DBS OCBC Bank United Overseas Bank Citibank Standard Chartered Maybank and HSBC. We also consider the systemic risk of the whole banking system by investigating how D-SIBs and non-D.

Chapter 13 Reinforcing Financial Stability In Realizing Indonesia S Economic Potential

This Consult puts forward an overview of the proposed regulatory framework the assessment methodology for identifying systemically important banks in Singapore the policy measures to be applied toward.

Domestic systemically important banks (d-sibs) singapore. RBI categorises IDBI Bank as Private Sector Bank. National authorities should establish a methodology for assessing the degree to which banks are systemically important in a domestic context. It also unveiled its inaugural list of such banks.

The other APAC countries do not currently require banks to. 4 Attorney Advertisement Appendix Assessment Methodology Principle 1. What is a domestic systemically important bank and why is it important.

But the official list released in 2015 contains only two banks. The 12 principles can be broadly categorised into two groups. When Systemically Important Banks SIBs were in danger of failure in the past only one.

Our analysis presents not only current levels of domestic systemic importance of individual banks but also the changes. The assessment methodology for a D-SIB should reflect the potential impact of or externality imposed by a banks failure. The Monetary Authority of Singapore MAS has published a consultation paper Consult proposing a regulatory framework for systemically important banks in Singapore.

The rationale for focusing on the domestic context is outlined in paragraph 17 below. Called Domestic Systemically Important Banks D-SIBs and evolved an empirical mechanism through which such banks could be identified in any jurisdiction. On the same day the MAS released the inaugural list of banking groups designated as D-SIBs.

The other four PNB Citi Standard Chartered and HDFC are also too big to fail and should have been included in this list. In other nations D-SIBs are required to maintain upto 35 additional capital. This consultation paper sets out the proposals for the D-SIB framework including an outline of the methodology to be employed to assess the systemic importance of banks in Singapore and a range of policy.

D-SIB means that the bank is too big to fail. According to the RBI some banks become systemically important due to their size cross-jurisdictional activities complexity and lack of. New Policy For Domestic Systemically Important Banks In light of the public bail-out of large global systemically important financial institutions FIs the Basel Committee on Banking Supervision BCBS published in November 2011 a framework for assessing global systemically important banks.

This paper serves as a response to the official assessment approach proposed by Basel Committee to identify domestic systemically important banks D-SIBs in China. Known as domestic systemically important banks D-Sibs the seven banks that include Citibank Maybank Standard Chartered and HSBC will. Authority of Singapore MAS has identified seven banks in Singapore as Domestic Systemically Important Banks D-SIBs in 2015 and required the D-SIBs to be compliant with BCBS 239 by 20194.

BCBS and the Financial Stability Board FSB to develop a framework for Domestic Systemically Important Banks D-SIBs1 in addition to the Global Systemically Important Financial Institutions G-SIFIs. A starting point for the development of principles for the assessment of D-SIBs is a requirement that all national authorities should undertake an assessment of the degree to which banks are systemically important in a domestic context. Bank Negara Malaysia the Bank today issued the policy document on Domestic.

It formulated an enhanced regulatorysupervisory regime for such banks to reduce their probability of failure. 05 Feb 2020. THE Monetary Authority of Singapore MAS on Thursday published its framework for identifying and supervising domestic systemically important banks D-SIBs in Singapore.

The first group SCO505 focuses mainly on the assessment methodology for D-SIBs while the second group RBC407 focuses on higher loss absorbency HLA for D-SIBs. The Committee has developed a set of principles that constitutes the domestic systemically important bank D-SIB framework. SBI ICICI and HDFC remain Systemically Important Banks.

The Monetary Authority of Singapore MAS today published its framework for identifying and supervising domestic systemically important banks D-SIBs in Singapore and the inaugural list of D-SIBs. I MAS proposes a framework to identify domestic systemically important banks D-SIBs in Singapore and address the risks they pose. 2 D-SIBs are banks that are assessed to have a significant impact on the stability of the financial system and proper functioning of the broader economy.

Singapore Banks D Sib Announced Singapore Stock Market News Stock Market Dbs Bank Marketing

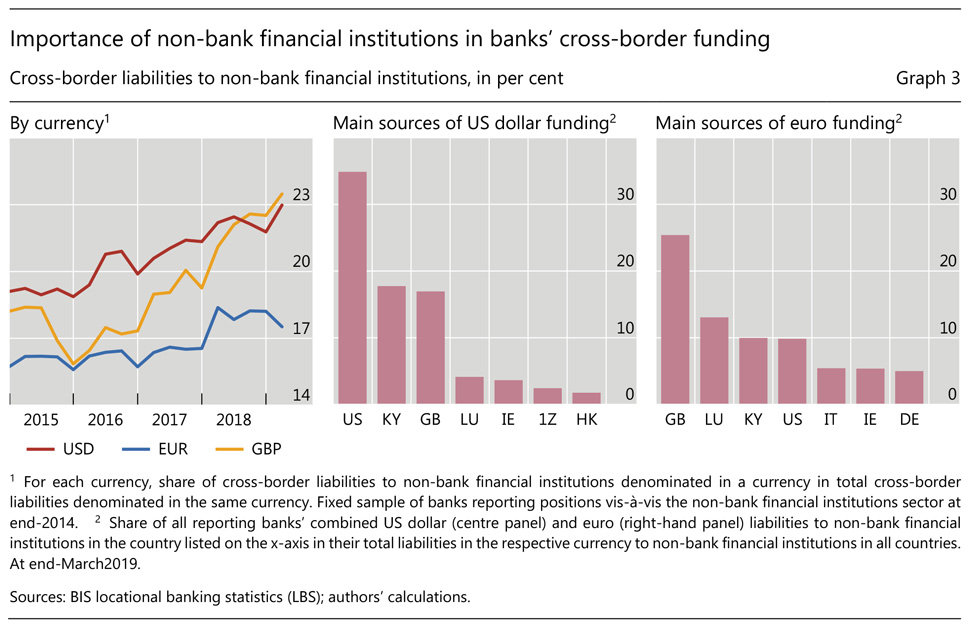

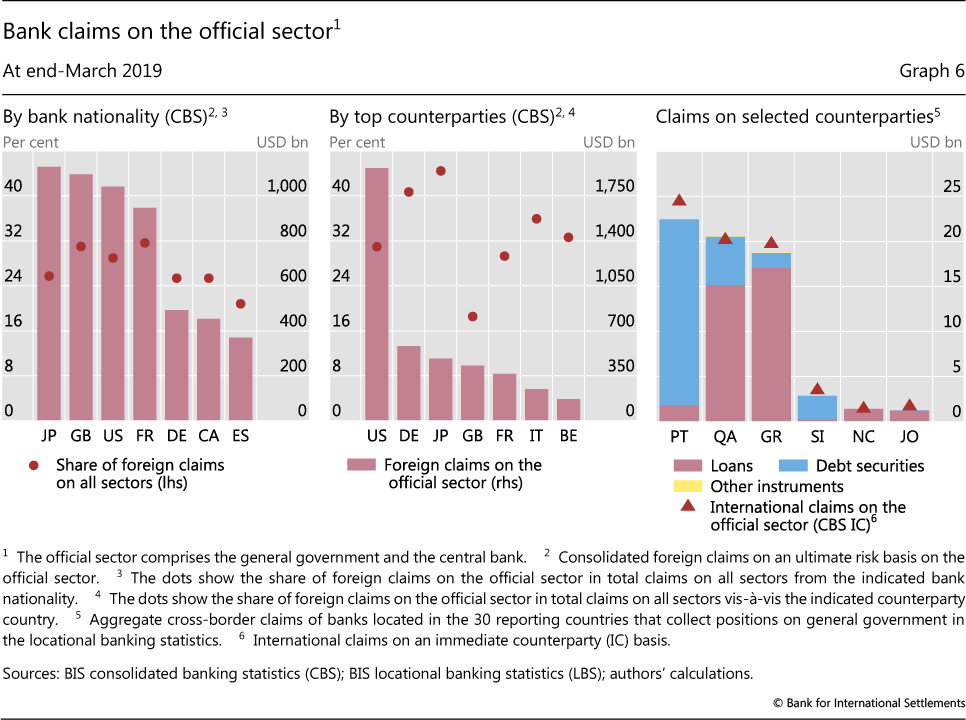

Non Bank Counterparties In International Banking

Thailand Financial System Stability Assessment In Imf Staff Country Reports Volume 2019 Issue 308 2019

Banking Industry Country Risk Assessment Taiwan S P Global Ratings

Non Bank Counterparties In International Banking

Non Bank Counterparties In International Banking

Singapore In Imf Staff Country Reports Volume 2019 Issue 228 2019

Https Www Bis Org Publ Bcbs233 Pdf

Too Big To Fail Measures Remedies And Consequences For Efficiency And Stability Barth 2017 Financial Markets Institutions Amp Instruments Wiley Online Library

Trade Offs In Bank Resolution In Staff Discussion Notes Volume 2018 Issue 002 2018

Non Bank Counterparties In International Banking

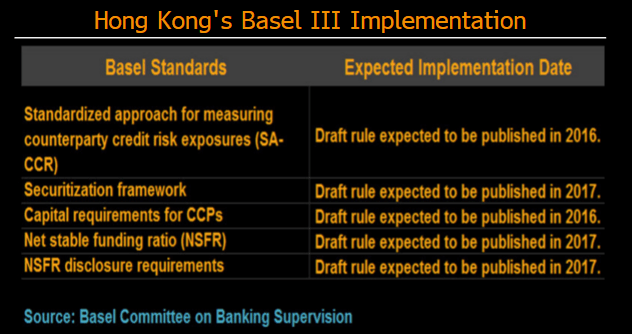

Basel Iii Implementation In North Asia 2016 Outlook Bloomberg Professional Services

Non Bank Counterparties In International Banking

Rdarr 101 Risk Data Aggregation And Risk Reporting Explained Workiva

Market The Week Ahead Nasdaq Trade Strategy Nasdaq Nasdaq Futures Strategies

Pin On A Data Pin Do Embedpin Href Http Www Pinterest Com Pin 401946335464277269 A

Australia In Imf Staff Country Reports Volume 2019 Issue 054 2019

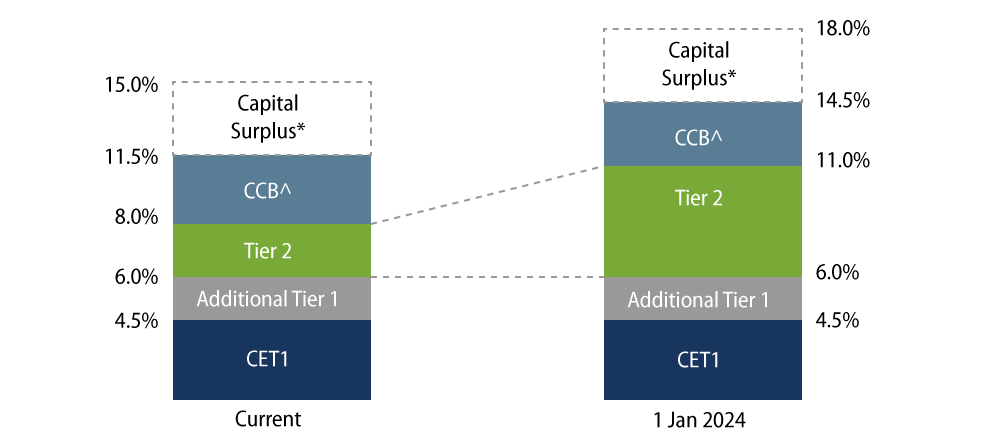

Australia S Regulatory Capital Requirements Increased For Banks Western Asset