A cafeteria plan is a benefit plan that offers the employee the option to. Because John has private hospital cover he does not have to pay the Medicare Levy Surcharge.

Five Easy Steps For Enrolling In The Small Business Health Options Program Health Options Care Plan Health

Depending on your income the surcharge will be between 1 to 15.

How does having private health insurance reduce tax. If you meet the eligibility requirements for a private health insurance rebate you can claim your rebate as either. The Affordable Care Act includes a small business health insurance tax credit to encourage business owners to offer employees health insurance for the first time or maintain coverage they already have. Health insurance isnt tax deductible but there are a bunch of ways you can pay less tax.

The private health insurance rebate is income tested. The MLS adds an additional amount to those who dont have private health insurance. That might save you 25 or so in terms of the amount of federal income taxes you pay.

The rebate can be paid to you as part of your tax return or used to reduce premiums across the year. The Medicare Levy Surcharge MLS is a private health insurance tax encouraging higher-income Australians to take out private hospital insurance or pay a penalty. With basic hospital cover John pays 1138 after the Private Health Rebate.

Assume that your total healthcare expenses for the year including your health insurance premiums add up to 5000. The surcharge covers you and your dependents. Its designed to incentivise higher income earners to take up private health insurance helping to reduce the burden on the public healthcare system.

The surcharge aims to encourage individuals to take out private hospital cover and where possible to use the private system to reduce the demand on the public Medicare system. For instance you may be entitled to the private health insurance rebate or offset. The surcharge is payable for each day you dont have private health insurance within a.

As the rebate is income-tested the size of your rebate will reduce as your income increases and once you earn over the maximum threshold you wont be entitled to any rebate at all. However if you dont claim the rebate as a premium reduction which lowers the price your insurer charges you you can receive it as a refundable tax offset. Therefore tax credits reduce taxes dollar for dollar.

This comes in the form of a rebate where members can either apply the rebate to reduce their overall premiums or factor it into their annual tax refund. The total amount and your eligibility are based on your single or familys total taxable income which changes every year. The private health insurance rebate is an amount the government contributes towards the cost of your health insurance premiums depending on your income.

Claiming the deduction will not decrease your total tax liability by that amount it will reduce your taxable income by 5000. With hospital cover Johns annual tax saving is about 237. The private health insurance offset is the same as the private health insurance rebate.

In order for the payroll reductions for health insurance to be tax-free the employer has to establish a cafeteria plan. For unincorporated businesses the cost of providing healthcare cover for employees is deductible when calculating taxable profits. Eligibility for the health insurance rebate is based on income and age.

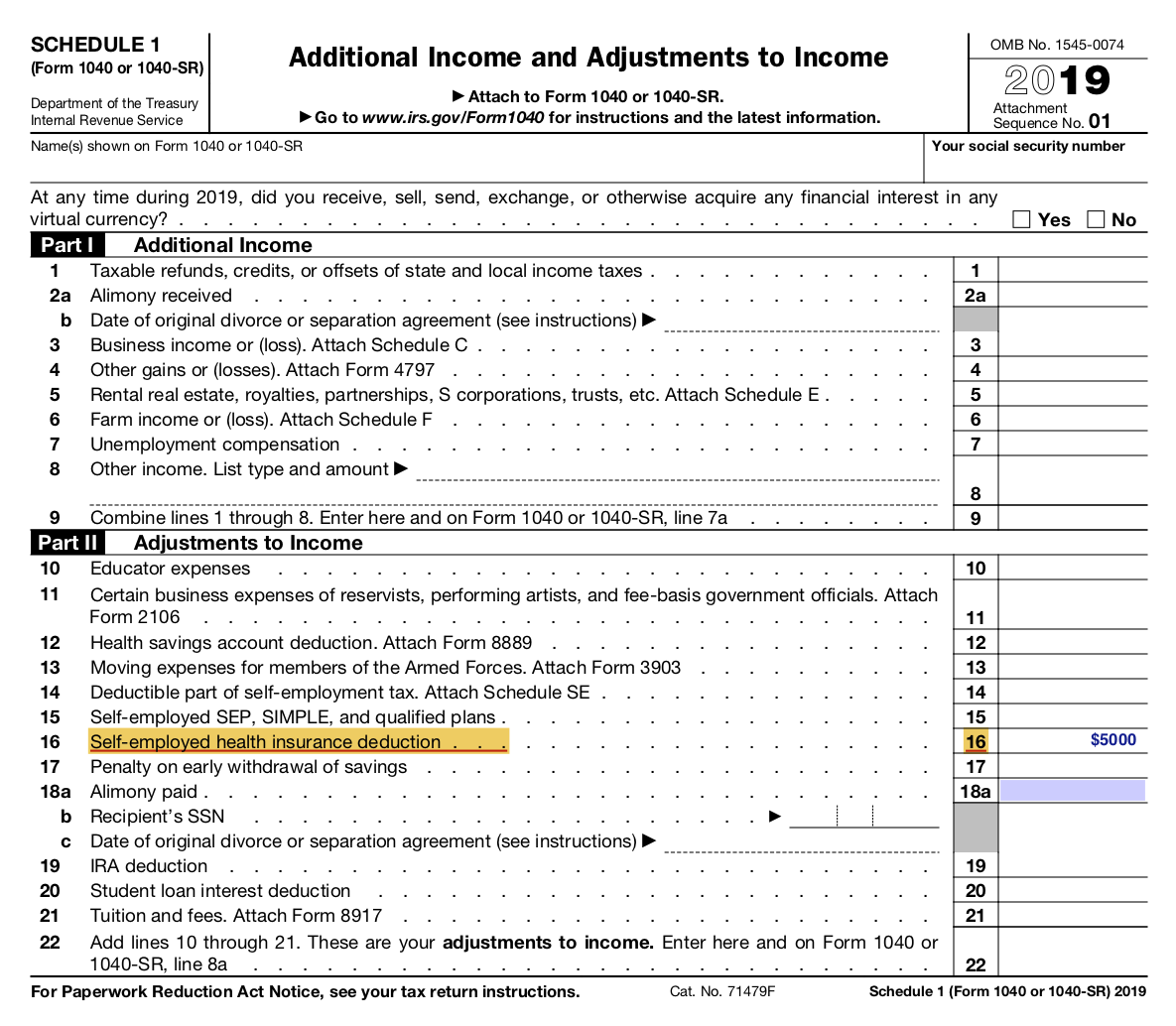

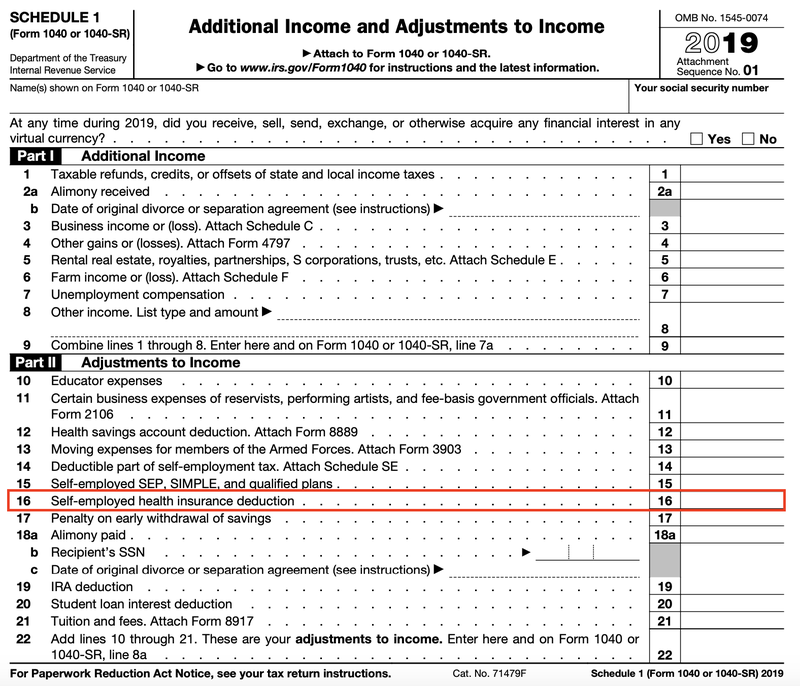

Self-employed persons can deduct health insurance above the line on their 2020 Schedule 1 which also eliminates the hassle and limitations of itemizing. The private health insurance rebate is an amount of money the government may contribute towards the cost of your private health insurance premiums. The Private Health Insurance rebate is federal government scheme set up to help Australians manage the costs of their premiums.

Tax credits are subtracted directly from a persons or business tax liability. A premium reduction which lowers the policy price charged by your insurer a refundable tax offset when you lodge your tax return. Am I eligible for a tax.

You can claim your private health insurance rebate as a. Employees benefit when health insurance premiums are deducted tax-free from their salaries without any of the limitations associated with the itemized deduction. If you are self-employed and purchase individual health insurance then this expense can be deducted directly on your Form 1040 as an adjustment to income.

Thats because its classed as a valid expense of the business and therefore eligible for tax relief. This will help reduce your taxable income and thus your income tax it will not however reduce your self-employment tax. In some cases the insurer will lower your premiums based on.

This can knock as much as 33 off your premiums. If you have private health insurance the amount of private health insurance rebate you can receive is reduced if your income is more than a certain amount. You can do this directly with your insurance provider to reduce your premiums throughout the year or the Australian Tax Office can calculate your private health insurance rebate as a lump sum when you lodge your tax return.

Usually Australians pay a standard 2 Medicare Levy at tax time. Without hospital cover John will pay the Medicare Levy Surcharge at 1375 per year. We will calculate the amount of private health insurance rebate you are entitled to receive when you lodge your tax return.

Cbo Scores Better Care Health Insurance Budgeting American Healthcare

Self Employed Health Insurance Deduction Healthinsurance Org

Amazing Way To Take Health Insurance As A Tax Deduction

Different Types Of Health Insurance Plans

Amazing Way To Take Health Insurance As A Tax Deduction

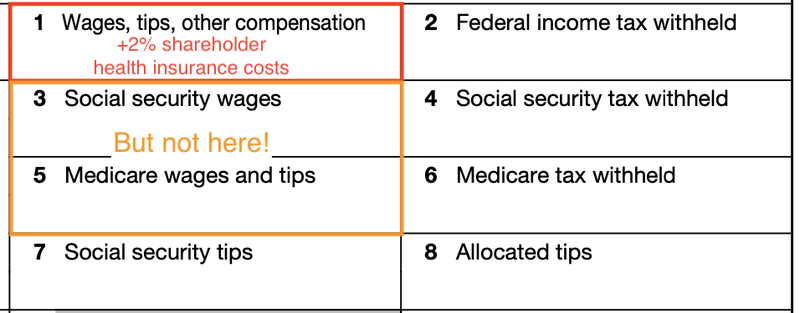

A Beginner S Guide To S Corp Health Insurance The Blueprint

How Does Corporate Health Insurance Benefit Employers Buy Health Insurance Health Insurance Health Insurance Plans

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

The 2020 Changes To California Health Insurance Ehealth

Infographic How Does Health Reform Work Infographic Health Health Care Reform Work Health

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

Can I Get Health Insurance Through My Llc

What Tax Changes Did The Affordable Care Act Make Tax Policy Center

A Beginner S Guide To S Corp Health Insurance The Blueprint

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

It Is No Secret Health Care Can Be Expensive Here Are Five Tips To Help You Save Money And Reduce You Health Insurance Companies Health Care Health Insurance

Pin By Only Health Matters On Right Religare Care Health Insurance Best Health Insurance Health