The 25 amount covers taxes calculated on income only within the 25 bracket. The calculator reflects known rates as of Janunary 06 2010 and please also note that the personal income tax calculator doesnt reflect the CPP and EI deductions or contributions for your 2010 personal income tax.

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Summary Highlights from tax year 2010 personal income tax returns include.

Personal income tax 2010. For example a single person earning 50000 would be in the 25 tax bracket in 2010. PA-19 -- PA Schedule 19 - Sale of a Principal Residence. All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format.

Official rate of interest 201011 200910 400 475 CAPITAL GAINS TAX 201011 200910 From 23610 Until 22610 Annual exempt amount 10100 10100 10100 CGT rates for individuals12 Gains qualifying for entrepreneurs relief see final section of table below 10 18 18. PERSONAL INCOME TAX BULLETIN 2010-02 Issued. Personal income tax PIT company income tax CIT and value-added tax VAT remained the largest sources of tax revenue collectively comprising around 80 of total tax revenue.

Greater AccuracyFewer errors mean faster processing. In May 2010 the new Coalition Government announced that in its first Budget it would introduce a substantial increase in the personal tax allowance a first step to its longer-term objective to raise the allowance to 10000. DFO-02 -- Personal Individual Tax Preparation Guide for Personal Income Tax Returns PA-40.

Chargeable income of that individual is less than 05 per cent of the total income of that individual the individual shall be charged to tax at the rate of 05 per cent of his total income. 4 rows The Income Tax and Personal Allowances for 2010 were set at the 2009 budget. OECDs dissemination platform for all published content - books serials and statistics.

PA-1 -- Online Use Tax Return. 2010 Personal Income Tax Forms. She would pay federal income tax of 468125 plus 25 on her income over 34000.

Joining the 95 million Americans who already are. OECD OCDE OECD iLibrary Organisation de coopration et de dveloppement conomiques bibliothque livres priodiques statistiques collections journaux. Total federal adjusted gross income FAGI of resident taxpayers returns with positive tax liability for 2010 equaled approximately 560 billion an increase of 39 billion 76 percent from 2009.

To have forms mailed to you please call 401 574-8970. Increases in the personal allowance since 2010. New York adjusted gross income.

Use Free File Fillable Forms. Options for e-filing your tax returnssafely quickly and easily. Items listed below can be sorted by clicking on the appropriate column heading.

2010 Personal Income Tax Forms. If your adjusted gross income was 58000 or less in 2010 you can use free tax software to prepare and e-file your tax return. 2010 Personal Income Tax Calculator Personal Income Tax Rates Canada Calculate your 2010 personal income tax combined federal and provincial tax bill in each province and territory of Canada.

Personal Income Tax Act. All taxpayers are eligible for this tax-. July 22 2010 Guidance for Investors in Fraudulent Investment Schemes The purpose of this bulletin is to provide guidance to investors in fraudulent investment schemes commonly known as Ponzi schemes.

The Income Tax and. The 468125 covers taxes calculated on income that falls in the 10 and 15 brackets. PIT as a percentage of total tax revenue decreased from 313 in 200405 to 284 in.

DEX 93 -- Personal Income Tax Correspondence Sheet. 2010 personal income tax forms Select to view another year - Year - 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985. Delaware Non-Resident Individual Income Tax Return Instructions for Form 200-02 Download Fill-In Form 181K 2010 Income Tax Table Download Fill-In Form 53K 200 V Payment Voucher Download Fill-In Form 90K Schedule W Apportionment Worksheet Download Fill-In Form 127K 200-01X Resident Amended Income Tax Return Download Fill-In Form 274K.

Tax Rates Congressional Budget Office

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Tax Revenue Statistics Statistics Explained

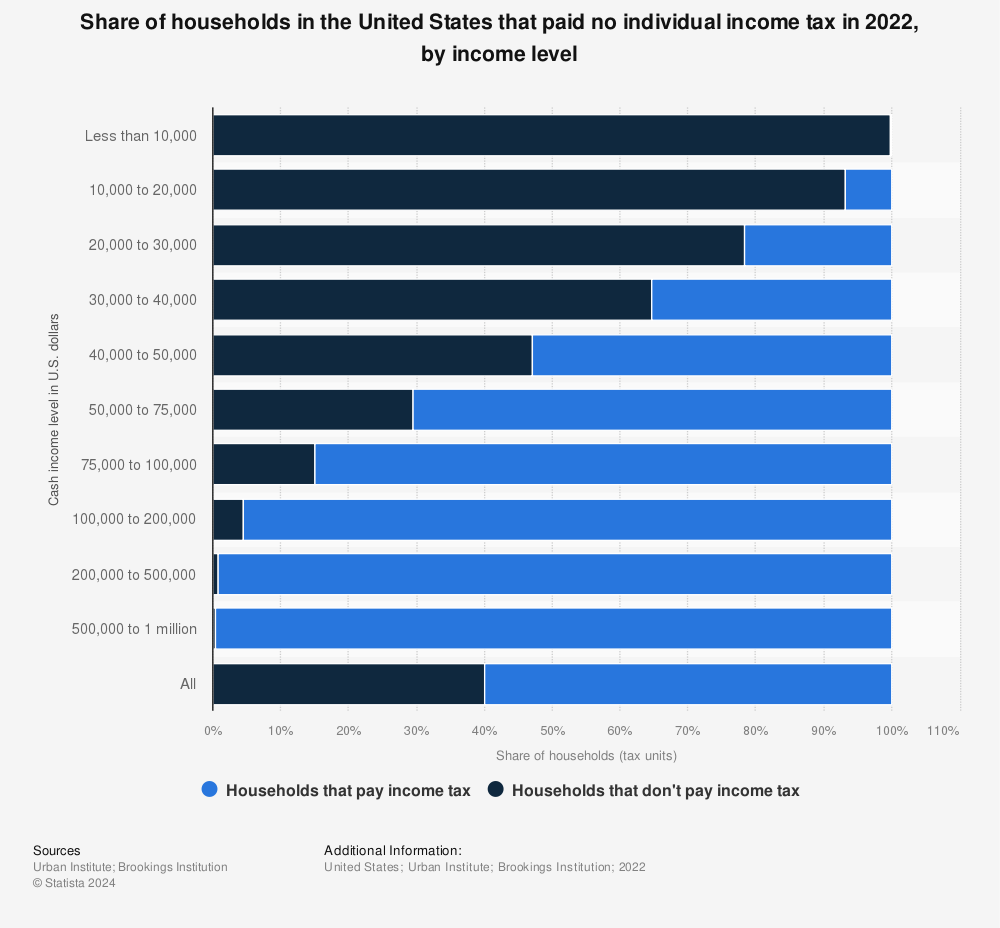

Percentages Of U S Households That Paid No Income Tax By Income Level 2019 Statista

The History Of Taxes Here S How High Today S Rates Really Are

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Tax Revenue Statistics Statistics Explained

Personal Income Tax An Overview Sciencedirect Topics

Biden Tax Plan And 2020 Year End Planning Opportunities

Federal Tax Cuts In The Bush Obama And Trump Years Itep

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Poland Personal Income Tax Rate 1995 2021 Data 2022 2023 Forecast Historical

What Are Itemized Deductions And Who Claims Them Tax Policy Center