The premium tax credit can help make purchasing health insurance coverage more affordable for people with moderate incomes. This is one of those deductions that.

This liability will be listed on your notice of assessment as an Excess private health insurance refund or reduction rebate reduced.

Excess private health insurance reduction tax. Private healthcare cover can be an attractive benefit for you your employees and your business. This is another above-the-line adjustment to income. If you get an excess private health insurance reduction or rebate reduced amount on your notice of assessment it is the amount of overpaid private health insurance you have received.

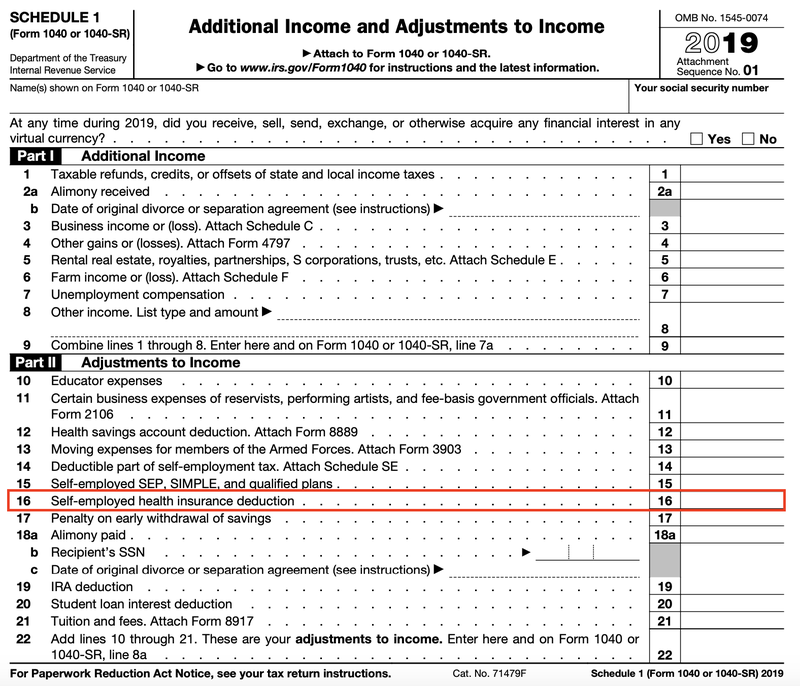

Your private health insurance statement. Self-employed persons can take a deduction for health insurance premiums they pay for themselves and their dependents directly on line 16 of the 2020 Schedule 1. You can receive the rebate or refund as either a direct reduction of the cost of your private health insurance through the year and this is a reduction.

This makes your income appear smaller similar to the way money you contribute to your 401K retirement savings makes your income appear smaller. In some instances it can even be beneficial from a tax perspective for businesses to take out a business private healthcare plan rather than a personal one. Selecting the correct tax claim code will ensure that MYOB Tax will calculate the correct Private health insurance rebate or Excess private health insurance reduction.

If you claim a net Premium Tax Credit for 2020 you must file Form 8962. 111-148 as amended and amended under the American Rescue Plan Act of 2021 ARPA PL. If you claim too much private health insurance rebate as a premium reduction we recover the amount as a tax liability.

This amount will be shown in the debit column of your notice of assessment. You can then transfer the total of Part 2 of Schedule 1 to line 10a on your 2020 tax return. Answer the yes-or-no questions in the following chart or via the accessible text and follow the arrows to find out if you may be eligible for the premium tax.

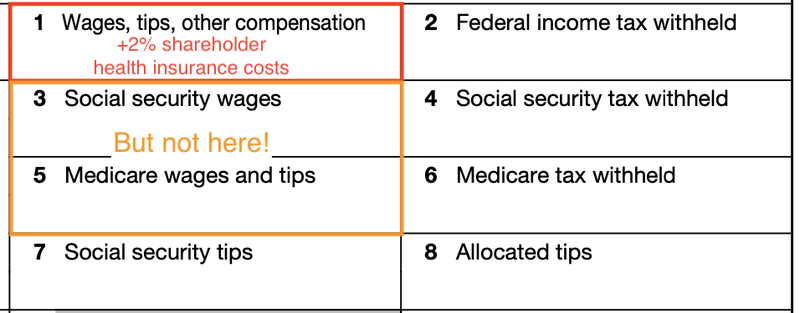

It is important for MYOB Tax to calculate correctly that you enter the Period 1 statement details in Period 1 likewise with Period 2. The premiums you pay for job-based health insurance usually come out of your paycheck before your income taxes are calculated. See section 28218 of the Private Health Insurance Act 2007 Liability for excess private health insurance premium reduction or refund.

We will calculate the amount of private health insurance rebate you are entitled to receive when you lodge your tax return. Through your private health insurance provider your private health insurance provider will apply the rebate to reduce your private health insurance premiums when you lodge your tax return as a refundable tax offset. Or if you choose not to claim the rebate this way you can claim it as a refundable tax offset on your tax return lodgement.

Claiming too much rebate Toby is single and 67 years old in 202021. However there are a number of specific circumstances where this is not the case. This means that in most cases private health insurance is not tax deductible and employees need to pay tax on any insurance premiums as reported in the P11D.

You can claim your private health insurance rebate as a. If you have private health insurance the amount of private health insurance rebate you can receive is reduced if your income is more than a certain amount. The private health insurance rebate is income tested.

This liability will be listed in the myTax estimate and on your notice of assessment as an Excess private health insurance reduction or refund. As soon as you go over one of these thresholds your entitlement to the governments private health insurance rebate will have changed and youll likely have a tax bill if. 117-2 to include several temporary provisions.

I think we can add that to the list of private health insurance ProTips. The rebate can be claimed for premiums paid for a private health insurance. Let your insurer know if you go above the following income thresholds.

Where private health insurance is provided to employees it is considered a benefit in kind. 5 Otherwise reduce your tax offset under subsection 1 by the amount worked out under subsection 3. The amount you pay would be.

Certain individuals without access to subsidized health insurance coverage may be eligible for the premium tax credit PTC established under the Patient Protection and Affordable Care Act ACA. Those singles with an income of over 84000 in the 2012-13 tax year are now only eligible for up to a 20 rebate on those premiums. Tax Excess Private Health Insurance Refund or Reduction Changes in the Tax system have resulted in many people losing part of the 30 Rebate on Private Medical Insurance premiums.

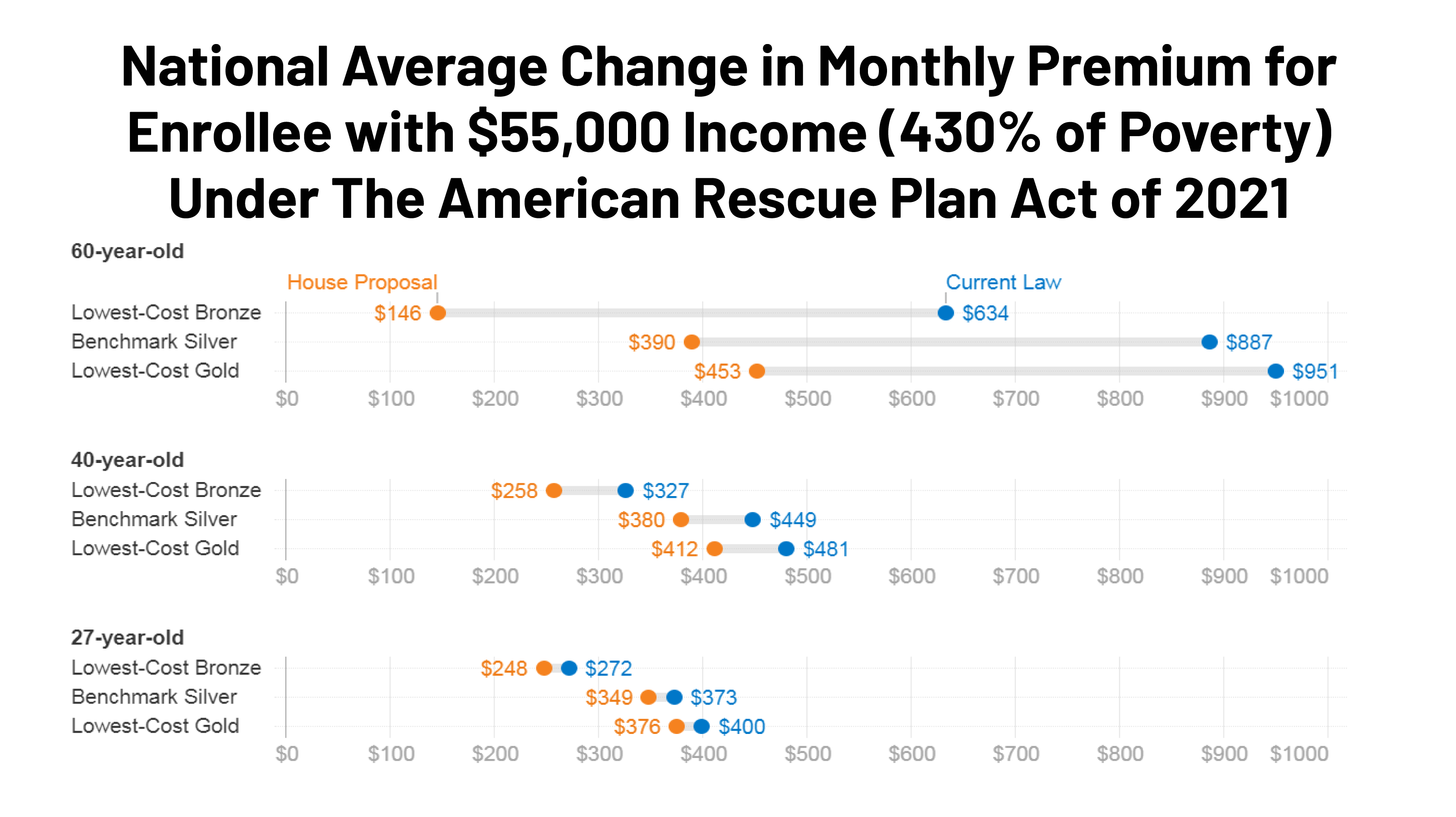

No deduction for Premiums You Paid With Pre-Tax Money. This is because the business would be eligible for tax relief on the costs so far as they. The American Rescue Plan removes the income cap for two years for health insurance premium tax credits through the federal health exchange or a state marketplace.

If you meet the eligibility requirements for a private health insurance rebate you can claim your rebate as either. If you have excess advance payments of the premium tax credit for 2020 excess APTC you are not required to report the excess APTC on your 2020 tax return or file Form 8962 Premium Tax Credit. A premium reduction which lowers the policy price charged by your insurer a refundable tax offset when you lodge your tax return.

If you claim too much private health insurance rebate as a premium reduction we recover the amount as a tax liability.

Are Health Insurance Premiums Tax Deductible

Impact Of Key Provisions Of The American Rescue Plan Act Of 2021 Covid 19 Relief On Marketplace Premiums Kff

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

What Tax Changes Did The Affordable Care Act Make Tax Policy Center

Who Is Affected By The Aca Subsidy Cliff Ehealth Insurance

Cbo Scores Better Care Health Insurance Budgeting American Healthcare

A Beginner S Guide To S Corp Health Insurance The Blueprint

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

A Beginner S Guide To S Corp Health Insurance The Blueprint

What Is Health Insurance Definition What Is Health Health Insurance Health

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Top Tax Planning Tips For 2019 Tax Planning Income Tax Audit Services

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

A Beginner S Guide To S Corp Health Insurance The Blueprint

Self Employed Health Insurance Deduction Healthinsurance Org

The 2020 Changes To California Health Insurance Ehealth

Arbonne S 30 Days To Healthy Living Flyer Arbonne Healthy Living Get Healthy