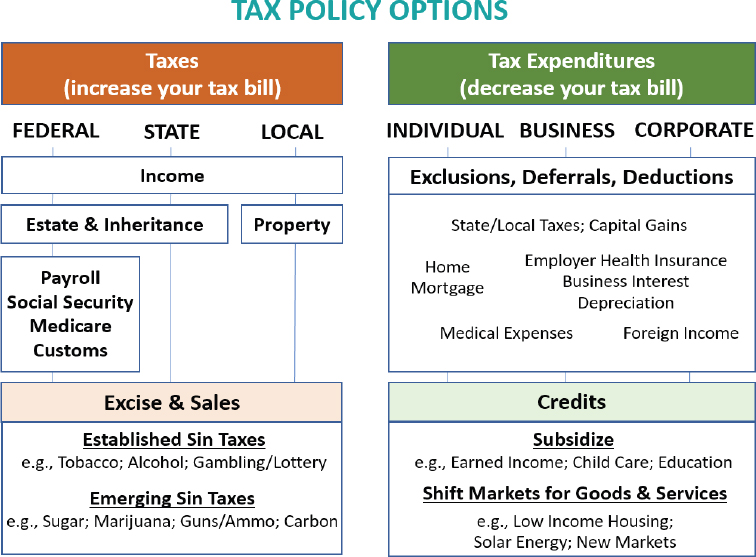

Exploring Tax Policy To Advance Population Health Health Equity And Economic Prosperity Proceedings Of A Workshop In Brief Exploring Tax Policy To Advance Population Health Health Equity And Economic Prosperity

Pre Tax Vs After Tax Medical Premiums

How Does Corporate Health Insurance Benefit Employers Buy Health Insurance Health Insurance Health Insurance Plans

What Tax Changes Did The Affordable Care Act Make Tax Policy Center

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Income Tax Consultant Services In Delhi Income Tax Tax Services Income

Five Easy Steps For Enrolling In The Small Business Health Options Program Health Options Care Plan Health

Broad Bipartisan Majorities In The Maryland Senate And House By Margins Of 46 0 And 119 12 Have Approved Legislation Health Programs Care Coordination Health

With Tax Laws And Regulations Changing So Quickly From Year To Year It Is Key To Find A Preparer Who Does The Due Diligence To Mak Tax Planning Income Tax Tax

Cbo Scores Better Care Health Insurance Budgeting American Healthcare

Pin By Only Health Matters On Right Religare Care Health Insurance Best Health Insurance Health

Tax Benefit Of Buying Health Insurance In India For Nri Section 80d Nri Saving And Investment Tips Buy Health Insurance Health Insurance Investment Tips

Infographic How Does Health Reform Work Infographic Health Health Care Reform Work Health

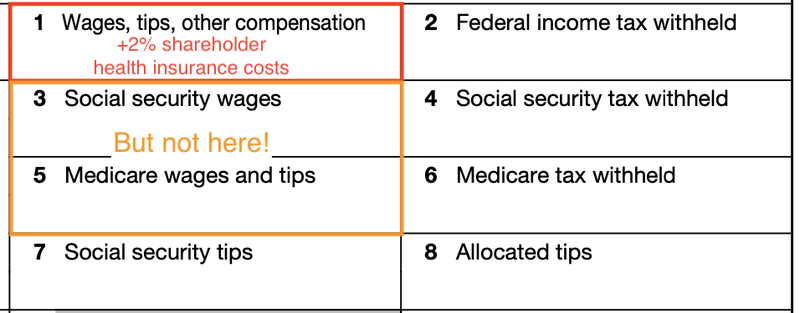

A Beginner S Guide To S Corp Health Insurance The Blueprint

Self Employed Health Insurance Deduction Healthinsurance Org

Even When They Have Insurance U S Women Struggle To Pay Medical Bills More Th Private Health Insurance Marketplace Health Insurance Health Insurance Coverage