The EPF organization has updated the withdrawal rule of EPF Balance which is an employee cant withdraw 100 corpus before retirement at any situation. If you withdraw your EPF amount before completing 5 years of service then you will be liable for payment of TDS at 10.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

The EPF subscriber has to declare unemployment in order to withdraw the EPF amount.

Can i withdraw my epf at 50. 50000 no TDS will be deducted. This means that if you retire at age 58 youd be able to withdraw 90 by age 57. You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time.

Nevertheless it is encouraged that members do not withdraw their savings in Akaun 2 at age 50 because once they withdraw it entirely its gone and they do not earn their annual dividends. Contribution period must be over 5 years. The EPF corpus can be withdrawn if a person faces unemployment before retirement due to lock-down or retrenchment.

EPF withdrawal before 5 years of continuous service attracts TDS on the withdrawal amount. However if the withdrawal amount is less than 50000 no TDS is deducted. When you reach a certain age owning your own home will be high on your list of things to do.

You will have to route your application through your previous employer in the prescribed form along with bank particulars indemnity form etc. By Ayisy Yusof - December 14 2017 453am. You can also withdraw money for funding the construction of your house.

You have the option to withdraw EPF savings at the age of 50 or 55 either partially or fully or at the age of 60 when you can then withdraw any amount of money at any time. A member can withdraw the full amount from their Akaun 2 when they turn 50. You can withdraw 90 of EPF balance once you reach the age of 57 years.

EPFO allows withdrawal of 90 of the EPF corpus 1 year before retirement provided the person is not less than 54 years old. Withdraw via i-Akaun plan ahead for your retirement. You can withdraw your PF only if you are no longer in service and have been without a job for more than two months.

Taxation on EPF withdrawal. But if you retire at age 55 youd be able to withdraw 90 of the EPF by age 54. The Employees Provident Fund EPF members aged 55 and 60 can now make partial withdrawals of any amount at any.

So do not waste your time or your computer printing ink to print out the. But the withdrawal must be made within one year of retirement superannuation whichever is later. How To Withdraw EPF Money Reaching 50 Years Old 1.

You can not withdraw an Employers contribution to EPF before 58 years An individual can not withdraw the EPF contribution by the employer before the retirement age of 58 years. Additionally if you have not provided you PAN at the time of withdrawal you will have to pay TDS at the rate of 30. From Jan 2018 EPF members aged 55 60 can withdraw any amount any time.

When you request to withdraw your EPF money you need to give EPF your bank account no which you need to verify first with the bank to get a confirmation letter that your account is active and then submit to the EPF. The withdrawals from the EPF within 5 years of joining are still taxable. For more details on types of withdrawal and how to go about checking their website is highly recommended.

Tax deducted at source TDS is deducted on the premature withdrawal only if the amount exceeds Rs. There are some other partial withdrawal rules also. There should be no break in the 5 years.

Purchase or construction of the house. You DO NOT need to fill up any form. EPF Withdrawals for Housing.

If your service period has been more than 10 years and you are between the age of 50 and 58 you may opt for reduced pension. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50. In case you want to withdraw your funds before 5 years of service you should keep the.

Even if you have resigned or are going through unemployment situation then also cant withdraw 100 balance from the EPF account. Age 50 withdrawal. The withdrawal conditions are.

The maximum PF withdrawal limit in this case is 50 of your share of contribution to PF. The money withdrawn from EPF accounts can be exempt from tax under certain conditions. You can withdraw money from your PF account if you are buying a house or a piece of land to build a house.

However if the withdrawn amount is less than Rs. No other banks you are owing can touch the. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

No photo-copied Identity Card IC is needed. Withdrawing PF balance and reduced pension age 50-58 over ten years of service You can only get pension after turning 50 years of age and have rendered at least 10 years of service.

Pf Withdrawal Online Epf Withdrawal Procedure Global Indian Nurses Organization

Epf Withdrawal Rules When And For What You May Withdraw Your Epf

Pf Withdrawal Form Know Epf Withdrawal Procedure

Epf Withdrawal Online Epf Withdrawal Procedure

New Online Epf Withdrawal Facility For Pf Eps Claims

Withdraw Pf Without Leaving Job Of Current Company Planmoneytax

Epf Withdrawal Online Epf Withdrawal Procedure

6 Reasons For Which You Can Withdraw Money From Your Epf Account

How To Withdraw Epf And Eps Online Basunivesh

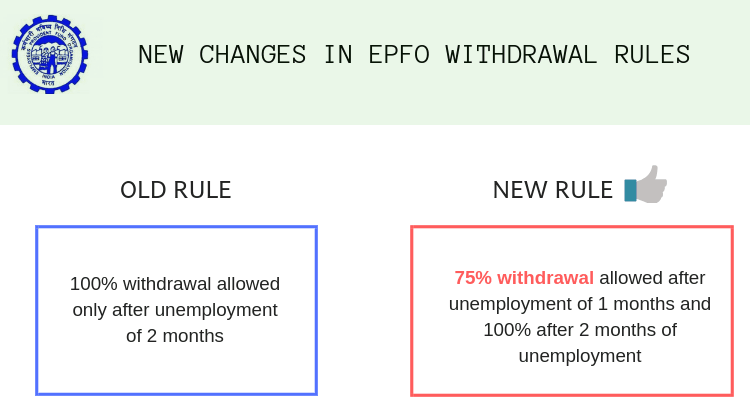

75 Of Epf Can Be Withdrawn Just After A Month Of Unemployment

Epf Form 15g How To Fill Online For Epf Withdrawal Basunivesh

Pf Withdrawal Rule Here S How To Withdraw Money From Your Epf Account Online Utkal Today

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

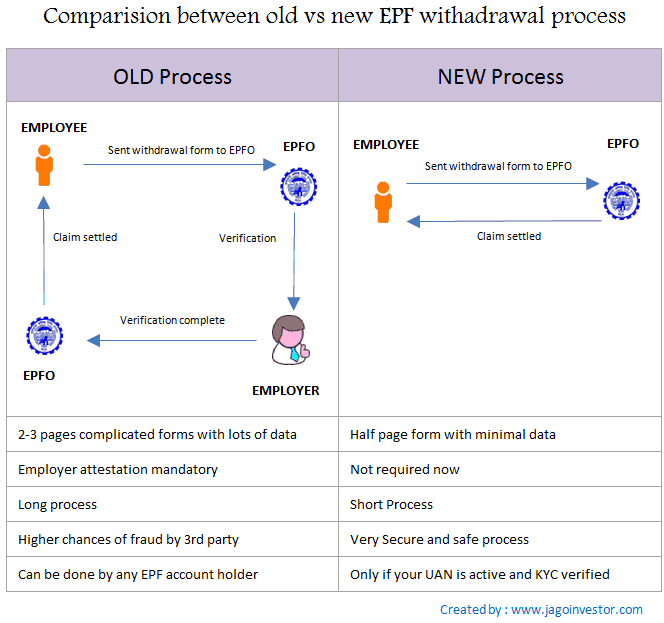

Epf Withdrawal Made Simple No Sign Required From Employer

Epf Withdrawals New Rules Provisions Related To Tds

How To Withdraw Money From Epf Emplyee Provident Fund Login Account Withdraw Money From Your Epf Account And All The Details Related To Epf Money Withdrawal

Epf Withdrawal Rules When Can You Partially Withdraw Your Pf Money