But if you havent transferred that accout and if your EPF account is new and less than 7 years old then you cannot withdraw it. This advance is non-refundable and the person will not have to.

Covid 19 Know How Much You Can Withdraw From Your Epf

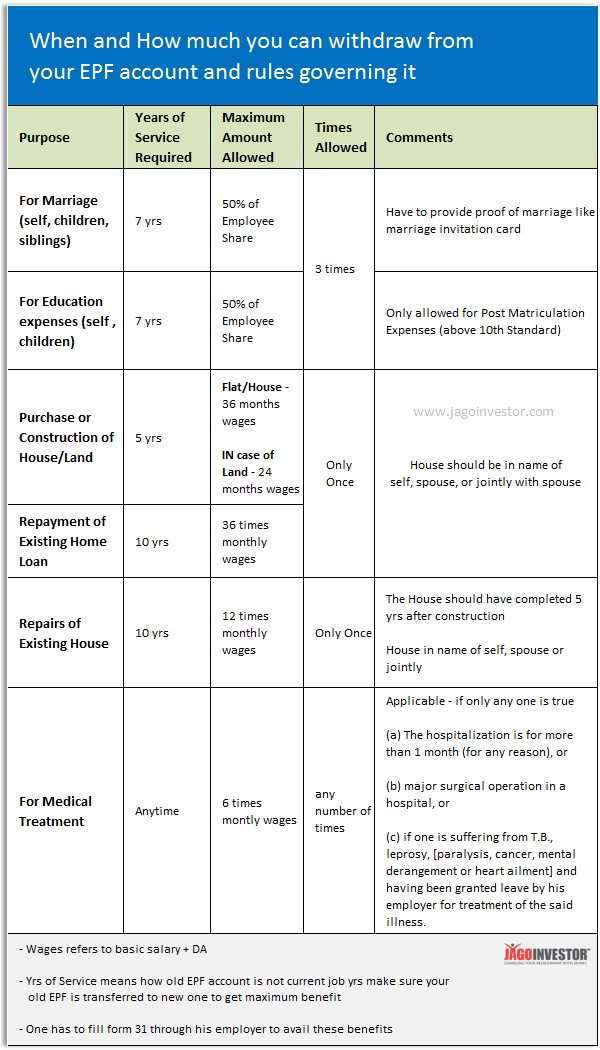

A person can obtain an advance from its EPF balance up to three months of basic salary plus dearness allowance or 75 per cent of the balance standing in its account whichever is less.

Lesser amount can be withdrawn for epf. But if youre planning for a job change then you can transfer the EPF amount to the company youd join. This will be taken as a non-refundable deposit. You can withdraw up to 75 of the total amount if youve been unemployed for more than a month.

10 Things To Know About EPF Withdrawal. The EPF members can not withdraw full PF amount before attaining the age of retirement. According to the new rules PF account holders can withdraw money equivalent to three months of their basic salary plus dearness allowance or 75 of the net balance in their PF or EPF account whichever is lower.

An individual who has worked for less than 6 months can apply for a scheme certificate but will not be able to withdraw EPS according to. EPF account New Rule. But as per new updated rules your age must be at least 57 to withdraw 90 EPF corpus amount.

The maximum withdrawal on cessation of employment cannot exceed an amount aggregating employees own contribution and interest accrued thereon. On the other hand 100 can be withdrawn after 2 months of constant unemployment. Only once the individual leaves the company and before joining a new company heshe can withdraw the EPS amount.

You get an EPS pension from the age of 58 provided you have completed at least 10 years of service. 1 According to current rules an EPFO subscriber can withdraw his or her EPF balance after remaining unemployed for two months. EPF partial withdrawal rule for purchasing a land a new house or construction.

In such cases the pension value is reduced to a rate of 4 per year until the employee reaches the age of 58 years. However if the members total savings amount to RM10000 the total maximum amount that can be withdrawn will be RM9900 as a minimum balance of RM100 is required to be kept in their Account 1 in order to be maintained as an EPF member. Since the withdrawal is considered as income of the investor the funds withdrawn from the EPF account before 5 years of continuous service are fully taxable as per the investors applicable tax slab TDS will be deducted if the amount withdrawn is more than Rs50000.

But if 5 years has not completed than the full withdrawal amount be taxable and all the tax benefits earned in the last years of contribution will be reversed. Reduced pension An EPF pension scheme member can withdraw early pension if he or she has attained the age of 50 but is less than 58 years old and if they have made an active pension contribution in EPF for 10 years or more. If the total PF amount is less than Rs50000 If the employee has not served 5 years of continuous service to the EPF yet wants to make a withdrawal then if the total PF amount is less than Rs50000 heshes withdrawal can be tax exempted.

833 of the employers contribution in the EPF goes to Employees Pension Scheme or EPS subject to a ceiling of Rs 15000 per month. The same goes for members with any amount of savings below RM10000. These withdrawal claims can be raised online.

If the amount is even a little more than Rs50000 the withdrawal will be subject to tax. You can withdraw your contributions interest portion only. You can withdraw your whole PF account only once you attain the age of 58 years old.

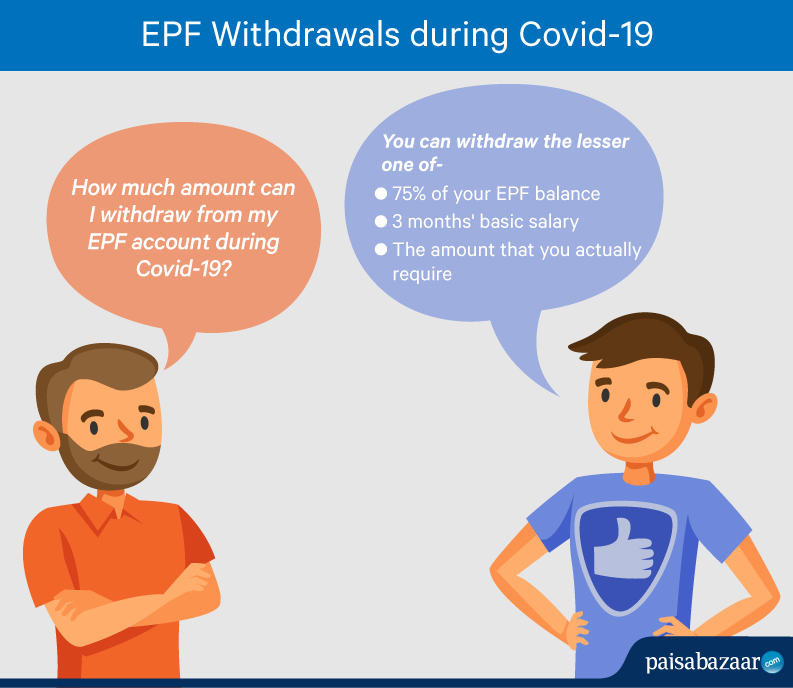

An amount up to 24 times an individuals monthly salary and dearness allowance can be withdrawn. You wont be eligible for this withdrawal facility before 57 and the main purpose of this withdrawal rule of EPFO is to keep the EPF amount for the old age days. The minimum monthly pension you get is Rs 1000.

EPF withdrawal rules say that any withdrawal after completion of 5 years of continuous service will be tax free in the hands of recipient. As per the latest rules you cannot withdraw your PF amount. 2 If the EPFO subscriber.

You can withdraw your EPF only if you have transfered your EPF account from your previous employer. Also that account needs to have been open for 7 years including the 4 years spent in this company. In case of withdrawal with less than 5 years of contribution not only the amount withdrawn becomes taxable but the tax benefits enjoyed.

Only if you are not working currently then you can withdraw your contribution interest but not your employers contribution.

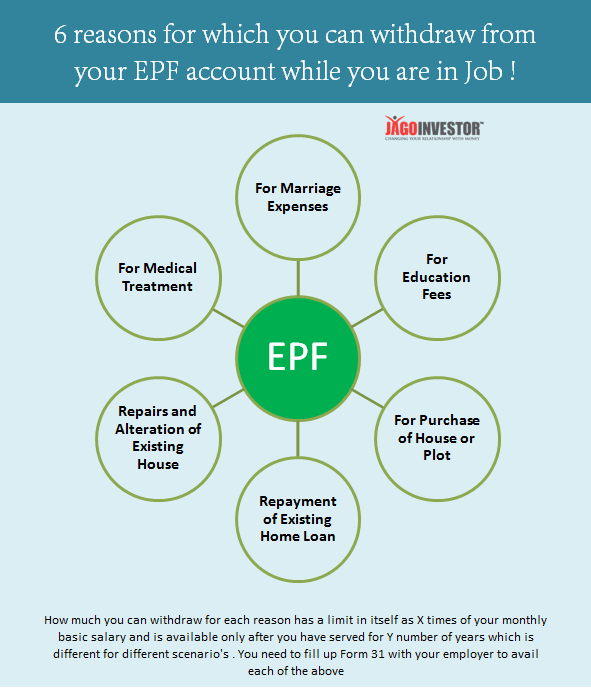

6 Reasons For Which You Can Withdraw Money From Your Epf Account

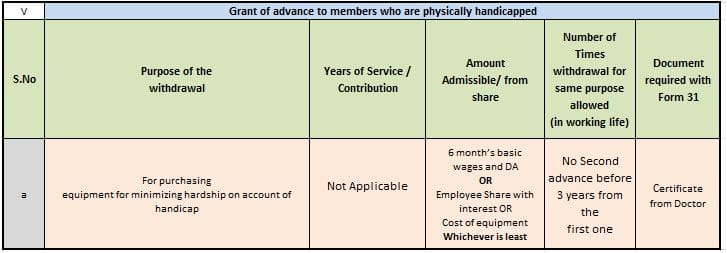

Epf Partial Withdrawals Advances Options Guidelines 2020 21

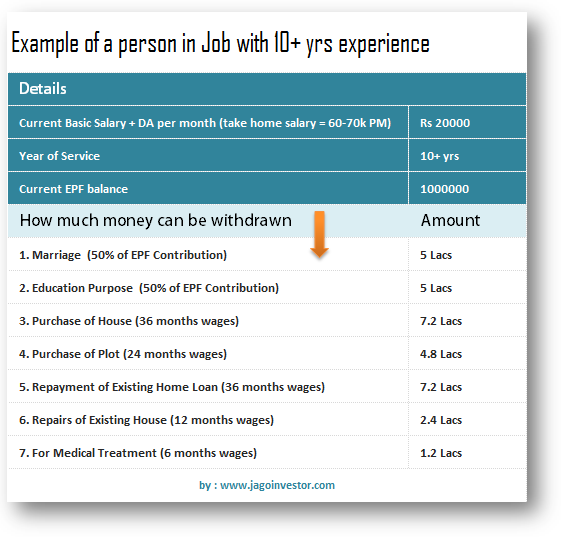

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Epf Partial Withdrawals Advances Options Guidelines 2020 21

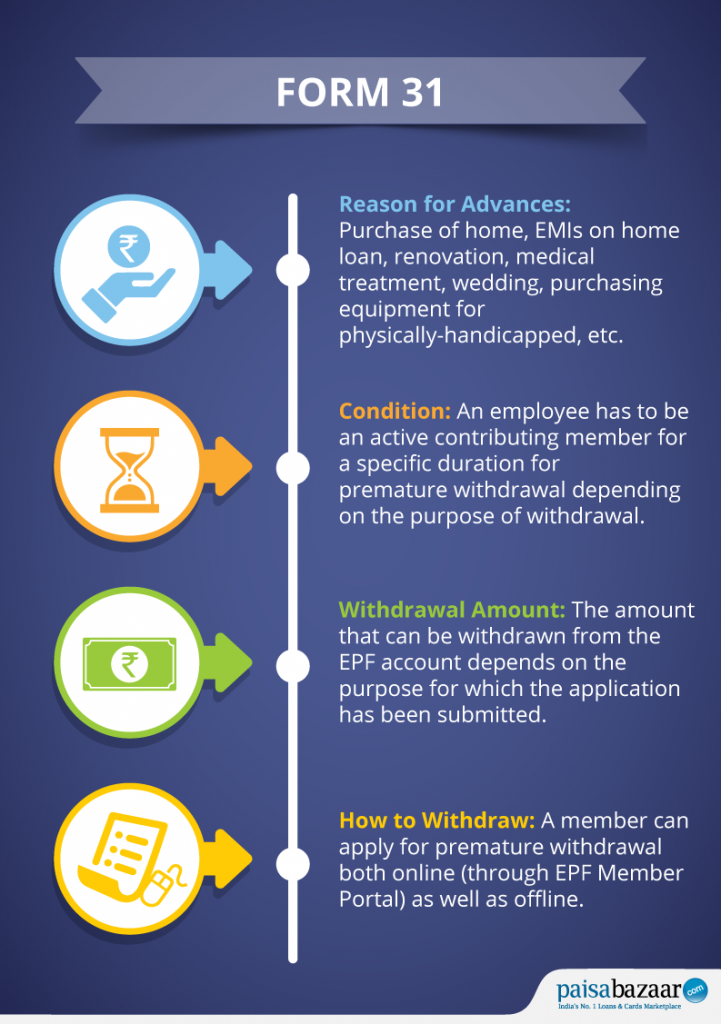

What Is The Use Of Form 31 In Pf Quora

Epf Withdrawal Or Advance For Medical Expenses Basunivesh

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Epf Form 31 Instructions Filing Procedure How To Download

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

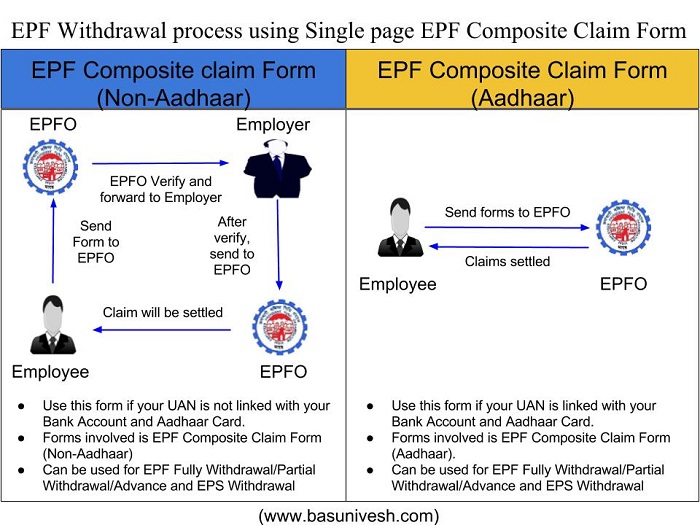

Epf Partial Withdrawal Or Advance Process Form How Much

Epf Form 15g How To Fill Online For Epf Withdrawal Basunivesh

Changes In Epf Withdrawal Rules From 10 Feb 2016

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

6 Reasons For Which You Can Withdraw Money From Your Epf Account