Following closely behind IGB REIT in terms of market capitalization size is Pavilion REIT RM408b Sunway REIT RM402b and CMMT RM302b. It intends to raise approximately 700m ringgit RM700m by offering 790m new shares at an indicative price of between 88-90 sen per share.

Top 5 Malaysian Reits That Made Money If You Invested From Their Ipos

This comprises 755 million shares offered to institutional investors and the rest came under the retail offering.

New ipo pavilion reit. 15042021 102 PM traintobullland pavilion good business unlike some other malls many closed shop. Based on the IPO price of RM125 IGB REITs market capitalization would be RM43bn making it the largest pure retail M-REIT. En route to a listing on Dec 7 Pavilion REIT is issuing 790 million new shares or 263 of its total issued units upon listing.

Ii 35000000 new units made available for application by the malaysian public the eligible tenants of the subject properties as defined herein the directors of pavilion reit management sdn bhd and the eligible employees of pavilion reit management sdn bhd urusharta cemerlang sdn bhd capital flagship sdn bhd and kuala lumpur pavilion sdn bhd at the retail price being the initial price payable by. Below is some info taken from RHB Research report on the IPO. Pavilion REIT Real Estate Investment Trust IPO.

Pavilion Reit raising RM710m in IPO KUALA LUMPUR Pavilion Real Estate Investment Trust a Malaysian shopping mall trust part-owned by Qatar Investment Authority is raising RM710 million S291 million in an initial public offering two people with knowledge of the matter said. Although it may started-off in 2nd place the new REIT may grows to clinch the first place from SunREIT. Out of these 755 million units are offered to Malaysian and foreign.

The positive sentiment from news that Pavilion REIT may debut on Bursa Malaysia as early as next month appears to have rubbed off on Mal. Based on the IPO price of RM125 IGB REITs market capitalization would be RM43bn making it the largest pure retail M-REIT. Based on the IPO price of RM125 IGB REITs market capitalization would be RM43bn making it the largest pure retail M-REIT.

The PSE raised around P104 billion in 2020. Below is some info taken from RHB Research report on the IPO. KUALA LUMPUR Pavilion Real Estate Investment Trust REIT aims to raise up to RM710 million in an initial public offering IPO which would.

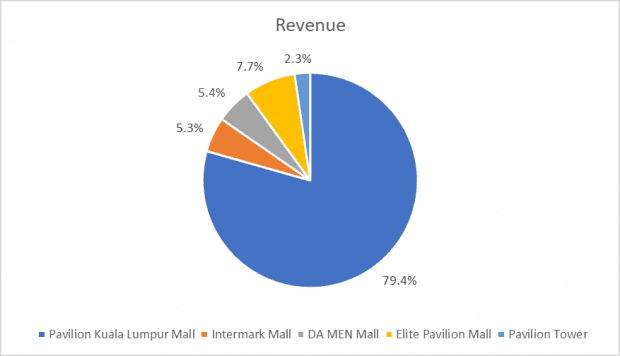

Pavilion REIT PavREIT has an asset size of RM35bn just after the largest MREIT - Sunway REITs RM45bn. Although it may started-off in 2nd place the new REIT may grows to clinch the first place from SunREIT. Malton surges on Pavilion REIT IPO.

P443 billion worth of IPOs P412 billion on follow-on offerings P56 billion through private. The first-ever Philippine real estate investment trust Ayala Land REIT AREIT also made its debut in PSE in 2020. Following closely behind IGB REIT in terms of market capitalization size is Pavilion REIT RM408b Sunway REIT RM402b and CMMT RM302b.

Below is some info taken from RHB Research report on the IPO. Following closely behind IGB REIT in terms of market capitalization size is Pavilion REIT RM408b Sunway REIT RM402b and CMMT RM302b. The Initial Public Offering IPO consists of 790 million units at an IPO price of RM088 per unit.

Fortunefire This new mall at bukit jalil is a good addition to the reit portfolio however yet to be tested and proven a strong mall. Following closely behind IGB REIT in terms of market capitalization size is Pavilion REIT RM408b Sunway REIT RM402b and CMMT RM302b. Pavilion Real Estate Investment Trust Pavilion Reit a Malaysian shopping mall trust is seeking a listing in Malaysia by December this year.

Pavilion REIT PavREIT has an asset size of RM35bn just after the largest MREIT - Sunway REITs RM45bn. The IPO is expected to raise RM710mil. Pavilion REIT Real Estate Investment Trust is scheduled to be listed in Main Market of Bursa Malaysia on the 7th December 2011.

Based on the IPO price of RM125 IGB REITs market capitalization would be RM43bn making it the largest pure retail M-REIT. Pavilion REIT PavREIT has an asset size of RM35bn just after the largest MREIT - Sunway REITs RM45bn. Based on the IPO price of RM125 IGB REITs market capitalization would be RM43bn making it the largest pure retail M-REIT.

Following closely behind IGB REIT in terms of market capitalization size is Pavilion REIT RM408b Sunway REIT RM402b and CMMT RM302b. Although it may started-off in 2nd place the new REIT may grows to clinch the first place from SunREIT.

Finance Malaysia Blogspot New Ipo Pavilion Reit

Finance Malaysia Blogspot New Ipo Pavilion Reit

St Louis Lambert Western Gable T1 St Louis Lambert International Airport Wikipedia Wow Air International Airport Southwest Airlines

7 Things I Learned From The 2019 Pavilion Reit Agm The Fifth Person

Finance Malaysia Blogspot New Ipo Pavilion Reit

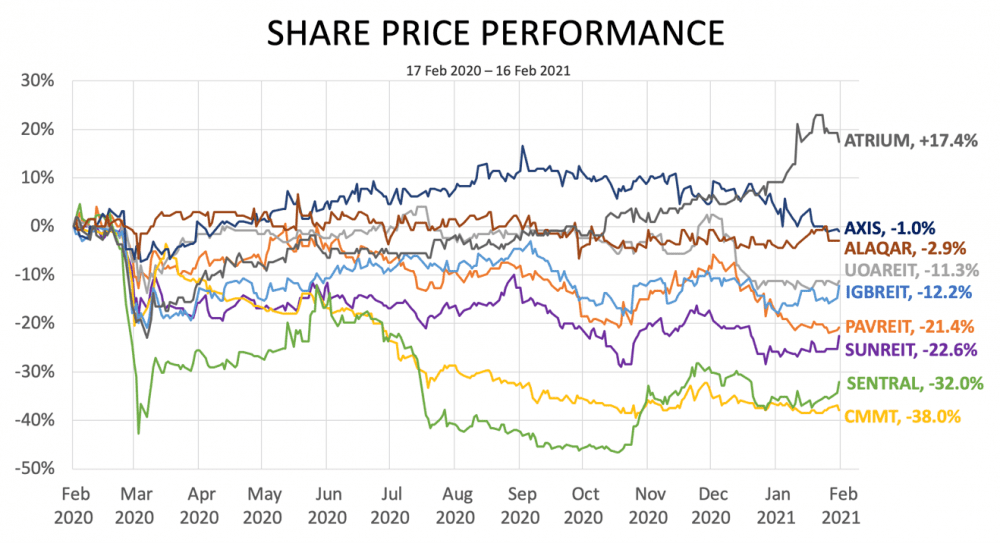

Slow And Steady Recovery For M Reits The Edge Markets

Financial Management Solutions Fortune My Investing Reit Financial Management

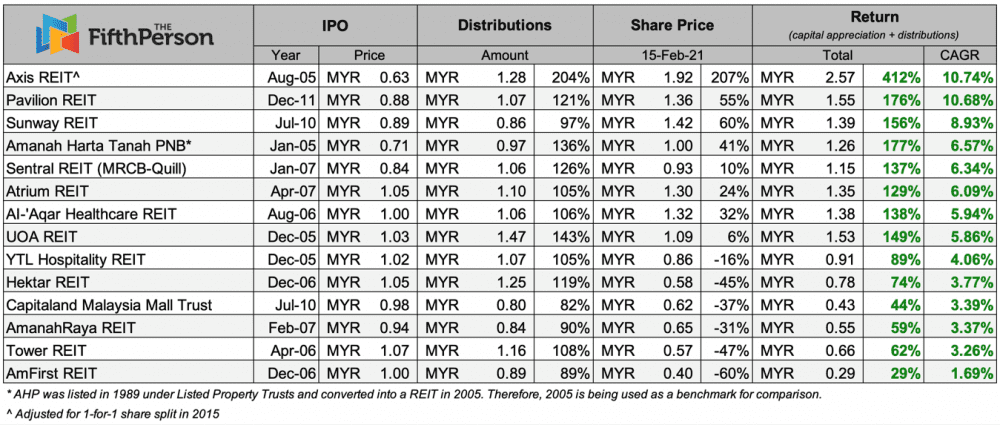

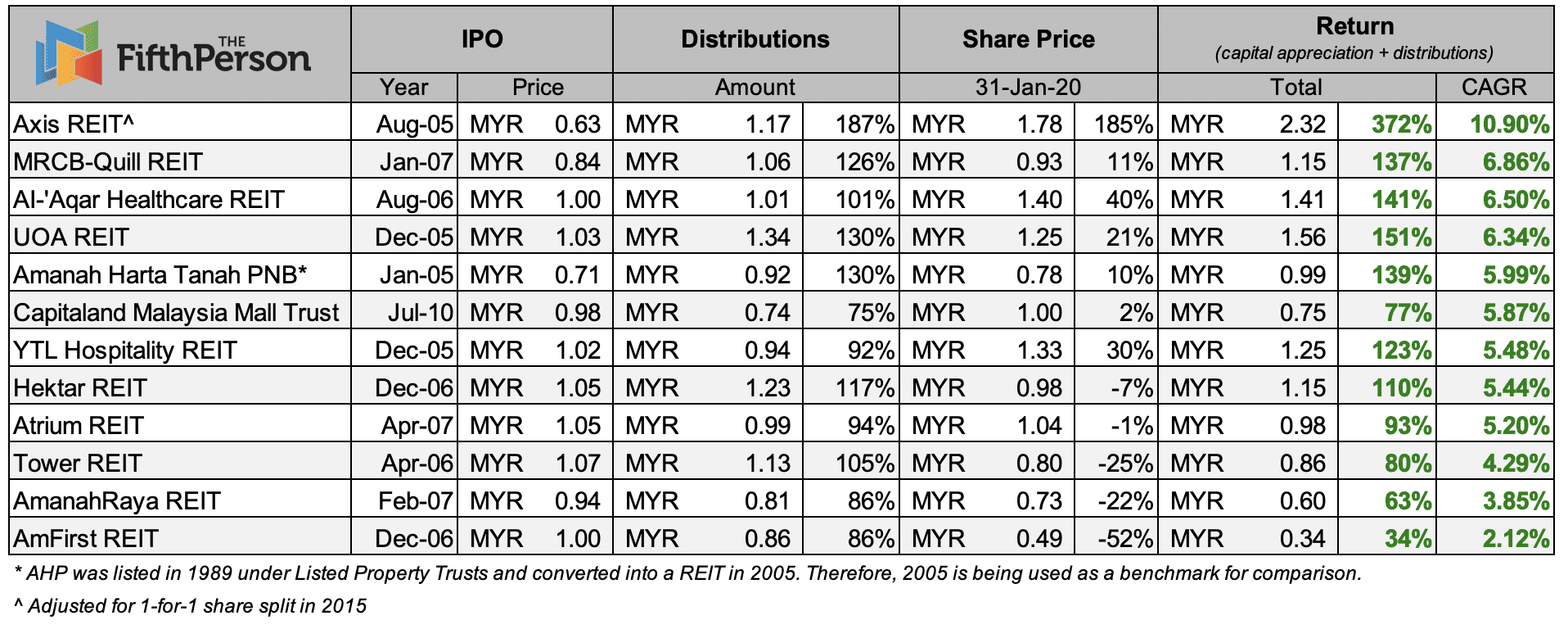

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

14 Things To Know About Pavilion Reit Before You Invest Updated 2020

Financial Management Solutions Fortune My Investing Reit Financial Management

5123 Share Price And News Mrcb Quill Reit Share Price Quote And News Fintel Io

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

14 Things To Know About Pavilion Reit Before You Invest Updated 2020

12 Things To Know About Pavilion Reit Before You Invest

What Are The Markets Financial Health Real Estate Investment Trust Marketing

Top 5 Malaysian Reits That Made Money If You Invested From Their Ipos

14 Things To Know About Pavilion Reit Before You Invest Updated 2020