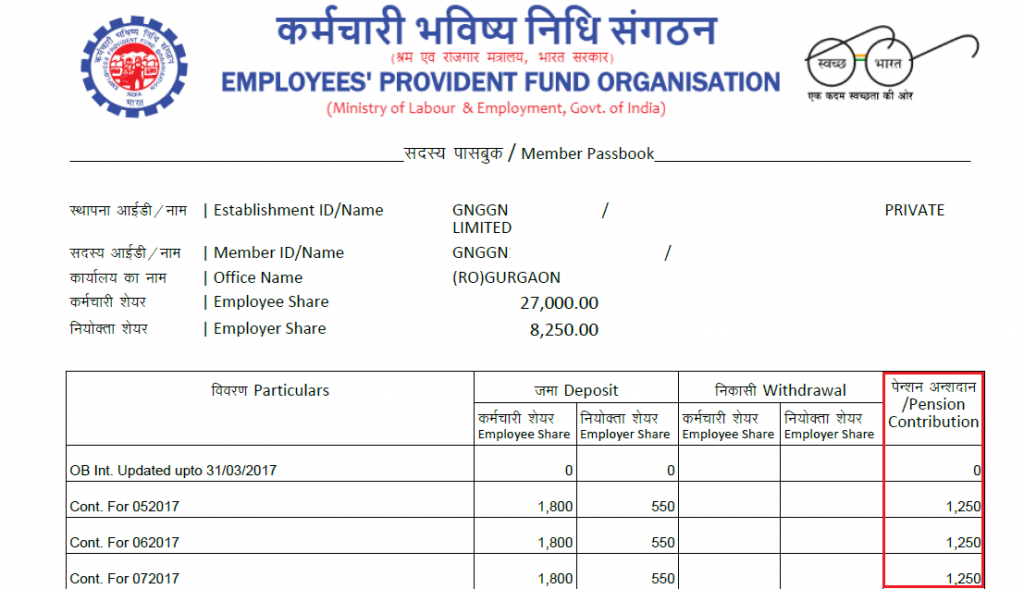

I am not recevied correct EPF pension amount from EPFO office. How to calculate EPF contribution This amount is calculated each month.

Epf A C Interest Calculation Components Example

21 years 1 month 7 days.

How to epf pension calculation. 21062017 past service service upto 151195. Service details date of joing. To simply the math assume that your basic salary is Rs25000 including dearness allowance.

Out of the 12 contribution 833 goes towards the Employee Pension Scheme Account and the remaining 367 goes to the employee EPF account. EPF Pension Calculator A useful online EPF pension calculator for you to calculate your future pension salary. Employees Pension Scheme EPS 1995 EPF EPS and EDLIS are calculated on the basis of your Basic Dearness Allowance DA including cash value of any food concession allowed to the employee Retaining Allowance RA if any.

Hi I worked for 32 years continuously in an organization took premature retirement at 58 years60 years was retirement age with last drawn basic of 4500000as par EPS Pension calculation my pension should be 34 taken as 2 years bonus for 20 continuous service as par epfo rule150003470INR-728500 but i am receiving only 234700. If the formula pension calculated is less than 335438635 respectively for X Y Z categories then only that minimum pension is to be given. If the total pension is less than 500600800 respectively for XYZ categories than that minimum pension shall be the total pension.

EPS Service Period x Pensionable Salary70. As the pensionable salary is capped at Rs 15000 the maximum monthly pension is also capped as per the formula. 6 years 5 months 15 days actual service service after 151195.

The employee and the employer mainly contribute to the EPF fund. But it is subject to discounting factor 4 wef. It is compulsory for all employees who draw a basic salary of less than Rs 15000 per month to become members of the EPF.

In case of death disablement the above restrictions doesnt apply. This is a pure life insurance policy with no returns. Add the Past Service Pension and the Formula Pension.

Add the Past Service Pension and the Formula Pension. The below-mentioned formula must be used for the calculation of pension in case the individual has joined after 16 November 1995. The formula for calculation of pension is Pensionable Salary X Pensionable Year 70.

C Procedure for the calculation of Total Pension-Add the Past Service Pension and the Formula Pension. Contribution to the Employee Provident Fund is optional if the basic salary is higher than Rs6500-per. 30th December 2016 From India Bangalore.

Calculation Made Easy. EPF Pension 5000 Rs Calculation. Pensionable Salary service period 70.

The formula to calculate monthly pension after retirement is 58 years is pensionable salary X service period 70. Early pension can be claimed after 50 years but before the age of 58 years. Hi FriendsIn this video we learn how to pension calculated in EPFO if you are under this scheme then you have to watch this videoYou can also watch other.

And the service period means the number of years the employee contributed to the. But this total pension is for an eligible service of 24 years or more and if the eligible. As per EPF Pension scheme a person who has contributed for minimum 10 Years in EPF is eligible for pension after attaining age of 58 Yrs.

Procedure for calculation of Total Aggregate Pension. The monthly pension amount will be calculated as follows. The calculation can be explained with an example.

Enter the details and the calculator will do the rest. A sum equal to 11 of your salary is contributed by your employer towards Administration Charges of EPF We have a component called EDLI Employees Deposit Linked Insurance. 01061989 date of exit.

26092008 for every year falling short of 58 years. 15000 x 15 70 Rs 321428 EPS members must remember that if you have joined the scheme before 2014 then the monthly pension will be calculated on a pro-rata basis. Calculation of Pension in case the individual has joined after 16 November 1995.

Please help me correct pf pension calculation based on following my service data. No pensioner can receive more than one EPF Pension. Here the pensionable salary means the average basic salary Dearness allowances drawn for the last 12 months.

The employee pension scheme calculation is based on the age date of joining of service the estimated or the salary recieved after completion of service 58 years and the pensionable part of your salary. Your employer contributes an equal amount to EPFO but only 367 of your salary goes into the EPF.

How Epf Employees Provident Fund Interest Is Calculated

Epfo S Pension Calculation Method Youtube

What Is Employees Pension Scheme Eps Eligibility Calculation Formula

Eps Pension Calculation Monthly Pension Calculate Youtube

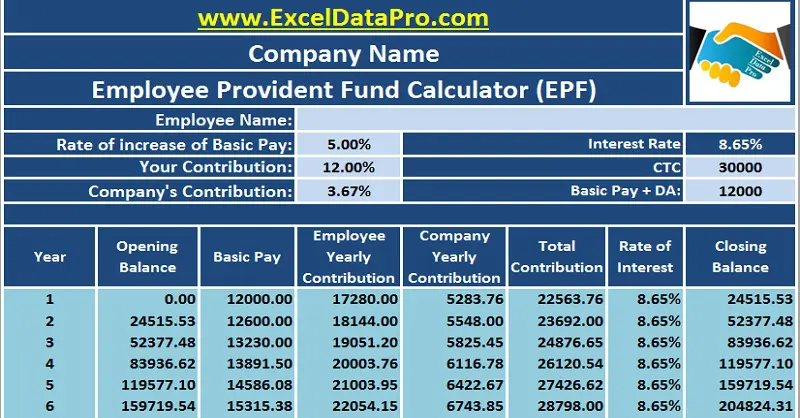

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Higher Pension As Per Sc Decision With Calculation Examples

Eps Employee Pension Scheme Eligibility Calculation Withdrawal

Epf Pension Calculation Eps 95pension Calculation After And Before 1995 Latest News Youtube

How To Calculate Member Passbook Pf Contribution Calculate Youtube

In India How Does The Eps Employee Pension Scheme Work Quora

Epf Pension Eligibility Pension Calculation In Tamil Explained With Formula Youtube

Epf Member Passbook For Tax Calculation In 2021 Passbook Flow Chart Hobbies To Try

Higher Pension As Per Sc Decision With Calculation Examples

Eps Pension Increase Supreme Court

All You Wanted To Know About Employee Pension Scheme Eps

How To Get Higher Eps Pension Rules Scenarios Court Order

Download Employee Provident Fund Calculator Excel Template Exceldatapro

How To Calculate Epf Pension Ii Epfo S Pension Calculation Youtube

Epf India Higher Pension With Employee Pension Scheme Eps Conditions Formula Calculation At Various Stages For Retirement