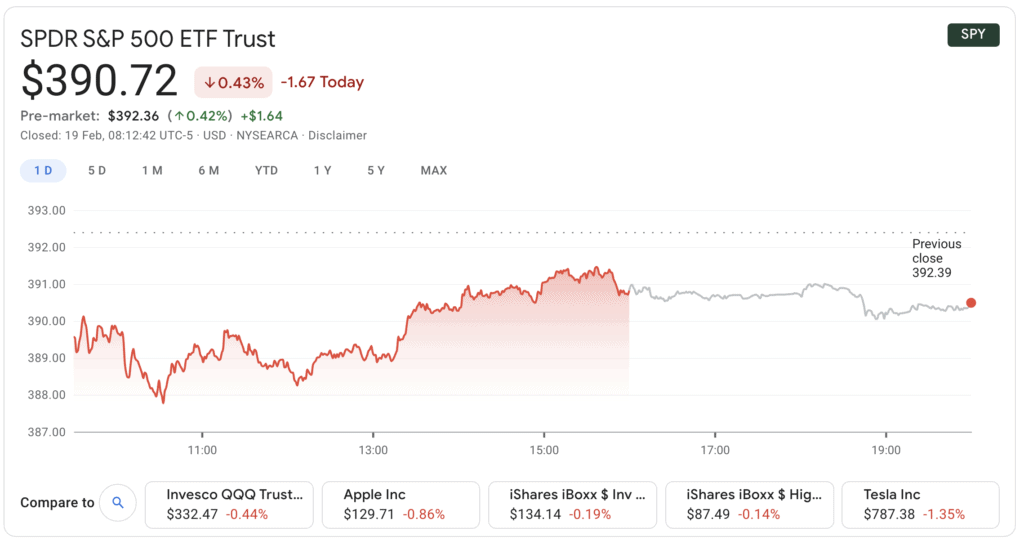

Current 5-Years Credit Default Swap quotation. The South Africa 10Y Government Bond has a 8935 yield.

Nowcasting Global Economic Growth A Factor Augmented Mixed Frequency Approach Ferrara 2019 The World Economy Wiley Online Library

A Moodys downgrade would force South Africa out of the FTSE World Government Bond Index which could prompt a sell-off and outflows of.

Ftse world government bond index south africa. Its rules and methodologies are consistent with those of the FTSE World Government Bond Index WGBI to enable performance comparisons across. 16 Jul 2021 1615 GMT0. With more than 25.

The index is calculated by FTSE FI or its agent. The Ashburton World Government Bond ETF aims to provide investors with exposure to investment grade sovereign bonds across developed and emerging markets through the purchase of a JSE listed ETF representing the FTSE World Government Bond Index WGBI. The South Africa credit rating is BB- according to Standard Poors agency.

Fund is to track the FTSE Group-of-7 G7 Index the Index as closely as possible in South African Rand. What does the fund invest in. The WGBI is a total-return index created in 1987.

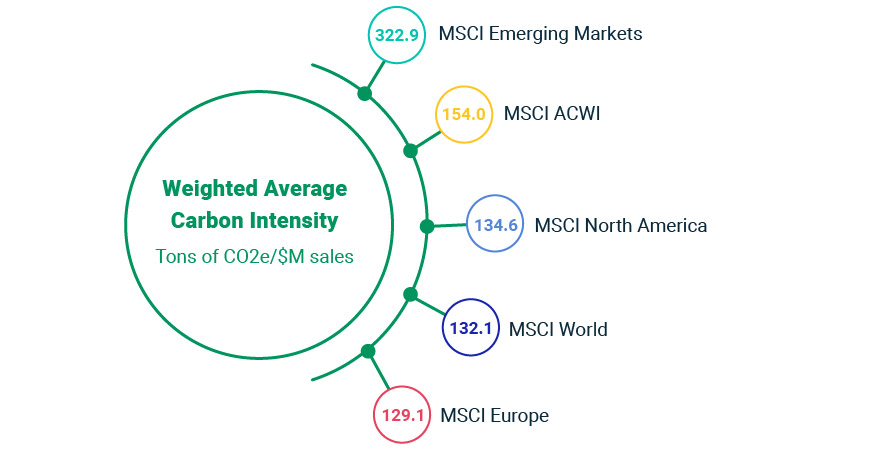

FTSE Emerging Markets Government Bond Index EMGBI The index comprises local currency government bonds from 14 countries. FTSE Russel said that for avoidance of doubt this means that South Africa would remain in the WGBI even in the event of a downgrade by Moodys until the end of April. The WGBI is a widely used benchmark that currently includes sovereign debt from over 20 countries denominated in a.

Companies in the FTSE All World Index that are also included in the FTSEJSE Shareholder-Weighted All Share Index are eligible for inclusion subject to criteria based on the FTSE ESG Model. This underlying fund tracks the Index and aims to replicate the performance of the Index. FTSE Russell as of June 30 2018.

Methodology of flagship FTSE government benchmarks including the investment grade FTSE World Government Bond Index WGBI. The FTSEJSE Fixed Income Index Series represents the performance of South African bonds. The Ashburton World Government Bond ETF the Fund has been developed solely by Ashburton Management Company RF Pty Ltd.

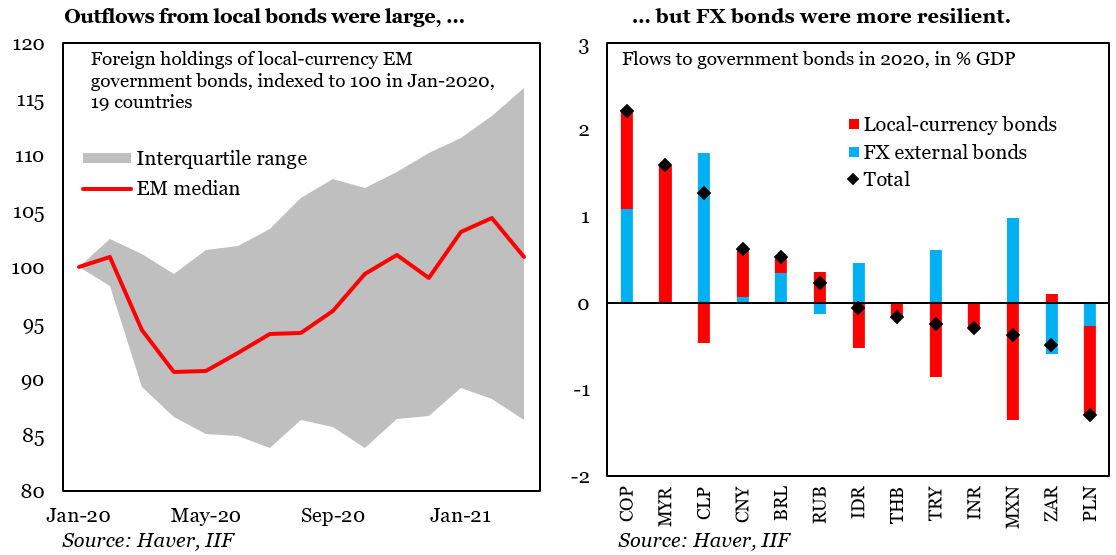

South Africa lost its last investment grade rating in March forcing it to be excluded from the World Government Bond Index WGBI on Thursday. As within the equity framework a Watch List of countries on the cusp of reclassification will be published and maintained with status updates provided each March and September. South Africa lost its last investment grade rating in March forcing it to be excluded from the World Government Bond Index WGBI on Thursday.

The FTSE World Government Bond Index WGBI measures the performance of fixed-rate local currency investment-grade sovereign bonds. The G7 Government. There are 12 South African government bonds in the index with a market value of US 9382 billion and their appearance in the WGBI affords the opportunity to investors to gain exposure to this exciting market said Ernest Battifarano Global Head of Index Development and Production.

The fund is a feeder fund and as such it invests in the iShares Global Govt Bond UCITS ETF. Analysts estimate up to R200 billion worth of SA government bonds may be sold as ETFs and mutual funds linked to these indices complete their next rebalance. Central Bank Rate is 350 last modification in July 2020.

The Citigroup World Government Bond Index or WGBI measures the performance of fixed-rate local currency investment-grade sovereign bonds. 10 Years vs 2 Years bond spread is 374 bp. The downgrade also means that South Africa will be removed from key investment-grade global government indices such as the FTSE World Government Bond Index WGBI.

FTSE FI and its licensors are not connected to and do not sponsor advise recommend endorse or promote the Fund and do not accept any liability whatsoever to any. Normal Convexity in Long-Term vs Short-Term Maturities. Past performance is no guarantee of future results.

The countrys debt was officially ejected on April 30 from the FTSE World Government Bond Index -- which tracks investment-grade debt and is followed by 3 trillion of funds -- after South. Inclusion of a market on the Watch. The series includes the FTSEJSE All Bond Index ALBI which.

Blackrock Global Index Funds En Emea Annual Report March 2018 Investment Fund Index Fund

Https Www Ft Com Content A5c6b91c 1ae2 11e7 9519 A200b6e21c5a 2019 10 31t23 46 28 000z Http Prod Upp Image Read Ft Com 75197746 9999 11e8 Ab77 F854c65a4465 Https Www Ft Com Content 284c1af0 Fbfd 11e9 98fd 4d6c20050229 2019 10

Nowcasting Global Economic Growth A Factor Augmented Mixed Frequency Approach Ferrara 2019 The World Economy Wiley Online Library

Https Retail Momentum Co Za Documents Invest And Save Fund Fact Sheets Mi Classic Factor Pr Momentum Investments Classic Factor 4 Ffs 20210331 Pdf

The Impact Of Sovereign Credit Ratings On Eurobond Yields Evidence From Africa Sciencedirect

Ftse Russell 2000 Stock Market Index Capital Market Shares Outstanding

Only A Handful Of Major Markets Four Of Those We Surveyed To Be Precise Carry A Valuation Today That Is Higher Than Absolute Value Stock Market Marketing

What Are Good Ways Of Investment In Germany Quora

Stores Close Across South Africa As Violent Riots Intensify

The Impact Of The Euro On Europe S Financial Markets Galati 2003 Financial Markets Institutions Amp Instruments Wiley Online Library

The Best Developed Markets Etfs Justetf

Jonathan Fortun Econchart Twitter

What Are Good Ways Of Investment In Germany Quora

Best Tracker Funds Uk 2021 Invest With Zero Fees Today

Value Etfs Could Be In Style For A While Ishares Dividend Stock Charts

The Impact Of The Euro On Europe S Financial Markets Galati 2003 Financial Markets Institutions Amp Instruments Wiley Online Library