Finding a real estate broker who specializes in foreign mortgage transactions -- preferably one who lives and works in the country where your property is located -- can help you. Simple answer YES you can there are loads here are some links.

Foreigners Vs Natives Bank Lending And Loan Pricing Vox Cepr Policy Portal

Understand your mortgage options.

Update local and foreign banks mortgage. Demand for Paris mortgages has played a major role in the development of the French mortgage market. If you dont pay cash financing real estate abroad is likely to cost more than at home. It is no different for mortgage business.

The criteria for proving your income so the lender can make sure the mortgage is affordable for you are the same whether youre a foreign national or not including if youre self-employed. Generally if the bank your income is paid into is in the UK or has branches in the UK then this is considered lower risk for a UK lender considering a borrower with overseas income. French Mortgages for Non-Residents.

Axos Bank offers a foreign national mortgage program that does not require a borrower to have a social security number green card or visa in order to qualify. The repayment schedule for your existing mortgage. If you want to use the property outside the UK as collateral youll need to use a bank in that country or region.

There are a lot of other operational challenges and risks with securing a property in a foreign country. Youll normally need to provide your government-issued ID card or passports of all borrowers repayment records from your existing bank if applicable. This mortgage would have a loan to value LTV of 90 because it would cover 90 of the total purchase cost.

They accept foreign credit reports. Joey Sheehan head of credit wwwmymortgagesie. Although the mortgage may be set up through the UK bank you would deal with the foreign arm of the bank once the mortgage had been arranged.

An Irish bank will only take security over an Irish property ie. Arranging an overseas mortgage abroad. Explore HSBC International Services.

Researching and comparing the current international mortgage rates can be incredibly time-consuming. The advisors we work can do this on your behalf. Bank statements showing your salary deposits.

Just googling foreign currency mortgage international mortgage or overseas mortgage gets you loads of starting points. While getting a mortgage in established overseas property markets such as France or Spain might be simple it may be trickier if youre looking further afield. They have access to hundreds of local overseas mortgage lenders as well as lenders in the UK and have successfully helped customers find the most favourable rates on overseas products including.

World first Baydon Hill IPF. If foreign banks accept the fact that they can never win on margin due to the inherent disadvantage in terms of funding costs where they will always end up paying more to acquire funds before they could lend out then there is. Watch for local laws and be sure your rights are protected.

If you plan to use your UK home as collateral you can look at UK banks for a range of mortgage options. You would then get a mortgage for 90000 to cover the rest of the price. For example if you bought a house for 100000 and paid a 10 deposit you would need 10000.

Foreign mortgage lenders are not currently allowed to do business in the UAE. There program also does not require you to have a US. And proof of employment.

Well not if they are not fully established as a lender or a bank with the central bank. What you can do though is take a personal loan and purchase property in a foreign. This is a market that attracts not only French property investors but international investors and ex-pats from around the world.

US banks cant issue a Home Loan on a property in a foreign country because they cannot hold a lien in another country. Within the State and will not lend to buy property in foreign. If the bank is overseas and you transfer this money into a UK account then it makes a difference which bank you use.

Proof of address for all borrowers. As with UK nationals the lender will want to see at least two years of accounts so you will find it harder to get a mortgage if you have become self-employed more recently Hollingworth says.

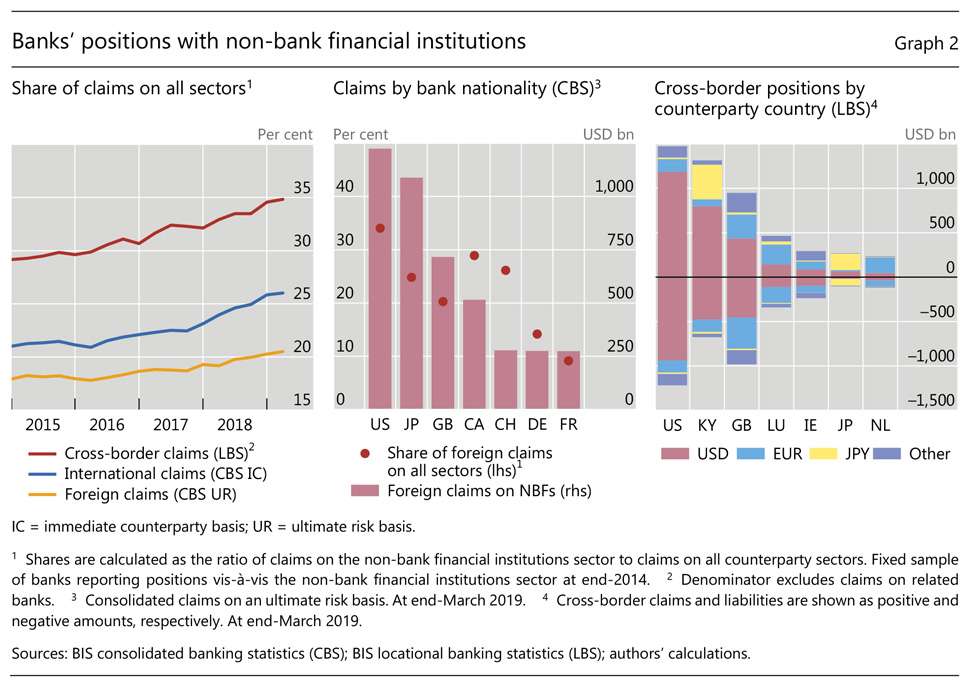

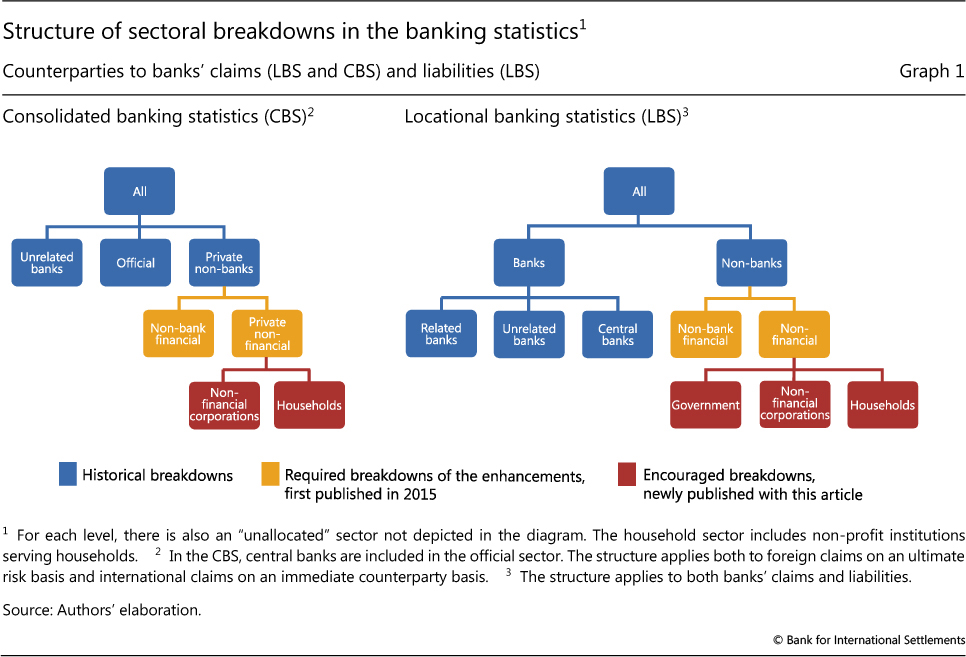

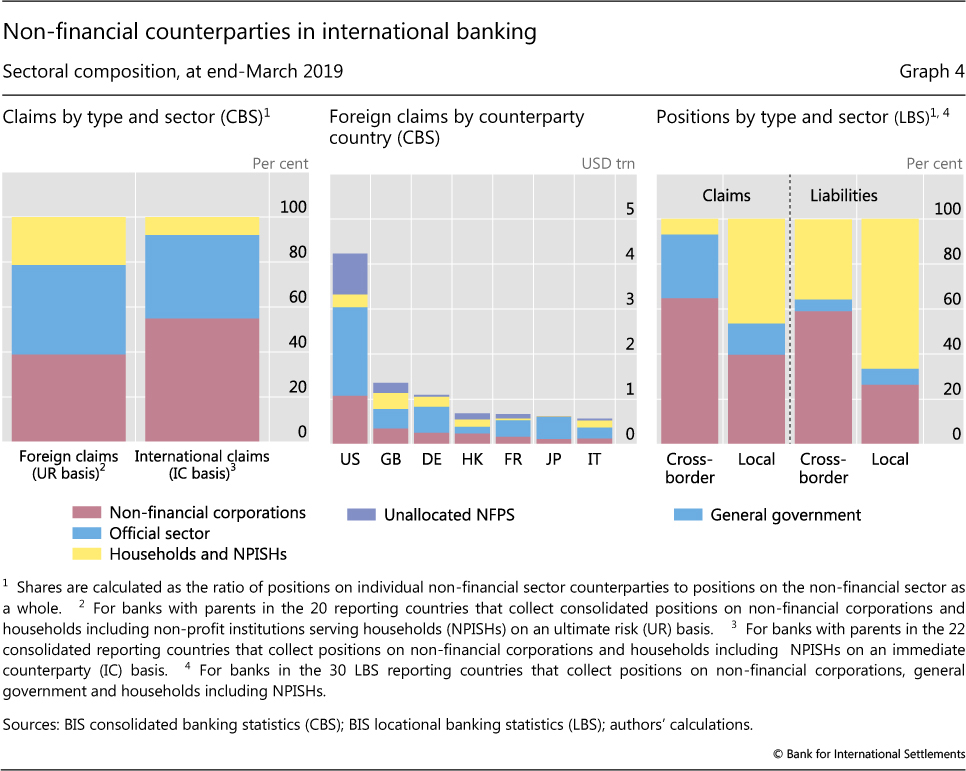

Non Bank Counterparties In International Banking

Summary Of The Shared Agent Network Expansion Facility Sanef Framework From Cbn Technology Infrastructure Finance Bank Repay Loan

Pin On Support Black Owned Businesses

Non Bank Counterparties In International Banking

Banks Logo Banking Logo Graphic Design Logo

In The Bid To Promote Affordable Housing In Nigeria Not More Than 400 Local And Foreign Exhibitors Will Feature In Home Renovation Loan Renovation Loans Abuja

Bank Of America Mortgage Fort Worth Tx Mortgage Bank Of America Home Loans

In China S Alleyways Underground Banks Move Money Wsj Offshorebankingbusiness Offshore Bank Offshore Banking

Non Bank Counterparties In International Banking

Uba Server Hacked N752m Stolen Auditor Fg Splash Ministers Estacode And Other Banking News Banking Retail Banking Mortgage Banking

How America S Wealthy Stole The American Dream And Cashed It At An Offshore Bank Offshorebankingbusiness Offshore Bank Banking Offshore

The Best Banks For Real Estate Best Bank Real Estate Tips Home Loans

Non Bank Counterparties In International Banking