If you dont typically file taxes and have had a child in 2019 or 2020 you may be wondering how to receive the payment for each of your qualifying dependents. For example dont refigure the medical expense deduction.

25 Teacher Tax Deductions You Re Missing In 2021 Teacher Tax Deductions Diy Taxes Tax Deductions

Your parent must first meet income requirements set by the Internal Revenue Service to be claimed as your dependent.

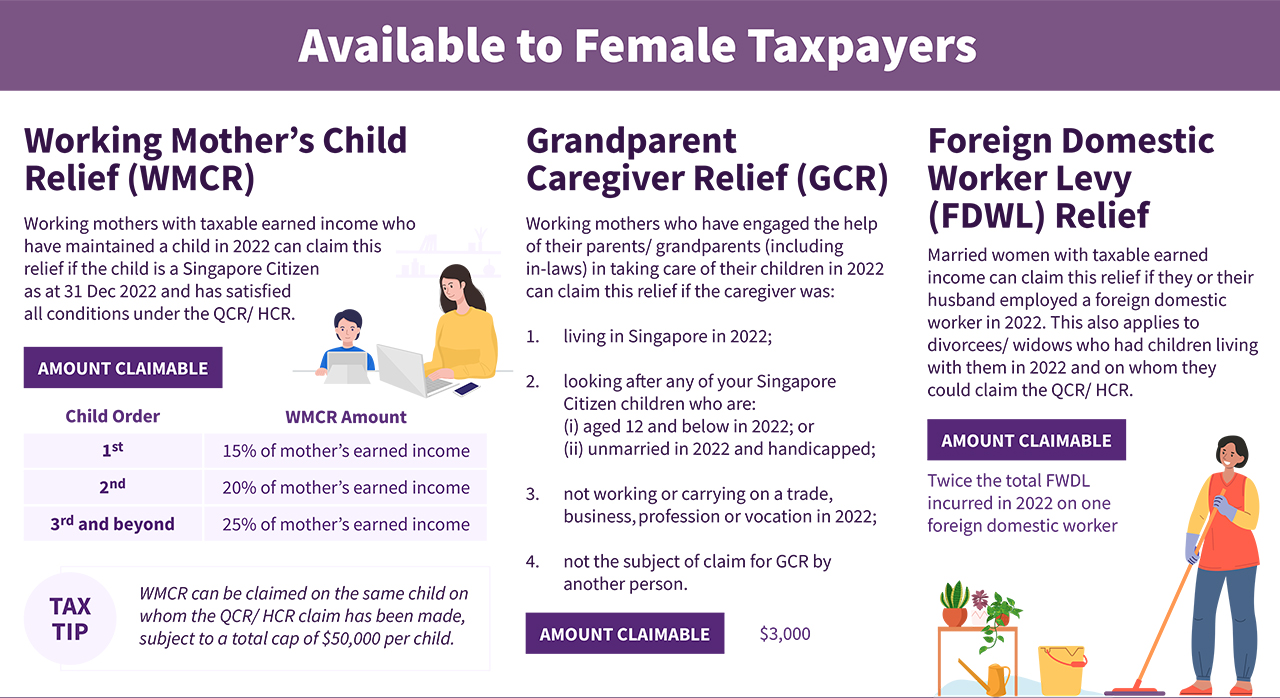

How to claim parent tax relief. You can claim either Parent Relief or Handicapped Parent Relief but not both for the same dependant up to a maximum of 2 dependants. Parents are eligible to claim the Parenthood Tax Rebate PTR of 5000 for their 1st child 10000 for the 2nd child and 20000 for the 3rd and each subsequent child. Tax Reliefs And Rebate For Parents.

To claim an older adult as your dependent you have to meet certain criteria outlined by the IRS. 3000 Limited Basic supporting equipment for disabled self spouse child or parent. Medical expenses for parents.

When figuring the tentative tax at the parents tax rate on Form 8615 dont refigure any of the exclusions deductions or credits on the parents return because of the childs net unearned income. You may use the PTR Eligibility Tool XLS 106KB to check your eligibility for PTR. Tax Relief Year 2020.

Limited 1500 for only one father. Both the father and the mother may share the PTR to offset their income tax payable. Those claiming Handicapped Parent Relief for the first time must also complete and submit the Handicapped-Related Tax Relief form via email.

The parent you claim does not have to be your biological relative. First-Time Handicapped Parent Relief Claims If you are claiming Handicapped Parent Relief and this is your first time claiming this relief on the dependant please complete and submit the Handicapped-Related Tax Relief form DOC 243KB by email. To qualify as a dependent Your parent must not have earned or received more than the gross income test limit for the tax year.

Amount RM Self and dependent. The first step to claiming any relevant tax credit for an elderly parent living with you is to claim them as a dependent. Any unutilised rebate can be used to offset the income.

Sarah TewCNET Roughly 60 million parents received child tax credit payments this week. Limited 1500 for only one mother. The form allows each person to release their claim to one party and you can even take turns in different tax years.

In April the IRS began issuing Economic Impact Payments EIP to provide much-needed financial relief during the coronavirus pandemic. To qualify you must be a Singapore tax resident who is married divorced or widowed in the relevant year. Claiming Dependents and Filing Status Determine your filing status with the Interactive Tax Assistant Find out if you can claim a child or relative as a dependent with the Interactive Tax Assistant File Form 8332 ReleaseRevocation of Release of Claim to Exemption for Child by Custodial Parent.

Parents that opt out of child tax credit payments will get one lump sum of the money during tax time. The Parenthood Tax Rebate PTR is given to tax residents to encourage them to have more children. The parents will be able to apply for the child tax credit on their 2020 return and if in fact the stimulus check did not issue to that parent they may be eligible to claim the Recovery Rebate.

This amount is determined by the IRS and may change from year to year. If you can claim your parent as an exemption just write in his or her name Social Security number and relation to. 6000 Limited Disabled individual.

If you have claimed this relief no other person is allowed to claim any other relief eg. How to Claim the Exemption. Figure the tentative tax on Form 8615 lines 6.

Parent Relief and Handicapped Parent Relief may be claimed by using e-Filing or paper filing. The amount of relief can be shared among all eligible claimants who wish to claim. Spouse Relief other than Grandparent Caregiver Relief for the same dependant s.

How To Organize Taxes Tax Time Tax Binder Free Printable Planner Checklist Editable Reciept Organi Tax Deductions Small Business Tax Printable Checklist

How To Fill Out Form W 4 Tax Forms Signs Youre In Love The Motley Fool

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

What Are Itemized Deductions And Who Claims Them Tax Policy Center

A Z Of Business Expenses For Sole Traders And Limited Companies Business Expense Business Sole Trader

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

How Many Tax Allowances Should I Claim Community Tax

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018 Money Malay Mail Tax Refund Income Tax Tax

How To Reduce Your Income Tax In Singapore Make Use Of These Tax Reliefs And Deductions

Income Tax 2020 Everything You Should Claim As Income Tax Relief News Rojak Daily

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Is Professional Tax Legal Services Tax Tax Accountant

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

Reduce Your Tax Payments In 2021 With These Tips Dbs Singapore

What Are Itemized Deductions And Who Claims Them Tax Policy Center