In this piece we discuss the importance of making a nomination for your life insurance policy and how it works. A nomination serves as an instruction for the insurer as to whom the claim amount needs to be settled in case of death of insured.

It is then important that your loved ones can access the funds quickly.

Importance of nomination in life insurance. When you advise your client to get a life cover for the full family make sure they name a nominee. In absence of a nomination the insurer would call for a succession certificate from the claimant which is issued by the court of law. This change was brought about through the Insurance Laws Amendment Act of 2015 and it rewrites the rules for Nomination in Life Insurance.

Nomination is governed by Sec. If you do not make a nomination in your insurance policy your insurance company is not. I wish it was that simple though for there are several things that you should know before rushing into making a nomination.

In a life insurance policy the policyholder nominates a person to whom the insurer must pay the policy proceeds in the event of hisher demise this person is called the nominee. It will be the nominee who will receive the proceeds of your life insurance policy on your demise. 39 of the Insurance Act 1938.

It could be your spouse parents children distant relative or even a friend. How Nomination Works in Life Insurance The holder of a policy of life insurance on his own life either may at the time of affecting policy or at any subsequent time before the policy matures nominate the person or persons to whom the money secured by the policy shall be paid in the event of his death. TLDR What Do I Need To Know About Insurance Nomination.

Thus Nomination is a right of the policyholder of the life insurance policy on his own life to select or appoint a person or persons to receive the proceeds of the insurance policy in event of his death during the policy term whereby raising a claim to the insurer. Making an insurance nomination allows you to distribute your policy proceeds to your loved ones according to your wishes. The rules for nomination in life insurance have changed for insurance policies maturing after March 2015.

Importance of nomination in a life insurance policy. If nominee is minor then appointee is required. What is Nomination in a Life Insurance Policy.

A policyholder can nominate any person usually a close relative to receive the money from the insurance company if he dies before the policy matures. That nominee should be. Although it is not mandatory to register a nominee one cannot overlook the importance of life insurance nominee as it prevents disputes and facilitates.

In simple words a nomination is a process of selecting one or more nominees for your policy. It gives you some basic information to help you understand the nomination. What does making a nomination even mean.

In the absence of a proper nomination the real beneficiaries are determined by various factors. The result was that in what could have been an unavoidable situation inheritance tax of 58000 had to be paid. Nomination is only an authorization to some one to receive the policy money if and when the policyholder dies.

Selection of nominee ensures that the life insurance company knows whom to pay the assured money after the demise of the policyholder. A stitch in time saves nine. In simple terms making a nomination in your life insurance policy means choosing someone to receive or manage the money disbursed by the insurance company when you die.

Who is a nominee. Sometimes clients can get put off by legal terms but you can easily put their uneasiness to rest by shedding light on thing they ought to know about nomination in life insurance. Proper nomination in Life Insurance is important to ensure that in the event of death the life insurance claim money goes into the right hands.

Importance of Having a Nominee On a Life Insurance Policy. Importance of nomination. As a policy owner you can make nominations on your own insurance.

Importance Of Making A Nomination. This is an introductory guide to help you understand the importance of making a nomination in your life insurance policy to safeguard the interest of your loved ones. Beneficial Nomination also help assignment where nomination rights are protected eg if policy is assigned to a bank then insurer will first clear the bank liability then pay the balance to nominee.

Read all the important key points of Nomination are given below. Making a nomination The purpose of having life insurance is to ensure that your loved ones are protected financially should anything happen to you. Unfortunately because no nomination were made on the life insurance policy or the pension the lump sum monies formed part of the estate which increased it to above the threshold and therefore inheritance tax was payable on the excess over 325000 at a rate of 40.

One should make sure that nomination of something as important as life insurance is up-to-date and in sync with whom policyholder actually wants to appoint as the beneficiary. Life Insurance Nominee Rules. Like for instance what is nomination with regards to life insurance.

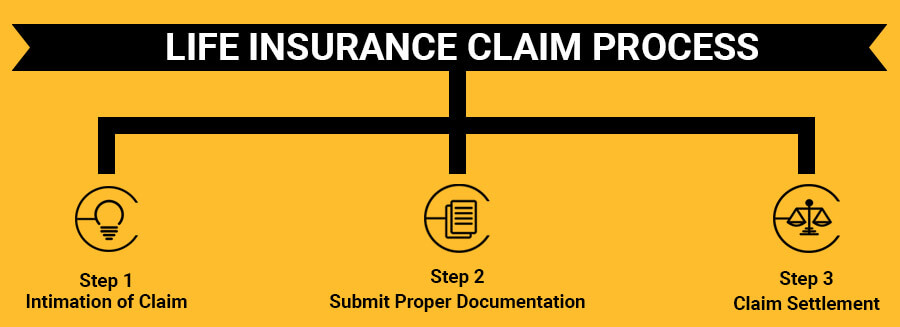

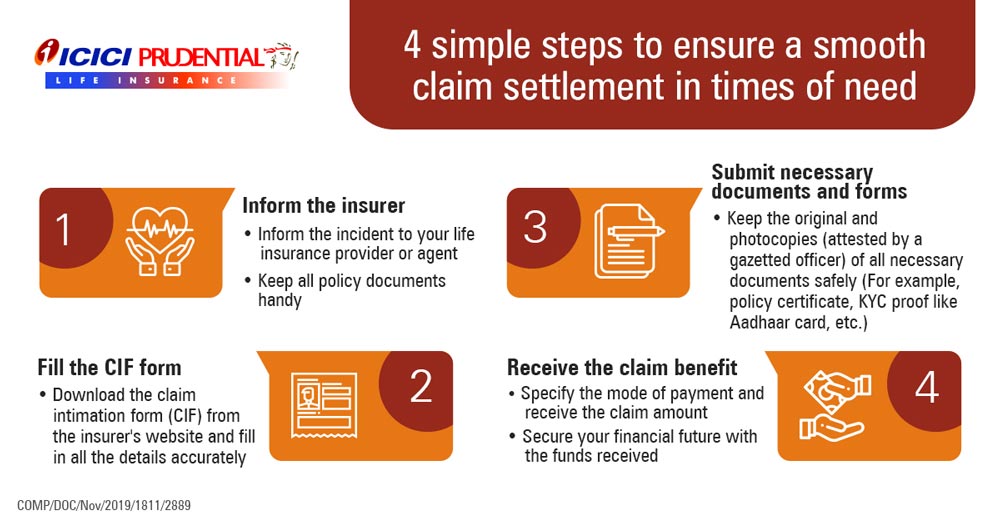

Life Insurance Claim Process And Required Documents Policyx Com

When Is The Best Time To Buy Life Insurance Insurance Investments Life Insurance Insurance

Insurance Consumer Protection A Video Series To Empower Consumers Empowerment Consumer Protection Insurance

Five Solid Reasons To Get Life Insurance Lifeinsurance Jeinsuranceassociatesdbaamcoinsurance Life Insurance Facts Insurance Investments Life Insurance Agent

Life Insurance Google Search Life Insurance Life Insurance Beneficiary Life

Importance Of Making A Nomination Life Insurance Corporate

Importance Of Nominee In A Life Insurance Abc Of Money

Assignment Of Life Insurance Policy Types Details Rules

Difference Assignment Vs Nomination In Life Insurance Policyx Com

Frank Lloyd Wright National Life Insurance Building Chicago 1925 National Life Insurance National Life Frank Lloyd Wright

Faq Can I Change My Nominee If Yes How Change Me I Can Faq

Term Insurance Calculator Helps You To Calculate Online Term Insurance Premium Payable For Life Life Insurance Calculator Life Insurance Policy Term Insurance

Protect Preserve The Well Being Of Your Loved Ones Saveandinvest Life Insurance Quotes Insurance Investments Life Insurance Policy

Life Insurance Best Way To Secure The Future Of Your Family Hdfc Sales Blog

What Is Life Insurance And Advantages Of Life Insurance Quora

What Is Life Insurance Life Insurance Definition Meaning Icici Prulife

Therapy On Demand On Health Insurance Cost Buy Health Insurance Health Insurance Plans