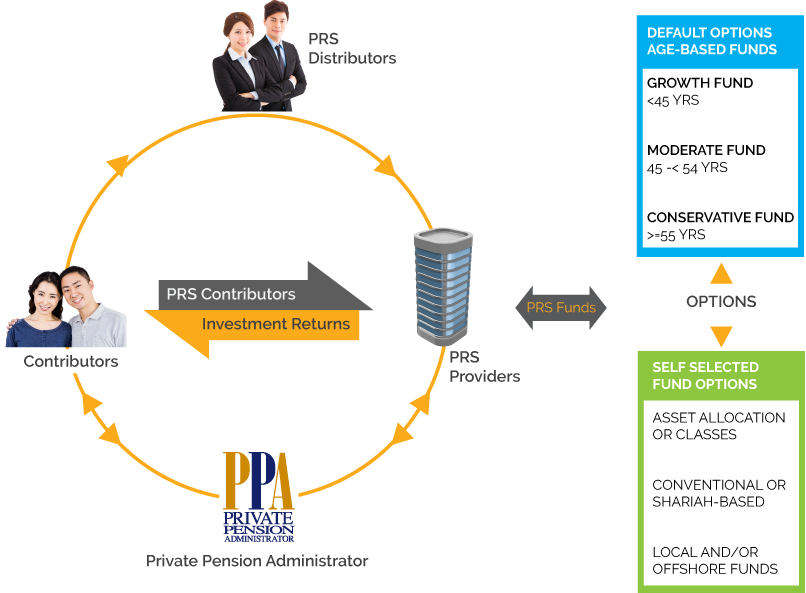

Prs seek to enhance choices available for all malaysians whether employed or self employed to supplement their retirement. PRS is a voluntary long-term investment scheme managed by a non-prot organisation set up by the government and known as the Private Pension Administrator Securities Commission Malaysia 2013.

The Private Retirement Scheme is governed under the Security Commission whereas the Deferred Annuity is governed by Bank Negara Malaysia.

Private retirement scheme (prs) and deferred annuity. The total deduction under this relief is restricted to RM3000 for an individual and RM3000 for a spouse who has a source of income. Do note that premiums paid for accidental and waiver riders are not eligible for tax reliefs. Private retirement scheme PRS and deferred annuity.

The Private Retirement Scheme is governed under the Security Commission whereas the Deferred Annuity is governed by Bank Negara Malaysia. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. When talking about the retirement funding method that Malaysian can choose from we have Private Retirement Scheme PRS and Deferred Annuity in which both of them also entitle you up to RM3000 tax relief.

Differences between Private Retirement Scheme PRS and. Differences Between Private Retirement Scheme Prs And Deferred Annuity. Differences between private retirement scheme prs and deferred annuity september 16 2020 by smdk friday 25 november 2016 published in retirement planning.

PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. What S The Difference Of Private Retirement Scheme And Deferred Annuity Plan Kclau Com.

Deferred Annuity Vs Immediate Annuity Explained In Detail Abc Of Money. Within these two categories annuities can. PRS is offered by Unit Trust Companies whereas Deferred Annuity is.

What S The Difference Of Private Retirement Scheme And Deferred Annuity Plan Investing Post. Personal Relief Private Retirement Scheme Or Deferred Annuity Malaysian Taxation 101. Pruretirement deferred annuity plan is a life insurance plan and is not a bank deposit.

Private Retirement Scheme Vs Deferred Annuity Youtube. Prs seek to enhance choices available. What S The Difference Of Private Retirement Scheme And Deferred Annuity Plan Investing Post.

Insurance Planing Founder Legacy. As you are probably aware with effect from the Year of Assessments 2012 to 2021 10 year-period only individual taxpayers are eligible to claim a personal relief of up to RM3000 annually for contributions to the Private Retirement Scheme PRS or the deferred annuity scheme. PRS is offered by Unit Trust Companies whereas Deferred Annuity is offered by Insurance Companies.

Here you can put in whatever. Differences Between Private Retirement Scheme Prs And Deferred Annuity Malaysian Financial Planning Council. There would be no fixed amounts or fixed intervals for making.

PRS is offered by Unit Trust Companies whereas Deferred Annuity is offered by Insurance Companies. Why Annuities Are A Poor Investment Choice The Economic Times. With PRS there are No Fixed Amount of intervals or term of contribution.

The tax relief entitlement makes this two planning methods even more attractive for retirement planning purpose. I have done a comparison between Private Retirement Scheme and Deferred Annuity. PRS operates as a unit trust scheme with trustee to ensure that the funds assets are segregated from the PRS provider.

The scheme also funded by after tax savings serves as a. Insurance Planing Founder Legacy. How To Find Deferred Annuity.

However the New Annuity Plan faces competition from the Private Retirement Scheme PRS launched in July 2012. When talking about the retirement funding method that malaysian can choose from we have private retirement scheme prs and deferred annuity in which both of them also entitle you up to rm3 000 tax relief. With PRS there are No Fixed Amount of intervals or term of contribution.

Retirement Income Coming Up With A Plan Fidelity. Differences between private retirement scheme prs and deferred annuity september 16 2020 by smdk friday 25 november 2016 published in retirement planning. Funds under PRS will be professionally managed by PRS providers to meet investors retirement objectives.

Differences between Private Retirement Scheme PRS and Deferred Annuity July 9 2021 by SMDK Friday 25 November 2016 Published in Retirement Planning. You can consider investing in a PRS or deferred annuity for your long-term goals to get this relief which you wouldnt be. Explained some differences between Private Retirement Scheme provided by unit trust.

The tax relief entitlement makes this two planning methods even more attractive for retirement planning purpose. We can see that these two categories share the same RM3000 tax relief. PRS is opened to all individuals aged 18 years old and above.

The Private Retirement Scheme is governed under the Security Commission whereas the Deferred Annuity is governed by Bank Negara Malaysia. Differences Between Private Retirement Scheme Prs And Deferred Annuity Malaysian Financial Planning Council. If you elect for joint assessment the deduction allowed is restricted to RM3000.

PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. What Is An Annuity Guide To Annuities. Private Retirement Scheme Vs Deferred Annuity Youtube.

What Is A Deferred Annuity Forbes Advisor.

Diversify Your Retirement Nest Egg

Private Retirement Scheme Principal Asset Management

Structure Of Private Retirement Schemes Prs Private Pension Administrator

Structure Of Private Retirement Schemes Prs Private Pension Administrator

Private Retirement Scheme Prs Photos Facebook

Personal Relief Private Retirement Scheme Or Deferred Annuity Malaysian Taxation 101

Differences Between Private Retirement Scheme Prs And Deferred Annuity Malaysian Financial Planning Council

Tax Filing Guide Tax Guide Tax Debt Relief Filing Taxes

Prs Tax Relief Private Pension Administrator

Private Retirement Scheme Prs A T Business Solution Services

Structure Of Private Retirement Schemes Prs Private Pension Administrator

Differences Between Private Retirement Scheme Prs And Deferred Annuity Malaysian Financial Planning Council

Insurance Planing Founder Legacy

How To Choose The Best Private Retirement Scheme Malaysia

How To Choose The Best Private Retirement Scheme Malaysia

Structure Of Private Retirement Schemes Prs Private Pension Administrator

What S The Difference Of Private Retirement Scheme And Deferred Annuity Plan Kclau Com