Interest Subvention on Loan of Farmers Posted On. Salient Highlights The objective of the scheme is to make available agricultural credit for.

Farmer S Suicide And Interest Subvention Scheme Insightsias

The Government provides interest subvention of 3 on short-term crop loans up to Rs300 lakh.

Interest subvention scheme for farmers upsc. 3 lakhs borrowed by them. This subvention will be available for a. Interest Subvention Scheme ISS was launched for short term crop loans in 2006-07.

The interest subvention scheme for farmers aims at providing short term credit to farmers at subsidised interest rate. All loans under this financing facility will have an interest subvention of 3 per annum up to a limit of Rs. The interest relief will be calculated at two percentage points per annum 2 pa on outstanding balance from time to time from the date of disbursal drawal or the date of notification of this scheme whichever is later on the incremental or fresh amount of working capital sanctioned or incremental or new term loan disbursed by eligible institutions.

300 lakh are made available to farmers at subvented interest rate of 7 per annum. These facilities should help farmers get a higher price for their produce as they will be able to reduce wastage store process and give value addition to their products. Interest Subvention Scheme ISS Under ISS scheme the farmers can get short term loans up to Rs.

3 Lakh at a subsidised interest rate for a period of one year. The Government has allocated Rs. All loans under this financing facility will have interest subvention of 3 per annum up to a limit of Rs.

Interest subvention scheme for farmers Interest subvention for short term crop loans Interest subvention for post harvest loans Interest subvention for relief to farmers affected by natural calamities Interest subvention under Deendayal Antyodaya Yojana - National Rural Livelihoods Mission. The policy came into force with effect from Kharif 2006-07. Interest subvention scheme-2 Jun 30 2020 The RBI circular notes that interest subvention of 2 per cent will be calculated on the crop loan amount from the date of its disbursementdrawal up to the date of actual repayment of the crop loan by the farmer or up to the due date of the loan fixed by the banks whichever is earlier subject to a maximum period of one year.

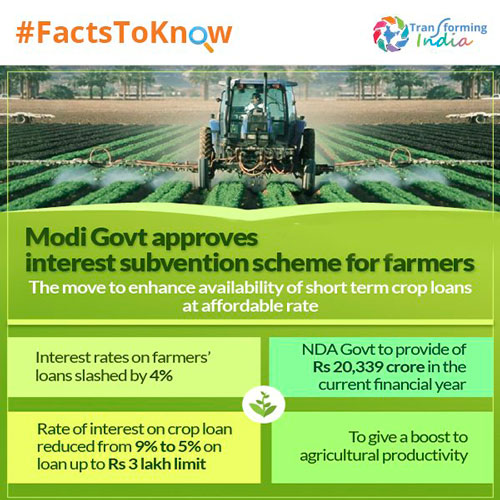

Interest Subvention Scheme Read More. The Government has approved an interest subvention scheme for farmers under which farmers will get short-term crop loans of up to Rs 3 lakh with interest. Interest subvention for short term crop loans.

INTEREST SUBVENTION SCHEME FOR FARMERS. The Interest Subvention Scheme will continue for one year and it will. Under this banks and financial institutions provide loans with an interest subvention of 3 per annum.

Interest Subvention Scheme ISS. The Union Cabinet has approved the Interest Subvention Scheme ISS for farmers for the year 2017-18. Presently loan is available to farmers at an interest rate of 7 per annum which gets reduced to 4 on prompt repayment.

The Union cabinet has approved the Interest Subvention Scheme ISS for farmers for the year 2017-18. The scheme will help farmers to avail short term crop loans up to Rs. Interest Subvention Scheme The interest subvention scheme was introduced in 2006-07 with the view of providing concessional credit to farmers.

The scheme is being implemented for the year 2018-19 and 2019-20. The scheme will run for ten years from 2020 to 2029. Additionally 3 prompt repayment incentive PRI is provided for good credit discipline.

10 AUG 2018 425PM by PIB Delhi The Government of India GoI has been implementing the Interest Subvention Scheme ISS since 2006-07 under which short term crop loans upto Rs. This will help farmers getting short term crop loan up to Rs. 3 lakh payable within one year at only 4 per cent per annum.

This will help farmers getting short term crop loan up to Rs. 20339 crore for this scheme. The Central Government provides to all farmers for short term crop loan upto one year for loan upto Rs.

If the farmers make prompt repayment they can also avail incentive of 3 this effectively bringing the rate of interest to 4. In case farmers do not repay the short term crop loan in time they would be eligible for interest subvention of 2 as against 5 available above. Under this scheme the farmers can avail concessional crop loans of upto Rs3 lakh at 7 per cent rate of interest.

3 lakh payable within one year at only 4 per annum. 2 interest subvention is given to farmers which is reimbursed to banks through RBI and NABARD. 3 lakh payable within one year at only 4 per annum.

Under the same scheme.

Agriculture Infrastructure Fund Aif Scheme Civilsdaily

Agriculture Infrastructure Fund Next Ias Current Affairs Blog

Interest Subvention Scheme Iss Current Affairs Gk News Gktoday

Bank Exams Interest Subvention Scheme Part 1 Offered By Unacademy

Cabinet Approval For Agriculture Infrastructure Fund Upsc Current Affairs

2.png)

Jatin Verma S Ias Academy 8882932364 Jatin Verma Best Ias Coaching In Karol Bagh Ias Coaching In Karol Bagh Classroom Courses For Ias Coaching In Karol Bagh Foundation Batches For Ias

Agriculture Infrastructure Fund Next Ias Current Affairs Blog

Editorial Notes Why All Crop Loans Should Be Routed Through Kisan Credit Cards

Union Government Has Introduced A New Scheme Of Interest Subvention On Working Capital Loans For Dairy Sector For Supporting Dairy Cooperatives And Farmer Producer Organizations Engaged In Dairy Activities For Implementation During

Central Sector Scheme Of Financing Facility Under Agriculture Infrastructure Fund Current Affairs Insight

09 July 2021 Daily Current Affairs For Upsc

Agriculture One Year Current Affairs For Upsc Cse Mains

Interest Subvention Scheme For Farmers Journalsofindia

National Rabi Campaign 2020 Upsc Iasbhai

Second Tranche Of Economic Stimulus Package Legacy Ias Academy

2 12 G Sa Agricultural Credit Farm Loan Waivers Interest Subvention Scheme Explained Youtube

Doubling Farmers Income Journalsofindia

Focus On Crop Diversification And Allied Activities Ias Aspirants Kingdom

Agriculture Infrastructure Fund Explained Current Affairs Upsc Current Affairs