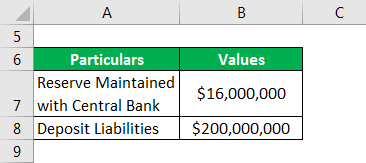

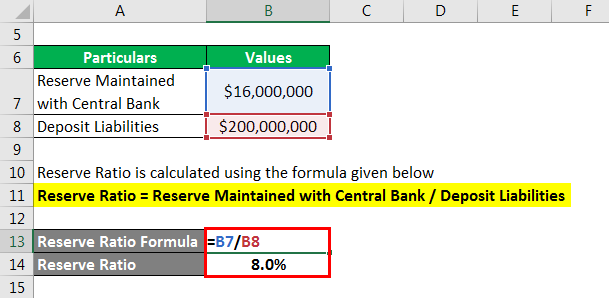

Losses has provided the most guidance to date as to how to calculate the ALLL. The calculation for a bank can be derived by dividing the cash reserve maintained with the central bank by the bank deposits and it is expressed in percentage.

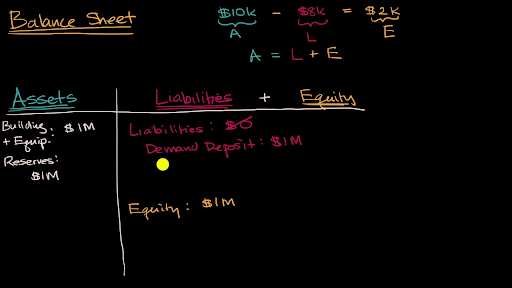

Bank Balance Sheets In A Fractional Reserve System Video Khan Academy

Total Recorded Investment Valuation Amount No Reserve Example 2 - Reserve requirement.

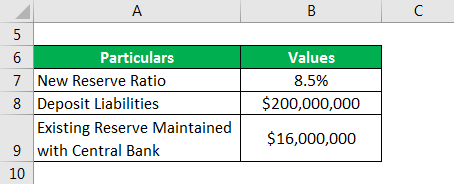

How do you calculate reserve requirement. Subtract the exemption amount from the net transaction amount accounts to get the adjusted net transaction accounts. If this same bank has 150 million in deposits and the required reserve ratio is 8 percent the total required reserves are 12 million notes SUNY Oneonta. Reserve Ratio Formula is represented as.

Per this statement calculations should be based on a comprehensive well documented and consistently applied methodology that produces reserve. Divide your grand total career point count by 360 because your pay is based on 30-day months and multiply by 25 to come up with your service multiplier. What does RESERVE REQUIREMENT mean.

Calculate the Required reserves. Reserve requirements are calculated by applying reserve ratios specified in Regulation D to an institutions reservable liabilities See Reserve Ratios as reported on the Report of Transaction Accounts Other Deposits and Vault Cash FR 2900 during the reserve computation period. This page provides summary information on how to determine the reserve requirements of an individual credit institution subject to the ECBs minimum reserve requirements.

If the required reserve ratio is 1 to 10 that means that a bank must hold. How to calculate the minimum reserve requirements. Required reserves 01 1000 100 The required reserves in this case are 100 and the bank is able to lend out the remaining 900.

Click to see full answer. For example 2134 points 360 25 1482. A more detailed description of the system can be found in the ECB publication entitled The single monetary policy in the.

Required reserves are calculated by taking the required reserve ratio multiplied by the total of the demand deposits in the bank. The requirement for the reserve ratio is decided by the central bank of the country such as the Federal Reserve in the case of the United States. The reserve ie cash balance may not go below zero.

In calculating the annual reserve requirement the board may adjust the amount each year in response to changes in the cost estimates and any current-year spending. If the result is negative then the bank has a reserve requirement of zero and a reserve balance requirement of zero. Reserves are measured by the number of months of the qualifying payment amount for the subject mortgage based on PITIA that a borrower could pay using his or her financial assets.

The required reserve ratio is the fraction of deposits that the Fed requires banks to hold as reserves. RESERVE REQUIREMENT meaning - RESERVE REQUIREMENT de. You can calculate the reserve ratio by converting the percentage of deposit required to be held in reserves into a fraction which will tell you what fraction of each dollar of deposits must be held in reserves.

While the required reserve ratio is set by an outside controlling financing board the actual reserve ratio on hand can be calculated by dividing the amount of deposited money retained on hand by the bank by the total amount of deposited money that the bank has. The standard method of determining reserve funding is taking the estimated replacement cost and dividing that by the estimated remaining useful. This is telling us that the commercial bank needs to keep 10 of its deposits as required reserves therefore.

The ReserveGuard retirement system calculates the multiplier from your total points. If the result is. A required reserve ratio is the fraction of deposits that regulators require a bank to hold in reserves and not loan out.

Calculating A Bank S Reserve Ratio Youtube

Bank Balance Sheet Free Response Question Video Khan Academy

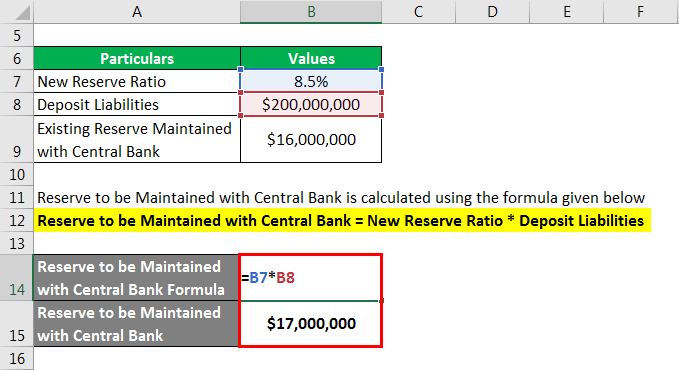

Reserve Ratio Formula Calculator Example With Excel Template

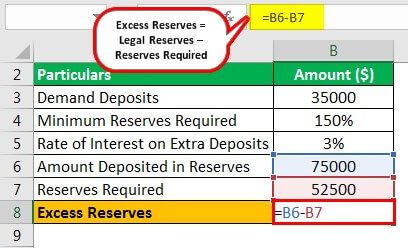

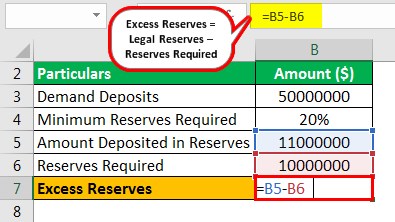

Excess Reserves Formula Example How To Calculate Excess Reserves

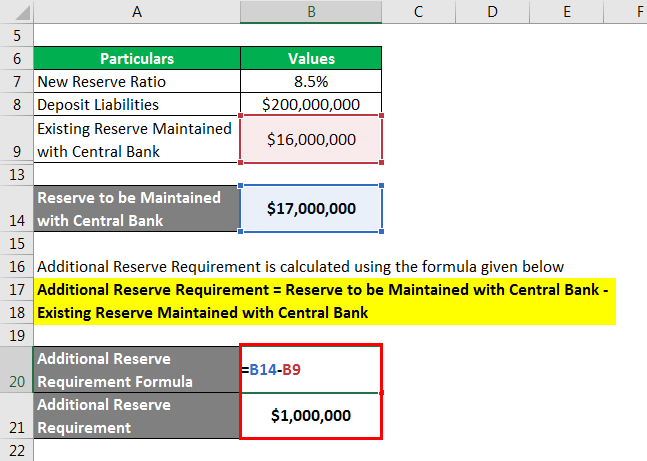

Reserve Ratio Formula Calculator Example With Excel Template

Money Creation Yellow Page Worksheet

Reserve Ratio Formula Calculator Example With Excel Template

Reserve Ratio Formula Calculator Example With Excel Template

Money Creation Yellow Page Worksheet

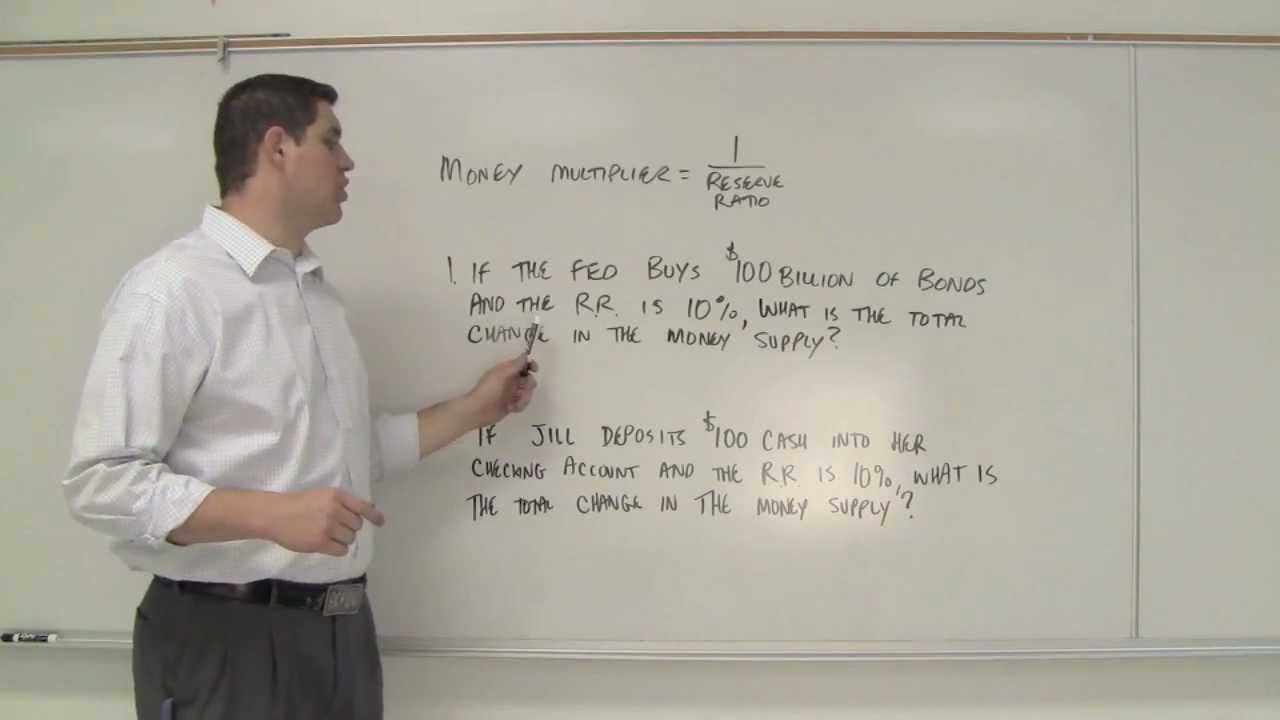

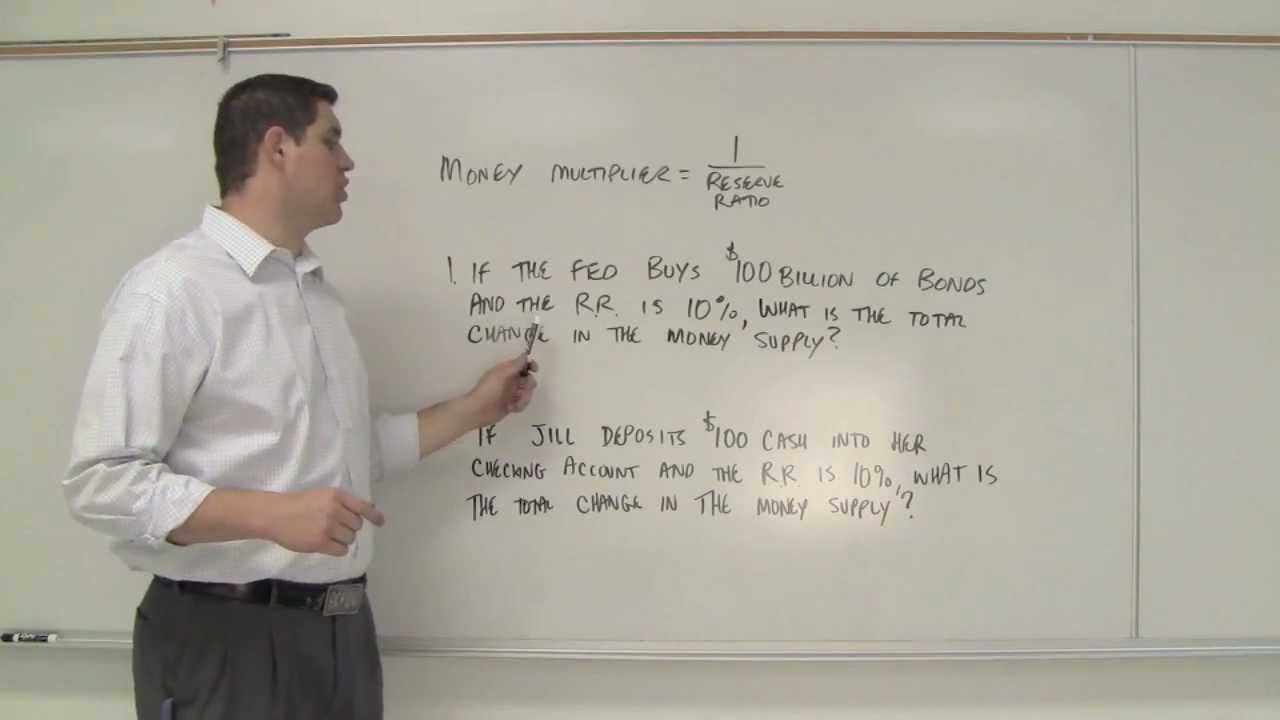

The Money Multiplier And Reserve Requirement Youtube

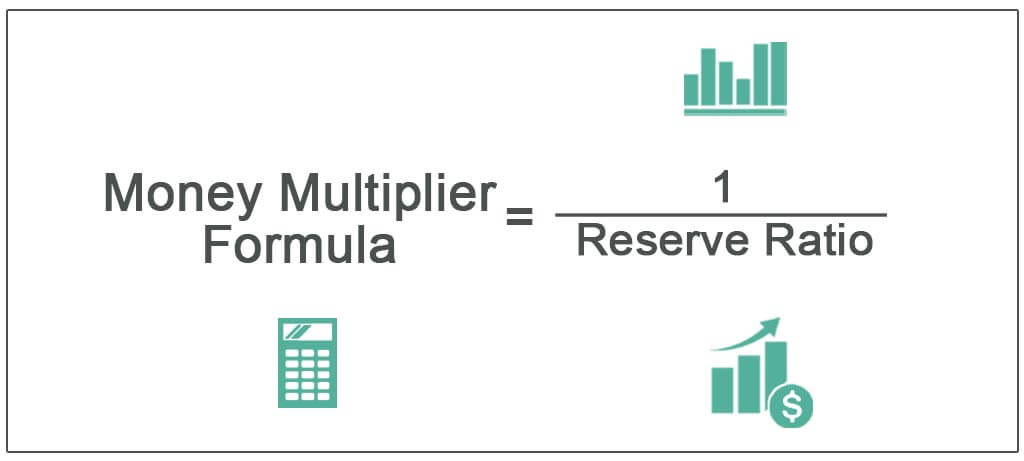

Money Multiplier Formula Step By Step Calculation Examples

Education What Effect Does A Change In The Reserve Requirement Ratio Have On The Money Supply

Excess Reserves Formula Example How To Calculate Excess Reserves

Reserve Ratio Formula Calculator Example With Excel Template

Reserve Ratio Formula Calculator Example With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

/dotdash_final_Deposit_Multiplier_Dec_2020-01-12355ee057a74ef1887bb1066444b606.jpg)