102 The Guidelines on Private Retirement Scheme s Guidelines are issued by the SC pursuant to section 377 of the Capital Markets and Services Act 2007 CMSA. The PRS is an integral feature of the private pension industry as part of the Economic Transformation Programme under Entry Point Project 6 EPP 6 with the objective of improving living standards for Malaysians at retirement through additional savings.

What Is The Private Retirement Schemes Prs Prs Live

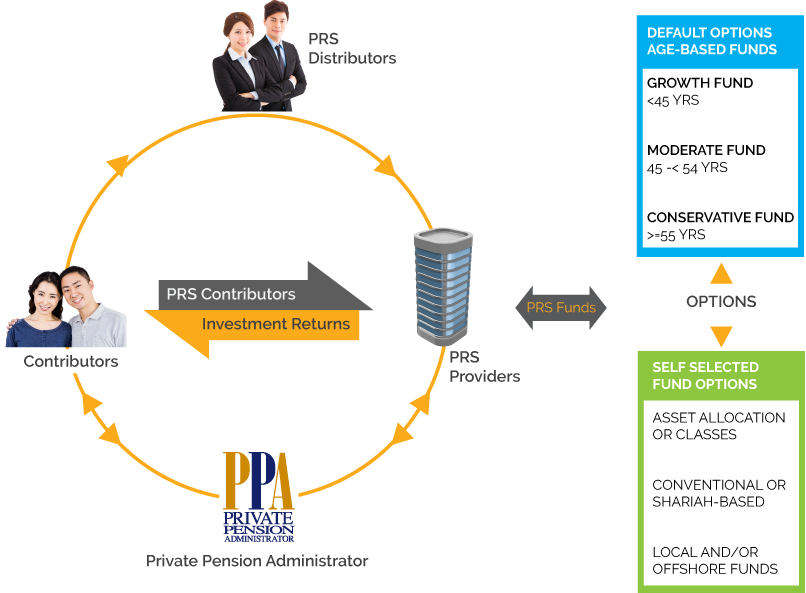

The PPA is a body approved by the Securities Commission and serves to protect PRS members interests and educate the public on PRS.

Private retirement scheme (prs) approved by the securities commission. 38 Private Retirement Scheme means a retirement scheme approved by the Securities Commission SC in accordance with the Capital Markets and Services Act 2007 CMSA. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. The Securities Commission Malaysia SC announced today that conservative funds under the Private Retirement Scheme can now invest in foreign markets.

The eight 8 available PRS Providers are. PRS is regulated by the Securities Commission Malaysia SC to provide a secured and supervised schemes for the public to save and invest for their retirement. 102 The Guidelines on Private Retirement Schemes Guidelines are issued by the SC pursuant to section 377 of the Capital Markets and Services Act 2007 CMSA.

These Guidelines set out requirements that must be complied with by a PRS Provider and a Scheme Trustee in relation to private retirement schemes. In addition PRS funds are also allowed to invest in exchange-traded-funds based on physical gold to increase asset diversification into alternative investments the commission said in a statement issued. We are a wholly owned subsidiary of AIA Bhd a leading insurer that has been serving Malaysia for over 70 years.

As such PRS provides a robust and safeguarded retirement schemes to facilitate long term retirement savings which will be drawn upon when the contributors reach their retirement. Who are the providers of PRS. 22 Zeilen Effective Date.

There are 8 approved providers approved by the Securities Commissioner as listed below-Affin Hwang Asset. The Guidelines on Private Retirement Schemes Guidelines are issued by the SC pursuant to section 377 of the Capital Markets and Services Act 2007 CMSA. They are voluntary private pension funds similar to EPF.

With the regulatory framework developed by the Securities Commission Malaysia PRS forms the 3rd pillar of Malaysias multi. These Guidelines set out requirements that must be complied with by a PRS Provider and a Scheme Trustee in relation. The PPA is a body approved by the Securities Commission and serves to protect PRS members interests and educate the public on PRS.

PRS This refers to the Private Retirement Schemes. Each PRS will include a range of retirement funds that individuals may choose to invest in based on their own retirement needs goals and risk appetite. Why AIA Private Retirement Scheme.

It complements the mandatory contributions made to EPF. Its a safer investment option too since the retirement investment scheme is operated by Providers that are approved by the Securities Commission of Malaysia. These Guidelines set out requirements that must be complied with by a PRS Provider and a Scheme Trustee in relation to private retirement schemes.

KUALA LUMPUR Feb 21. The Private Retirement Schemes are offered by PRS Providers who are approved by the Securities Commission Malaysia. AmInvestment Management Sdn Bhd AIA Pension and Asset Management Sdn Bhd.

PRS fund managers collectively known as PRS providers are required to be approved by the Securities Commission and all PRS activities are administered by the Private Pension Administrator Malaysia PPA. PRS Provider This refers to a company which has been authorized by the Securities Commission SC to offer PRS. Who what when where why and how.

Investing in Private Retirement Schemes PRS is eligible for a tax rebate of up to RM3000 until the year of assessment YA 2021. As at 5 April 2012 there are 8 approved PRS Providers. AIA Pension and Asset Management Sdn.

The requirements on matters relevant to members. PRS is regulated by the Securities Commission Malaysia and the schemes are safeguarded by the Scheme Trustees. 39 Basis year in relation to a year of assessment for an employment source income is the basis period for that year of assessment.

AmInvestment Management Sdn Bhd American International Assurance Bhd CIMB-Principal Asset Management Bhd. At present there are eight PRS providers which include Affin Hwang AM AIA AmInvest CIMB-Principal Kenanga Investors Manulife AM Public Mutual and RHB AM. The PRS providers approved by the Securities Commission you can choose from are.

PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. A private retirement scheme PRS is a voluntary long-term investment scheme designed to help individuals accumulate savings for retirement. Affin Hwang Asset Management Berhad formerly known as.

APAM is the provider for AIA Private Retirement Scheme PRS which is an approved pension scheme governed by the SC. Is part of the AIA Group. Ill be writing this piece in a 5Ws and 1H approach ie.

The requirements on matters relevant to members are binding on them including the.

Structure Of Private Retirement Schemes Prs Private Pension Administrator

What Are The Tax Benefits From Private Retirement Scheme Prs

Cimb Principal Prs Plus Cimb Principal Asset Management

Ppa Malaysia Private Retirement Schemes Are Offered By Prs Providers Who Are Approved By The Securities Commission Malaysia Click Here To Know Eight 8 Available Prs Providers Https Www Ppa My Prs Providers Facebook

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live

Private Retirement Scheme Prs A T Business Solution Services

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live

Investors Drawn To Local Private Retirement Schemes Only Because Of Tax Rebates

Private Retirement Scheme Why Do We Need It Lck Agency

Private Retirement Scheme In Malaysia Dividend Magic

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live

Private Retirement Scheme Prs Malaysia 2021 Guide Flames Of Fi

Private Retirement Scheme Prs Choon Hong

Private Retirement Scheme A Complete Guide To Prs And How I Choose The Best Fund

Https Dokument Pub Dl F00936a9 8049 468d 90a5 Ff936993bbed1 Flipbook Pdf

Https Www Ppa My Wp Content Uploads 2021 05 Ppa Press Release Prs Continues To See Steady Growth Nav Exceeds Rm5 Billion Pdf