Parents are eligible to claim the Parenthood Tax Rebate PTR of 5000 for their 1st child 10000 for the 2nd child and 20000 for the 3rd and each subsequent child. If your child is 16 year or over at the start of the year they must have been in full time instruction at any school or in full time higher education for example a degree course or equivalent.

Child Tax Credit Enhancements Under The American Rescue Plan Itep

Tax relief means that you either.

Personal income tax child relief. Both the father and the mother may share the PTR to offset their income tax payable. Marginal relief may apply where the individuals total income exceeds the specified limit. If you are claiming HCR and this is your first time claiming this relief on your child please complete and submit the Handicapped-Related Tax Relief Form 243KB DOC by email.

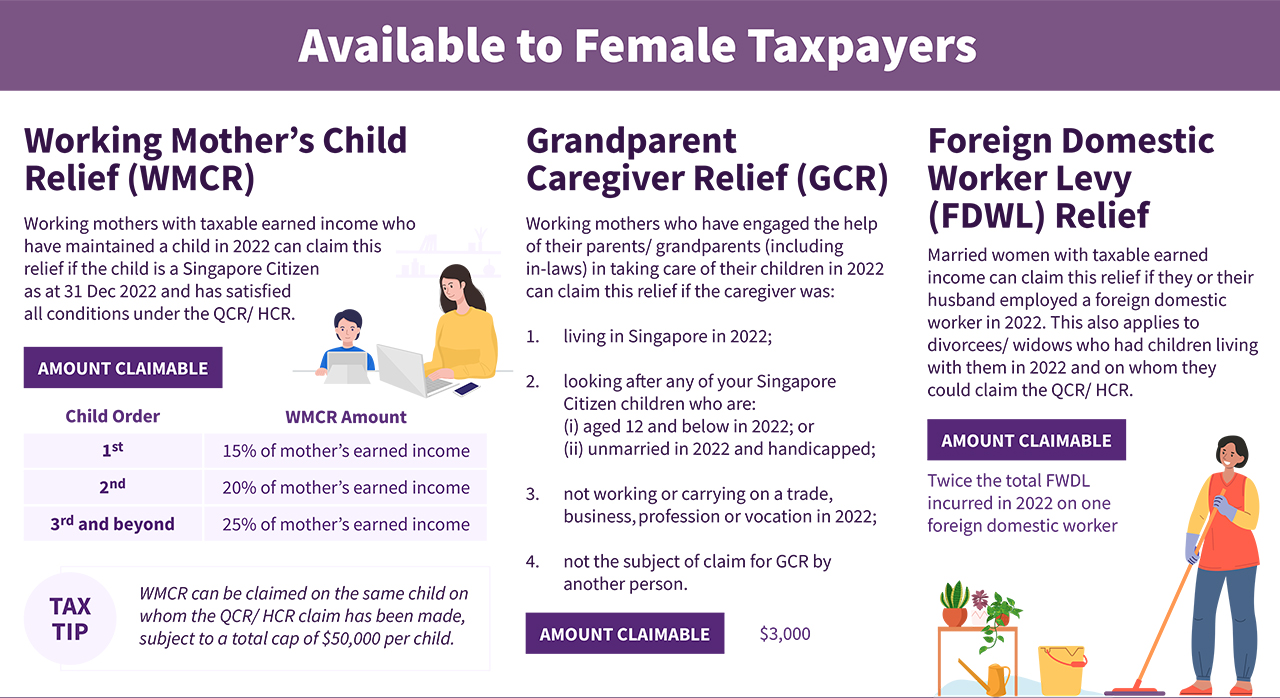

Generally parents can claim tax relief of RM1000 per unmarried child per year until he or she turns 18. Marital and civil status. For the second child 20 of earned income is eligible for tax relief.

32000 20 x 160000 - Foreign Domestic Worker Levy Relief. Claiming a tax refund if you are unemployed. For the third and subsequent children 25 of earned income is eligible for tax relief.

Individual and dependent relatives. Each unmarried child of 18 years and above that. PART V Rate of tax and double taxation 37.

28 rows Tax Relief Year 2020. Charge of income tax. The purpose of this paper is to examine the personal tax reliefs for resident individuals under the Income Tax Act 2015 Act 896 as amended.

The percentage of tax rebate can also be added up to a. For 2021 the specified limit is EUR 18000 for an individual who is singlewidowed and EUR 36000 for a married couple. Each unmarried child of.

24000 15 x 160000 - WMCR on 2nd child. Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner Parent. Each unmarried child of 18 years and above who is receiving full-time education A-Level certificate matriculation or preparatory courses.

80410 160000 - 79590. Method of calculating relief to be allowed for double taxation. For the first child a working mother may claim 15 of the total income earned.

Tax rates bands and reliefs. Check your bank account because the first child tax credit payment was sent to millions. 1440 Total Personal Reliefs 79590.

Personal relief and relief for children dependants. 20400 - NSman Wife Relief 750 - WMCR on 1st child. Details about the apportionment of income tax exemption thresholds personal allowances and reliefs Child care tax relief Find out the circumstances in which we grant tax relief for.

Deductions to be claimed. 1000 - CPF Relief. Restricted to 1500 for only one father.

An unmarried child who is over 18 and continuing full-time education at a secondary school he or she entitles the parent to a RM1000 tax relief. I have received my tax bill for the Year of Assessment YA 2021. There are no local income taxes in Ireland.

PART IV Ascertainment of total income 36. Total income from all sources. Claiming tax relief for a child 3.

Tax Reliefs And Rebate For Parents. If your child is in full time higher education they must be a dependent student as defined by student finance. 23 rows Each unmarried child and under the age of 18 years old.

These limits are increased in respect of dependent children. Pay less tax to take account of money youve spent on specific things like business expenses if youre self-employed get tax back or get it repaid in. High Income Earner Restriction HIER Stay and Spend Scheme.

Personal Reliefs - Earned Income Relief. The paper starts by explaining assessable income chargeable income resident individual and proceeds to analyse six 6 personal tax relief situations. Amount RM Self and.

Restricted to 1500 for only one mother. Chargeable Income of Mrs Ang.

Income Tax 2020 Everything You Should Claim As Income Tax Relief News Rojak Daily

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Is The Child Tax Credit Ctc Tax Foundation

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Child Tax Credit Calculator Figure Out How Much You Ll Get Monthly

Child Tax Credit 2021 3 Ways To See If You Re Eligible For The Extra Cash Cnet

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

Child Tax Credit Calculator How Much Will I Get

Lhdn Irb Personal Income Tax Relief 2020

How The Tcja Tax Law Affects Your Personal Finances

Reduce Your Tax Payments In 2021 With These Tips Dbs Singapore

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

2021 Edition Complete Guide To Baby Grants In Singapore

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

.jpg)