If you are a non-accountant that wants to understand the financial reports prepared by accountants this course is for you. Explain the term preference shares.

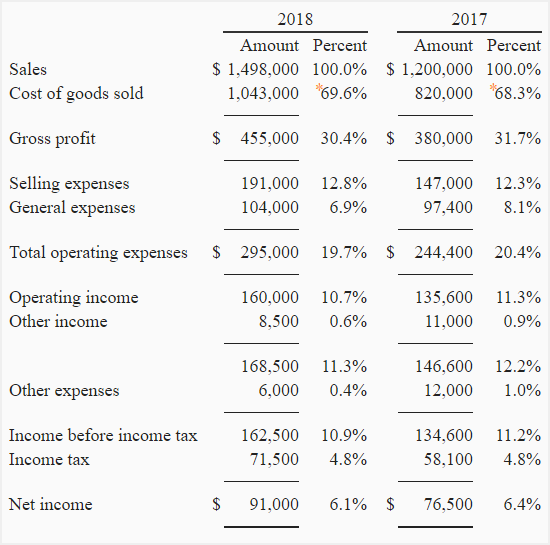

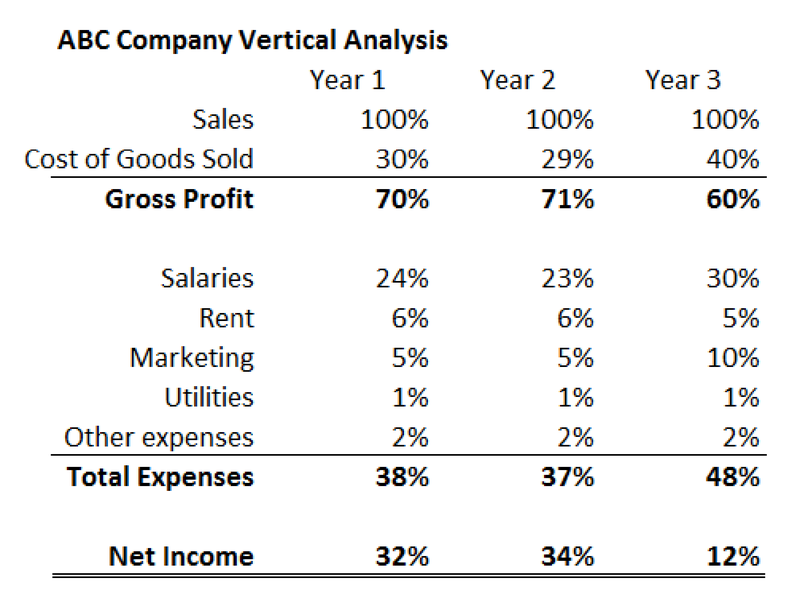

Vertical Common Size Analysis Of Financial Statements Explanation Example Accounting For Management

Analysis and interpretation of financial statements are an attempt to determine the significance and meaning of the financial statement data so that a forecast may be made of the prospects for future earnings ability to pay interest debt maturities both current as well as long term and profitability of sound.

What do you understand by interpretation of financial statements. The analyst must grasp what represent sound and unsound relationship reflected by the financial statements. Draw a specimen form of Methodical Classification of Income Statements and Balance Sheet. What do you understand by Trend Analysis.

Explain the term fully paid. Beside above what do you mean by analysis and interpretation of financial statement. 3 How do I know if the audited financial statements accurately reflect the financial position of our community.

The analysis and interpretation of financial statements requires a comprehensive and intelligent understanding of their nature and limitations as well as the determination of the monetary valuation of the items. Analysis and Interpretation 169 10. CBSE CBSE Arts Class 12.

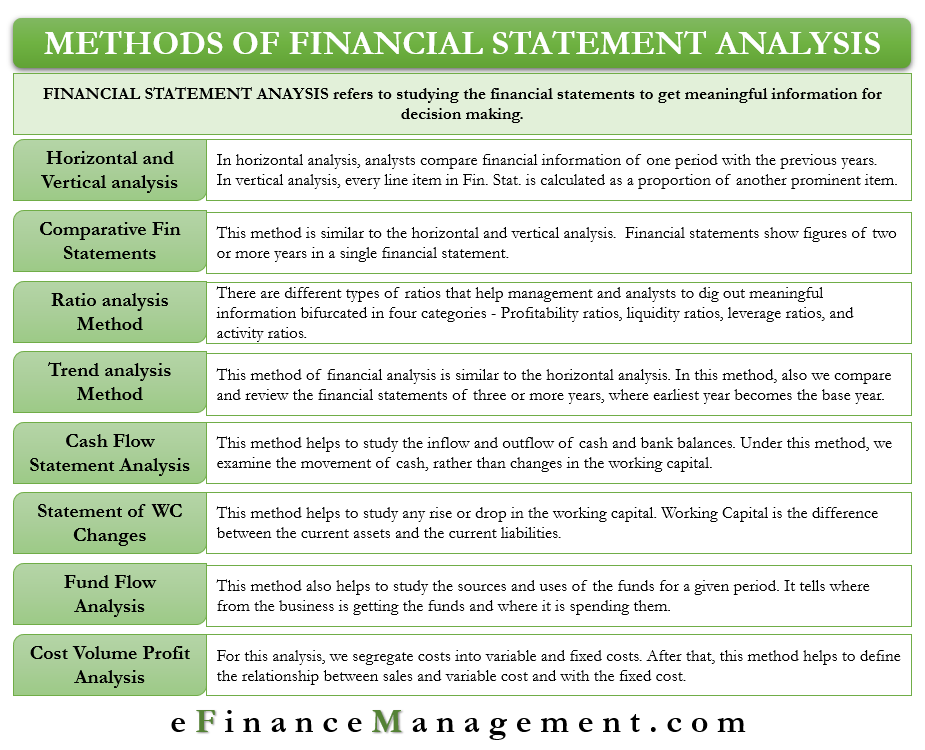

What do you mean by analysts and interpretation of financial statements Explain briefly the different techniques used for this purpose What do you mean by analysts and interpretation of financial statements Explain briefly the different techniques used for this purpose. What is Fund Flow Analysis. Write a brief note on Common Size Statements.

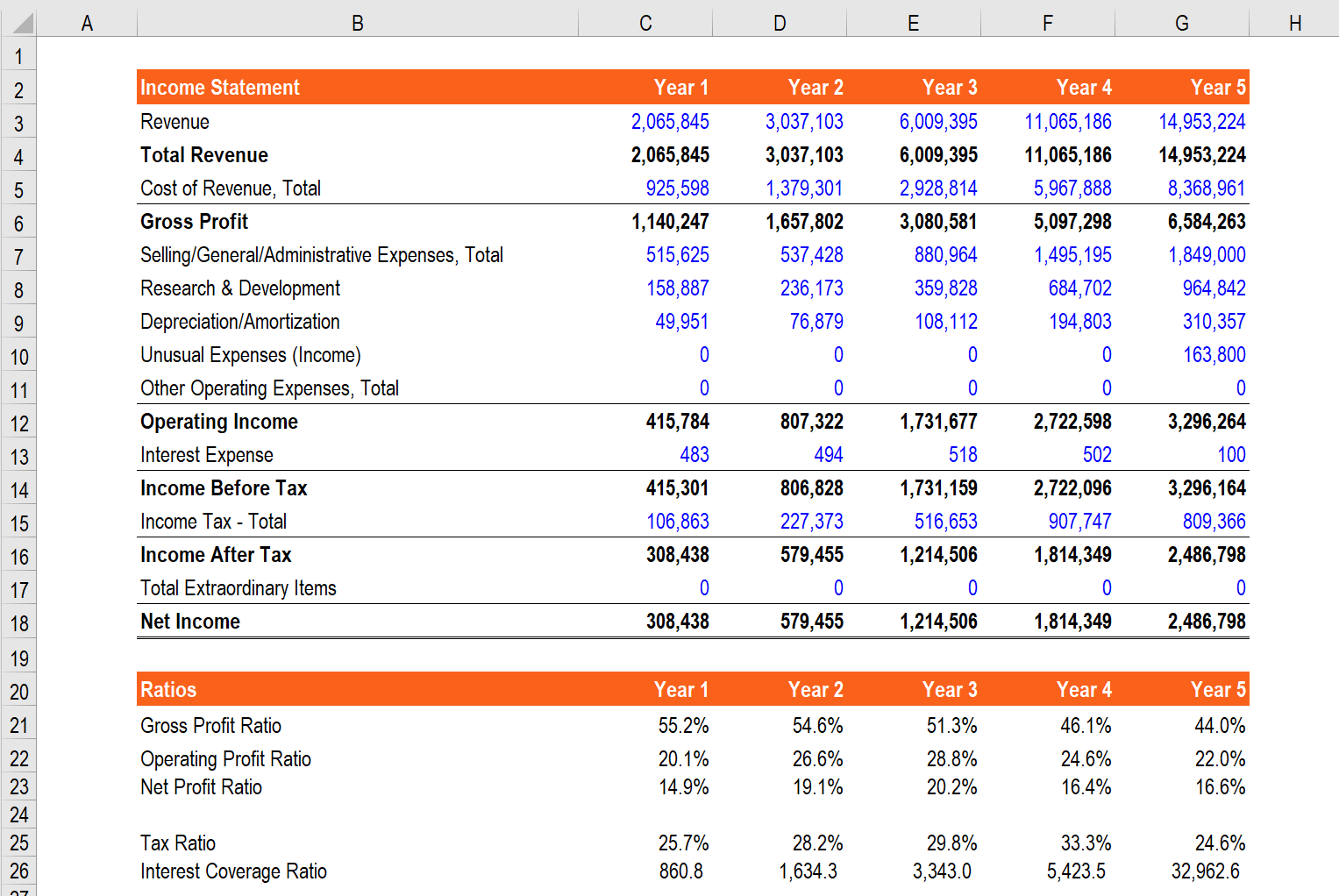

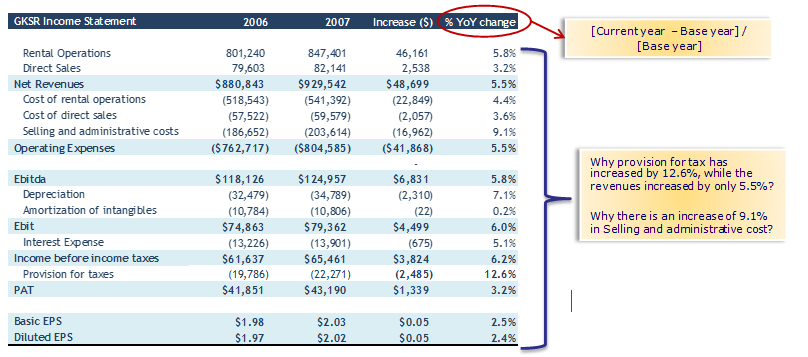

Accountants create income statements using trial balances from any two points in time. The purpose of an income statement is to show a companys financial performance over a period. Question Bank Solutions 14552.

This course focuses on financial statements and its interpretation. Ratio analysis shows whether the company is improving or deteriorating in past years. Explain the term trade receivables.

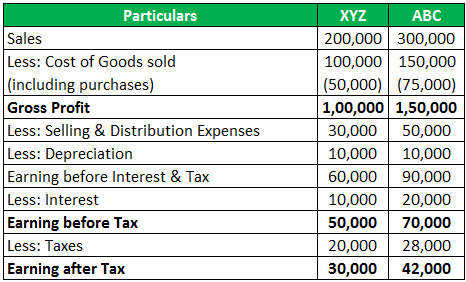

Within an income statement youll find all revenue and expense accounts for a set period. Analysis and interpretation of financial statements are an attempt to determine the significance and meaning of the financial statement data so that a forecast may be made of the prospects for future earnings ability to pay interest debt maturities both current as well as long term and profitability of sound dividend policy. Analysis and interpretation of financial statements help in determining the liquidity position long term solvency financial viability and profitability of a firm.

It tells the financial story of a businesss activities. Click here to get an answer to your question What do you understand by analysis and interpretation of financial statements. What Do You Understand by Analysis and Interpretation of Financial Statements.

It will teach you the accounting standard that guides the preparation and presentation of financial statements. It helps the clients to decide in which firm the. These financial data are not useful until they are analysed.

Tmadmin Accounting Financial Mgmt 22 Accounting Financial Mgmt What do you mean by analysts and interpretation of financial statements Explain Q1. The audit opinion which is near the front of the audited financial statements advises readers whether the statements provide an accurate. There are various tools and methods such as Ratio Analysis Cash Flow Statements that make the financial data to cater varying.

What do you understand by analysis and interpretation of financial statements Discuss their importance Financial Analysis has great importance to various a. Proper interpretation of financial statements assists in identifying a companys strengths and weaknesses. Financial statements in order to understand what the complete financial situation is and how well your communitys finances are being managed.

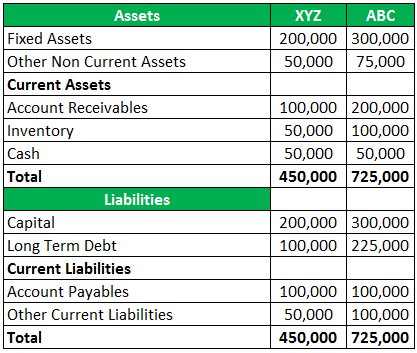

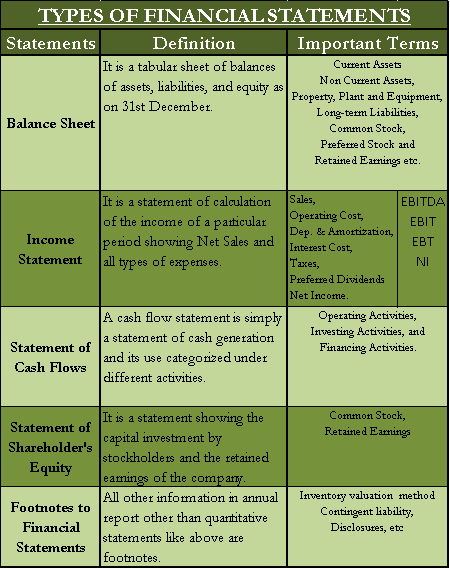

Explain the term earnings per. Accounting Financial Mgmt Q1. Financial statements are comprised of a balance sheet an income statement and a statement of cash flow.

Discuss the different techniques or tools of Financial Analysis. Explain the term trade receivables. Income Statements Balance Sheets and other financial dataprovide information about expenses and sources of income profit or loss and also helps in assessing the financial position of a business.

Q3 Explain the term memorandum for a company. Concept Notes Videos 451. Moreover Comparison of different aspects of all the firms can be done effectively with this.

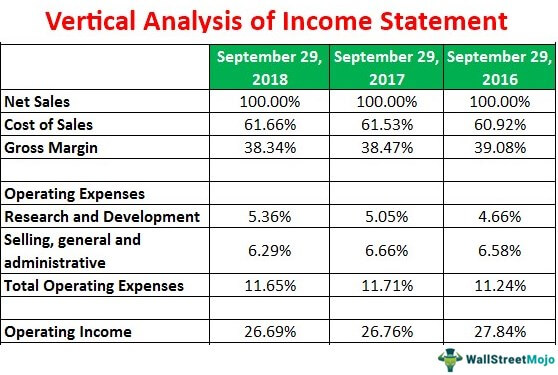

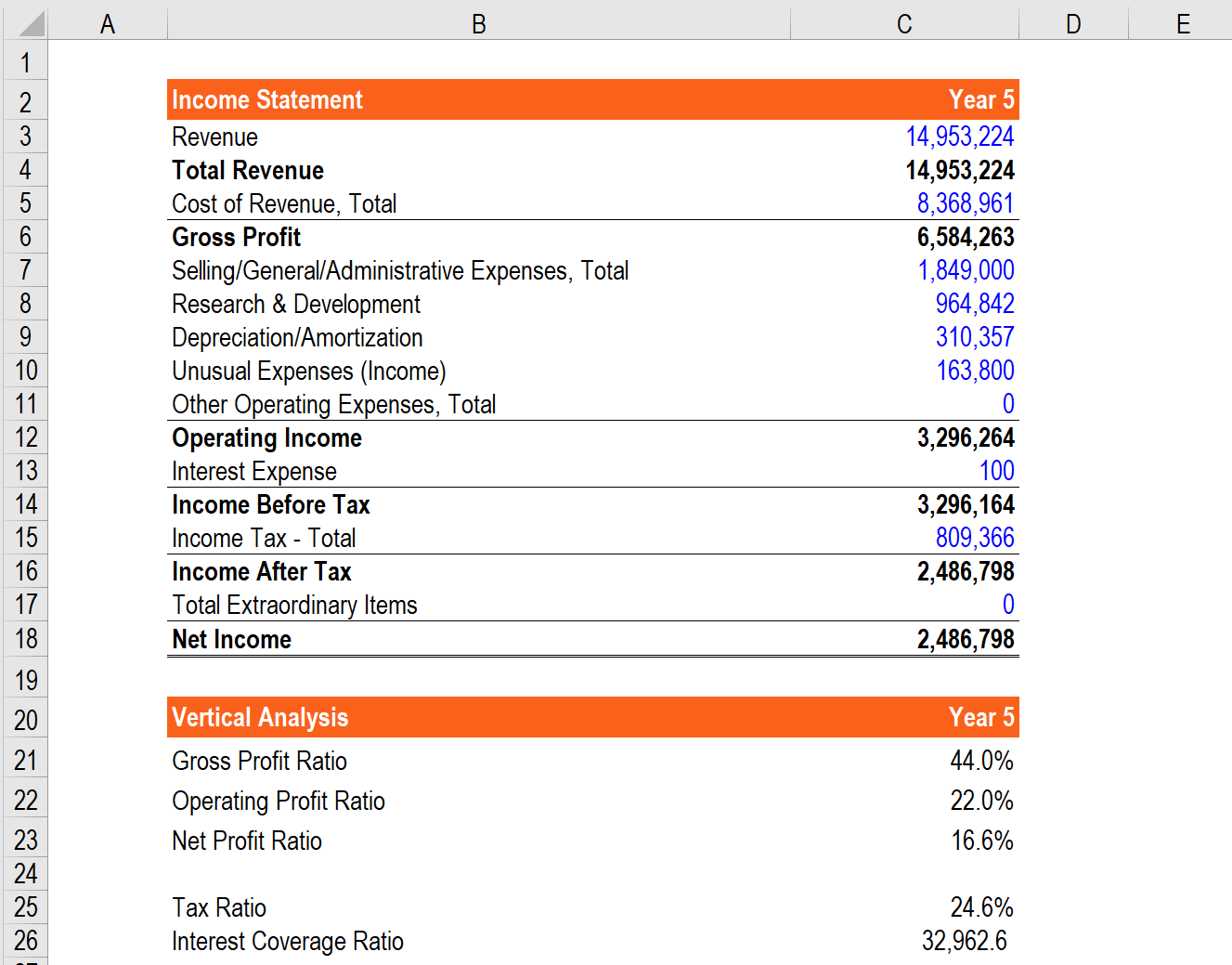

Vertical Analysis Of Income Statement Example Interpretation Limitation

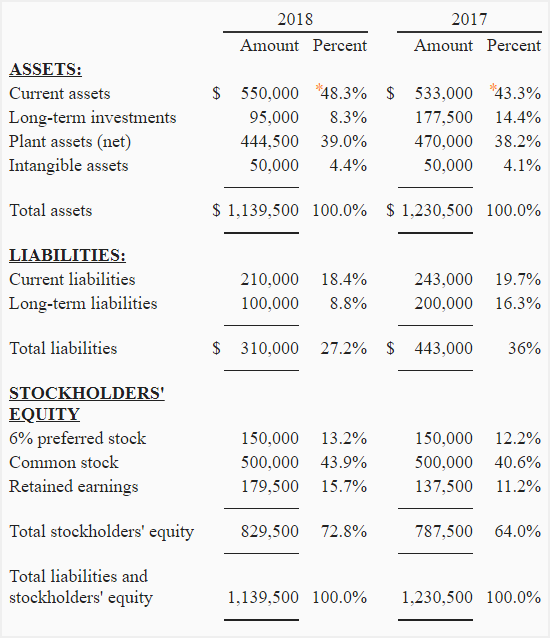

Vertical Common Size Analysis Of Financial Statements Explanation Example Accounting For Management

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition

Comparative Statements Analysis Of Balance Sheet Income Quickbooks

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition

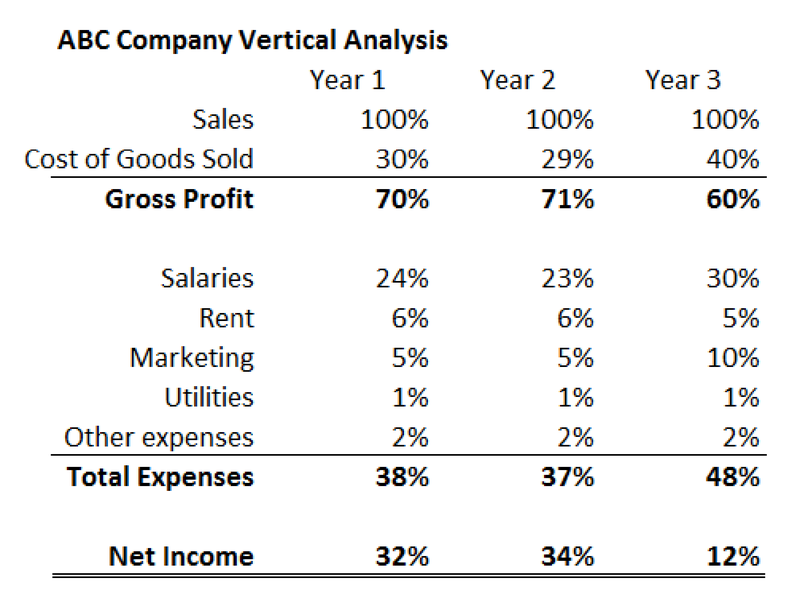

The Common Size Analysis Of Financial Statements

Examples Of Financial Analysis Step By Step Guide

Analysis Of Financial Statements Financial Statement Analysis Financial Statements Financial Statement

Comparative Statements Analysis Of Balance Sheet Income Quickbooks

Financial Analysis Overview Guide Types Of Financial Analysis

Financial Analysis Overview Guide Types Of Financial Analysis

Examples Of Financial Analysis Step By Step Guide

5 Types Of Financial Statements Balance Sheet Income Cash Flow 2

Financial Analysis Tools Guide To Top 4 Tools Used For Financial Analysis

Methods Of Financial Statement Analysis All You Need To Know

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

Financial Statements Definition

The Common Size Analysis Of Financial Statements

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

Financial Statements Definition

A Beginner S Guide To Vertical Analysis In 2021 The Blueprint