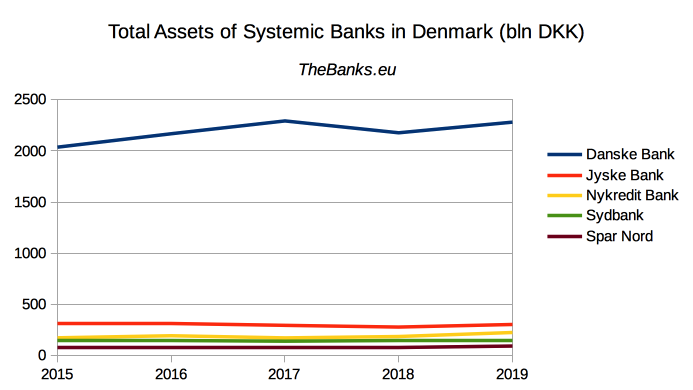

Global Systemically Important Banks Lower Their Capital Surcharges. The additional Common Equity Tier 1 CET1 requirement for D-SIBs has already been phased-in from April 1 2016 and will become fully effective from April 1 2019.

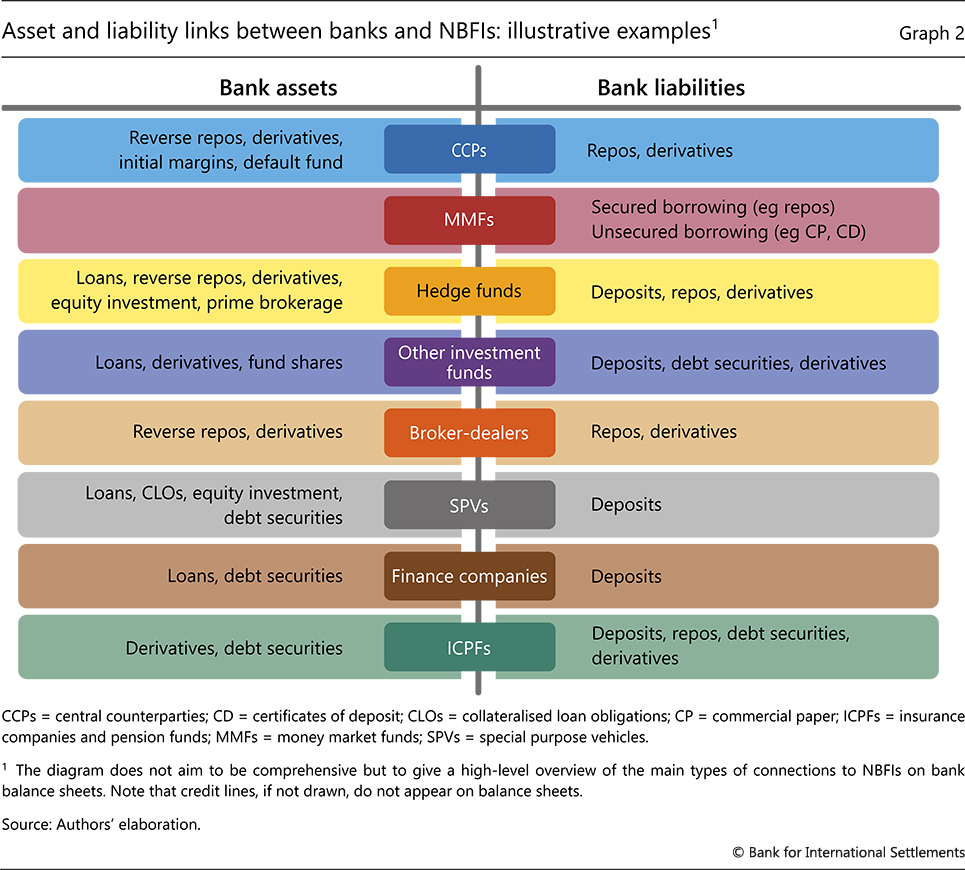

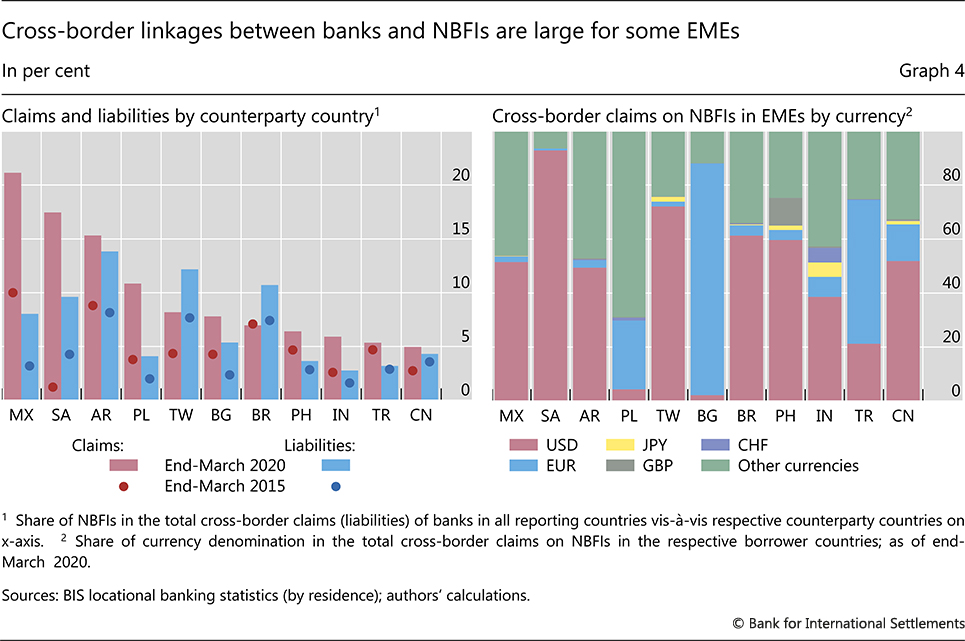

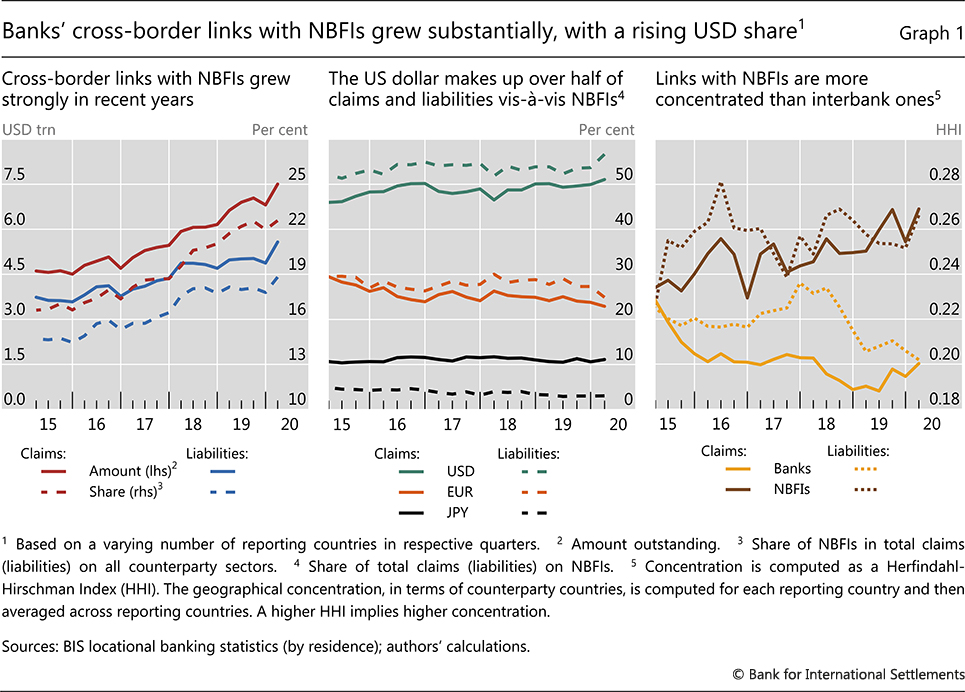

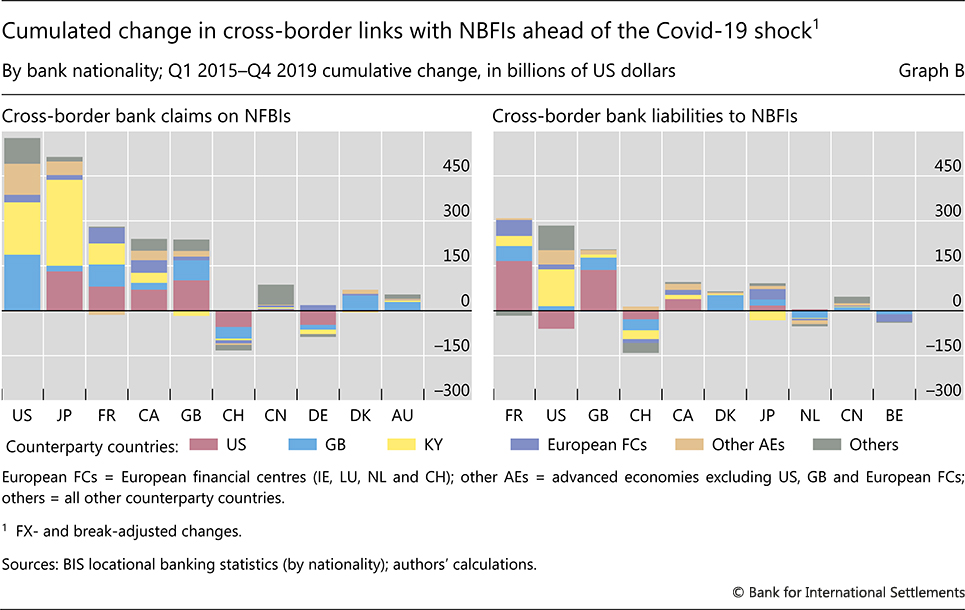

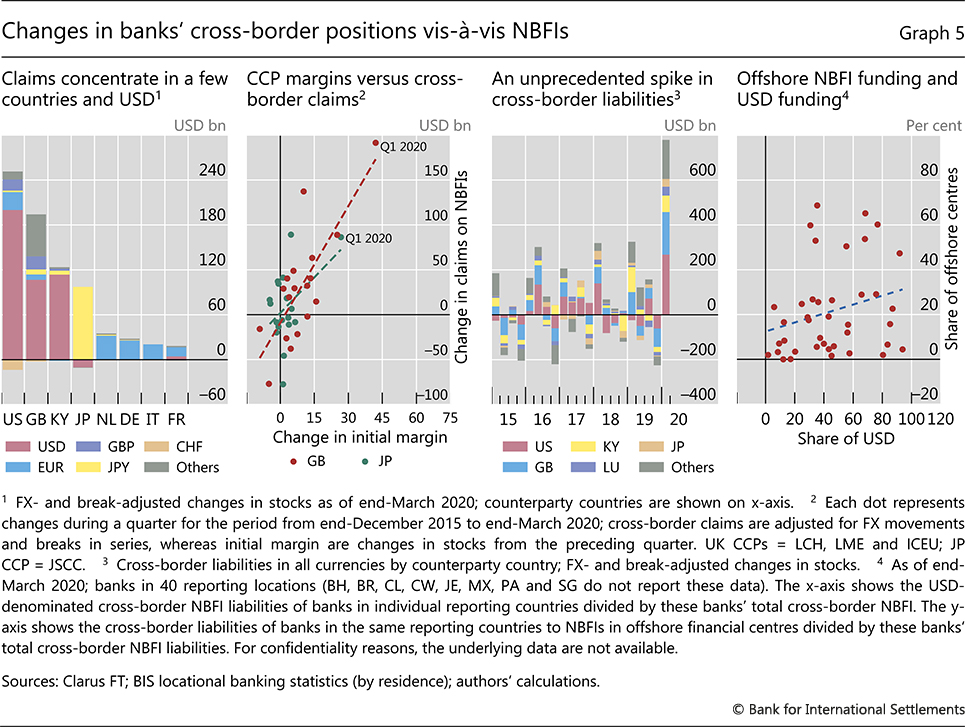

Cross Border Links Between Banks And Non Bank Financial Institutions

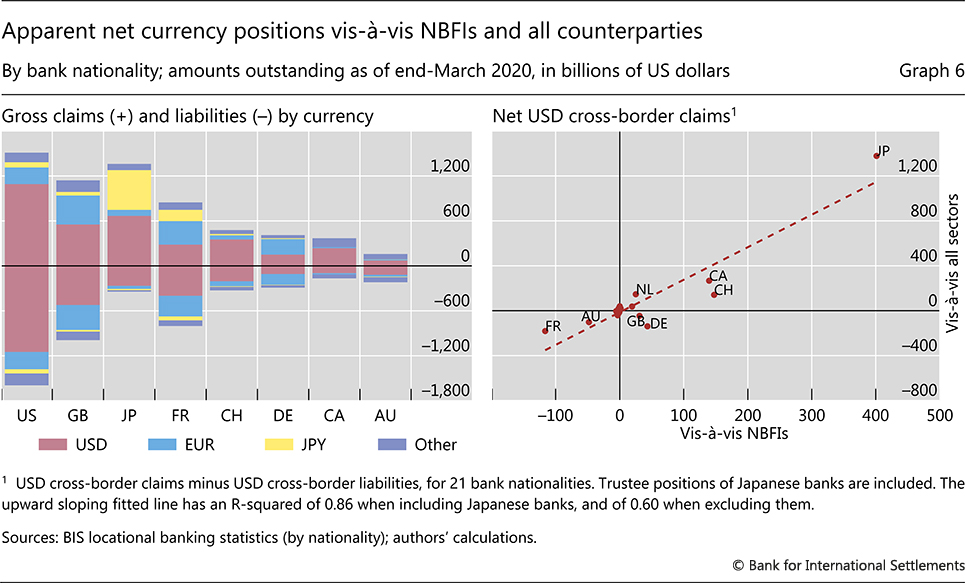

Foreign and domestic interests predictably diverge.

Domestic systemically important banks 2020. 322 kb Date. The State Bank of Pakistan has today announced the designation of D-SIBs for the year 2020 under the Framework for Domestic Systemically Important Banks. September 3 2020.

The Global Systemically Important Financial Institutions. The SRF is in line with Fitchs Domestic Systemically Important Bank SRF for Kuwait. At end-1H20 BBs CET1 regulatory.

The minimum capital requirement includes capital conservation buffer CCB of 1875 and additional CET1 capital surcharge of 020 on account of the Bank being designated as a Domestic. In June 2016 I. Next Steps - Locate Important Papers Find the deceaseds important papers and documents as soon as possible.

5 February 2020 S 104 Unless otherwise specified by the Bank a prescribed development financial institution designated as a D-SIB by the Bank under paragraph 93shall hold and maintain capital buffers to meet the. RBI releases 2020 list of Domestic Systemically Important Banks D-SIBs SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs. Jared Berry Akber Khan and Marcelo Rezende 1.

Fitch considers BBs capitalisation tight for the banks risk profile. In the financial markets including hedge funds investment banks and private equity funds. The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from.

Under applicable law including the Dodd-Frank Wall Street Reform and Consumer Protection Act the Board of Governors of the Federal Reserve System Board has the responsibility for the supervision of systemically important financial institutions including large banking organizations and nonbank financial companies that are designated by the Financial Stability Oversight Council FSOC for. For immediate release 05 Feb 2020 Bank Negara Malaysia the Bank today issued the policy document on Domestic Systemically Important Banks D-SIB Framework which sets out the Banks assessment methodology to identify D-SIBs in Malaysia and the inaugural list of D-SIBs. In recent years many countries introduced surcharges on global systemically important banks G-SIBs.

As per the transitional arrangement at June 30 2020 ICICI Bank the Bank is required to maintain minimum CET1 CRAR of 7575 minimum Tier-1 CRAR of 9075 and minimum total CRAR of 11075. List of D-SIBs by RBI 2020 SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs. Friday January 22 2021 Friday February 26 2021 62 SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in.

Lower interest rates and a subdued operating environment will further put pressure on the banks profitability in 2020 and our outlook is negative. Domestic Systemically Important Banks 7 of 14 Issued on. The Banking Capital Rules and the HKMAs regulatory framework for D-SIBs follow the provisions in A framework for dealing with domestic systemically important banks issued by the Basel Committee in October 2012 by enabling the Monetary Authority i to designate an authorized institution as a D-SIB if the Monetary Authority considers.

January 31 2020. RBI releases 2020 list of Domestic Systemically Important Banks D-SIBs SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the. The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from April 1 2016 and became fully effective from April 1 2019.

The framework introduced by State Bank is consistent with the international standards and practices and takes into account the local dynamics. I have served as independent consultant for the Securities and. The State Bank of Pakistan has today announced the designation of D-SIBs for the year 2020 under the Framework for Domestic Systemically Important Banks D-SIBs that was introduced in April 2018.

RBI Delivers List of Domestic Systemically Important Banks 2020. If necessary ask close family friends or the deceaseds doctor or lawyer if they know where these important papers can be found and the location of a bank safety deposit box if any. RBI releases 2018 list of Domestic Systemically Important Banks D-SIBs SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as last year.

Sell Off In Itc Negative Global Cues Pushes Sensex 0 92 Lower Social News Xyz Yes Bank Stock Exchange Bse Sensex

Canadian Banks Are Set To Face Covid 19 Related Headwinds From A Position Of Strength S P Global Ratings

The Australian Financial System Financial Stability Review April 2021 Rba

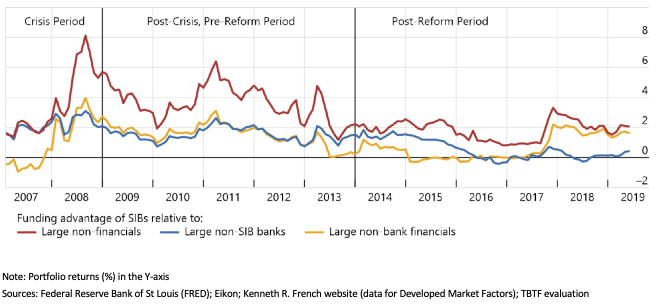

Evaluation Of Too Big To Fail Reforms Lessons For The Covid 19 Pandemic Financial Stability Board

Cross Border Links Between Banks And Non Bank Financial Institutions

Canadian Banks Are Set To Face Covid 19 Related Headwinds From A Position Of Strength S P Global Ratings

Canadian Banks Are Set To Face Covid 19 Related Headwinds From A Position Of Strength S P Global Ratings

Cross Border Links Between Banks And Non Bank Financial Institutions

Cross Border Links Between Banks And Non Bank Financial Institutions

Canadian Banks Are Set To Face Covid 19 Related Headwinds From A Position Of Strength S P Global Ratings

Vati Rn 2nd Comprehensive Predictor Focused Review Cardiovascular Disorders Case Management Nursing School Survival

Cross Border Links Between Banks And Non Bank Financial Institutions

Wells Fargo S Oil Misfire Pushes Profits Below 1 A Share But No Cause For Alarm Wells Fargo Fargo Wells Fargo Account

Cross Border Links Between Banks And Non Bank Financial Institutions

Expectations On The Use Of Pillar Ii Capital Buffers For Dtis Using The Standardized Approach To Credit Risk

The Australian Financial System Financial Stability Review April 2021 Rba

Https Www Ijcb Org Journal Ijcb20q4a3 Pdf

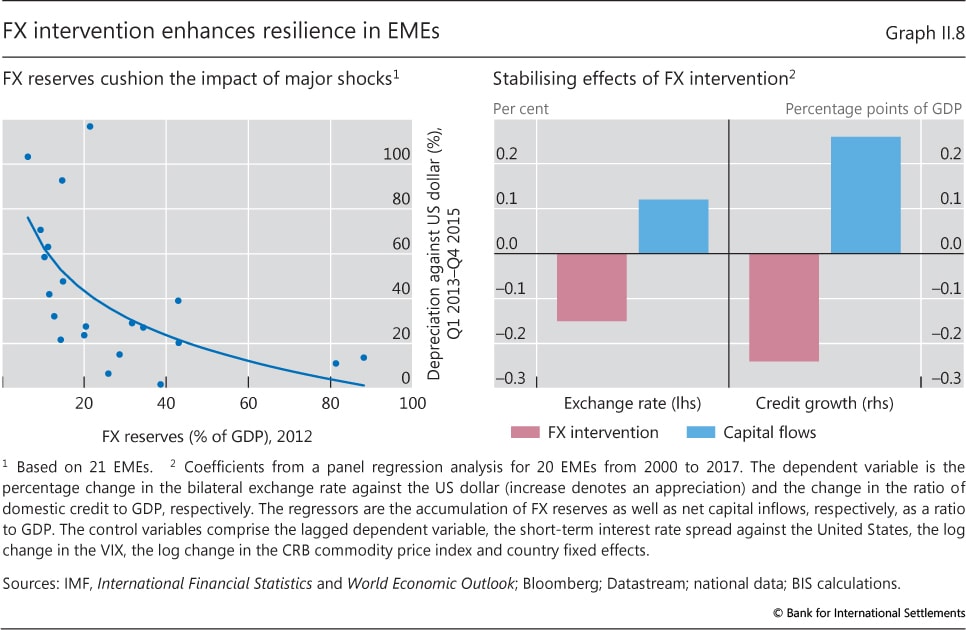

Ii Monetary Policy Frameworks In Emes Inflation Targeting The Exchange Rate And Financial Stability