Business applicant debt service coverage ratio. They are more vulnerable to an economic or financial shock such as a recession or an.

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

Debt To Equity D E Ratio Definition And Formula

A good LTV is a lower LTV.

What is an acceptable loan to value ratio. For example if youre buying a home thats appraised at 200000 your loan cant be more than 180000. A loan-to-value ratio LVR is a measure of how much a bank lends against mortgaged property compared to the value of that property. USDA VA and other specialty loan types may allow for a 100 percent LTV for a purchase loan.

If your credit score falls between 500 and 579 your LTV ratio cant be higher than 90. Where LTV is the loan to value ratio LA is the original loan amount PV is the property value the lesser of sale price or appraised value. Are acceptable based on lender policies and procedures for similarly-sized non-SBA guaranteed commercial loans.

An LTV no higher than 80 will give you the most options but you can buy a home with an LTV as high as 100 if you qualify for a USDA or VA loan. For a new mortgage divide the amount of the loan request after subtracting out the down payment by the lower of the purchase price or appraised value of the home. If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent.

Its quite common for owner-occupied residences to get loans at LTVs of 80 percent. So if you borrow 20000 to buy a 20000 car your LTV will be 100 100 2000020000. Borrowers with LVRs of more than 80 percent less than 20 percent deposit are often stretching their financial resources.

Lenders rely on the loan-to-value ratio to help them determine how much risk they are. FHA purchase loans will allow you to have a loan-to-value ratio of up to 965 percent. Your LTV for your car loan is simply the ratio of your loan amount to the market value of your car.

Refinance Options for Borrowers with a Loan to Value Ratio Over 100. The loan-to-value LTV ratio of a property is the percentage of the propertys value thats mortgaged. Lenders use different requirements to determine whether a loan will be granted and the LTV is usually a key factor.

Thats why home buyers with 20 down and an 80. LTV Loan Amount Property Value. 2000 is 33 of 6000 Evidence from studies of mortgage loans suggest that borrowers with a higher debt-to-income ratio are more likely to run into trouble making monthly payments.

LTVs are usually expressed in percentages. For homebuyers who are trying to qualify for an FHA loan an acceptable loan-to-value ratio is 965 if your credit score is at least 580. For example if the loan request is 200000 and the home has an appraised value of 250000 the LTV is 200000250000 or 80 percent.

Your loan-to-value ratio LTV shows the size of the loan compared to the value of the home. The Loan to Value Calculator uses the following formulas. You can calculate your LTV by dividing your loan amount by the home value.

For example a borrower who provides a 20 down payment has an LTV of 80. LTV is the inverse of a borrowers down payment. D Debt service is defined as the future required principal and interest payments on all business debt inclusive of new SBA loan proceeds.

From a lenders perspective an 80 loan to value ratio is ideal because it minimizes their risk of losing money if the borrower defaults. Lenders in a falling market like to build in a buffer and will adjust their acceptable LTV ratio. The loan-to-value ratio is the percentage of your new homes purchase price that your mortgage loan covers.

A Guide To Loan To Value Ratio Rocket Mortgage

Loan To Value Ratios Dscr S Joe Banfield

What Is An Ltv Ratio And How Does It Determine Home Loan Eligibility Housing News

Average Ltv Ratio In The U S By State 2019 Statista

Why Loan To Value Ratio Matters For Your Mortgage Unbiased Co Uk

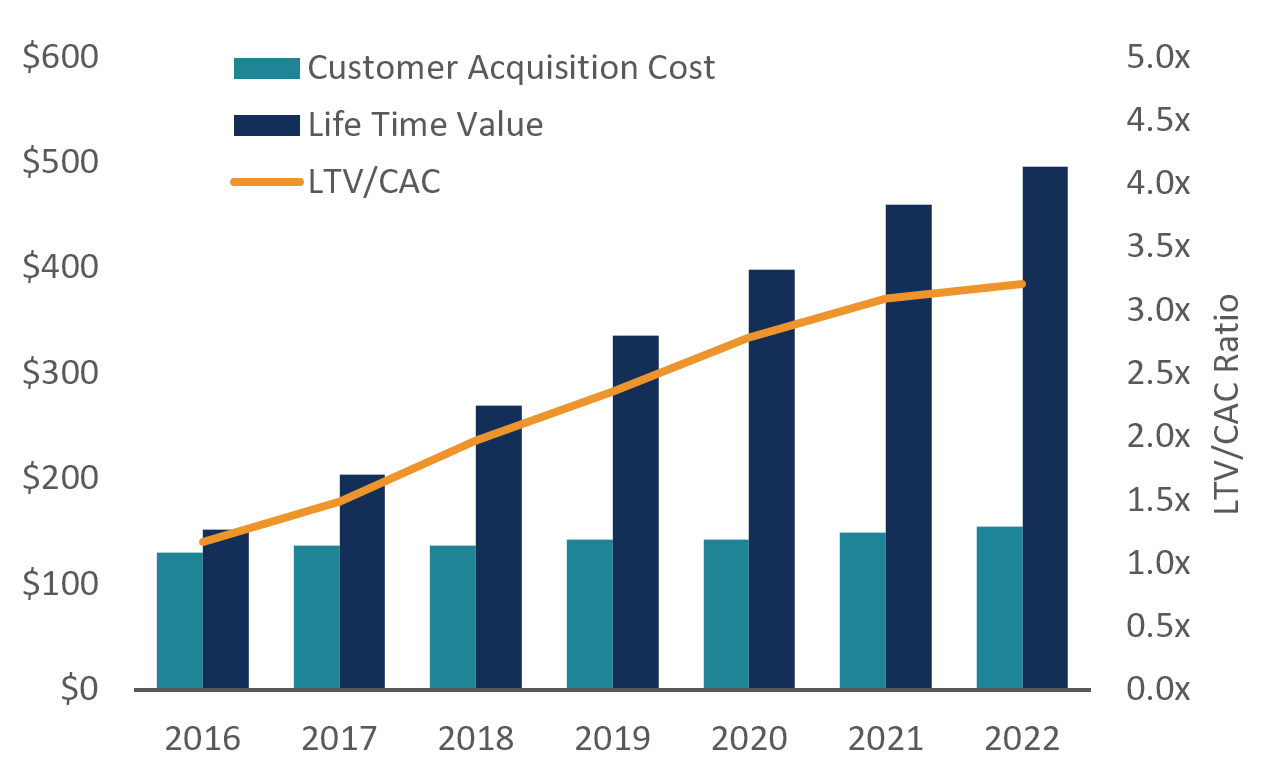

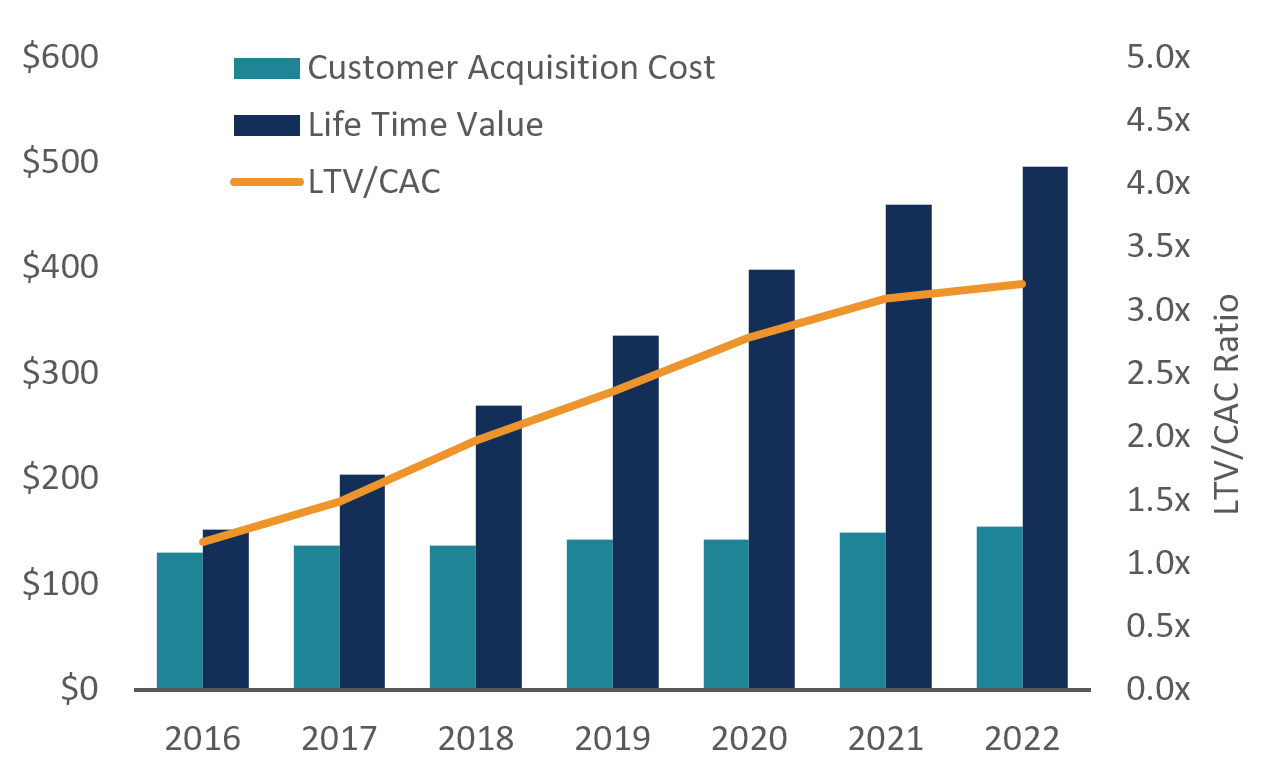

Ltv Cac Ratio Important Ecommerce And Saas Metrics

10 000 Down Payment Assistance Grant For Louisville Kentucky Home Buyers In Jefferson County Ky 2018 Kentucky Mortgage Lenders Mortgage Loans

Maximum Loan To Value Ratio Definition

What Is Va Loan An Overview Of Va Home Loan 2019 Va Mortgage Loans Va Mortgages Va Loan

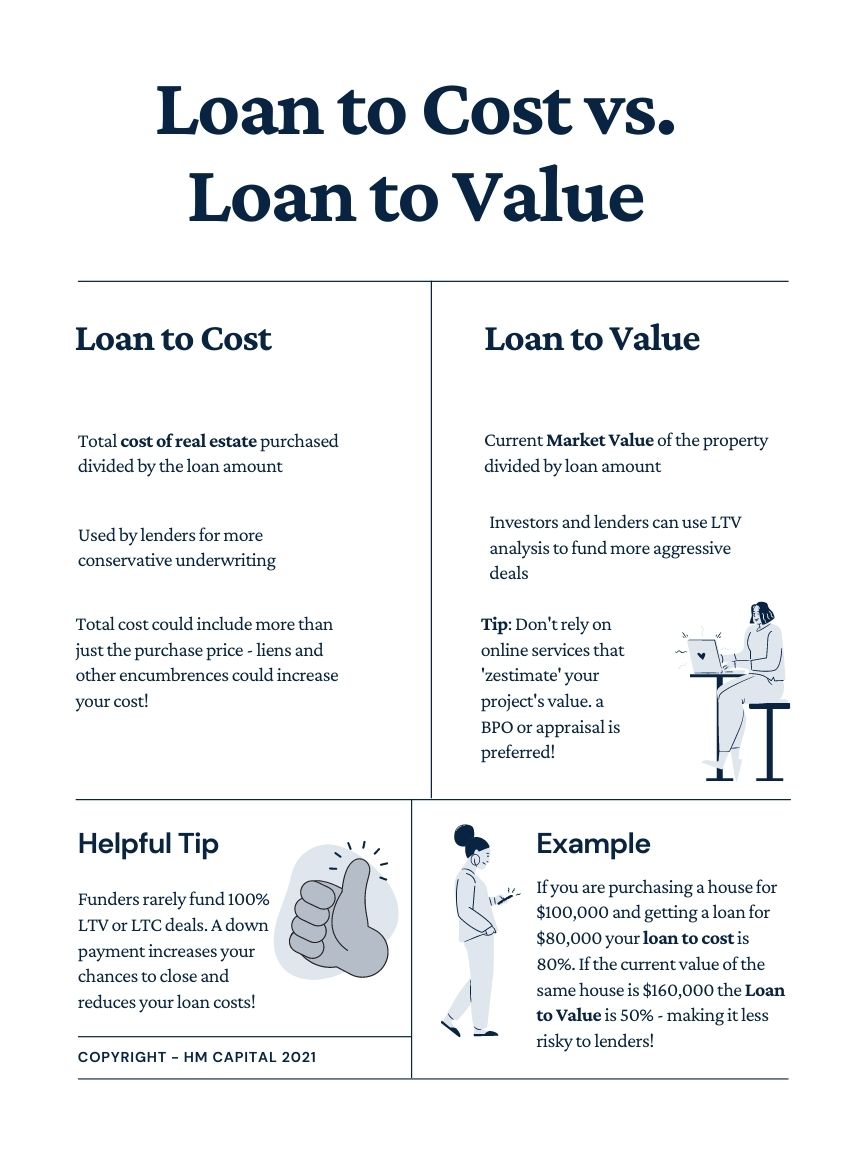

Loan To Cost Vs Loan To Value Definitions

Loan To Value Ratios What You Need To Know Asap Finance

Loan To Value Ltv Ratio Loans Canada

What Is An Appraisal Waiver Refinance Mortgage Mortgage Loans Mortgage Checklist

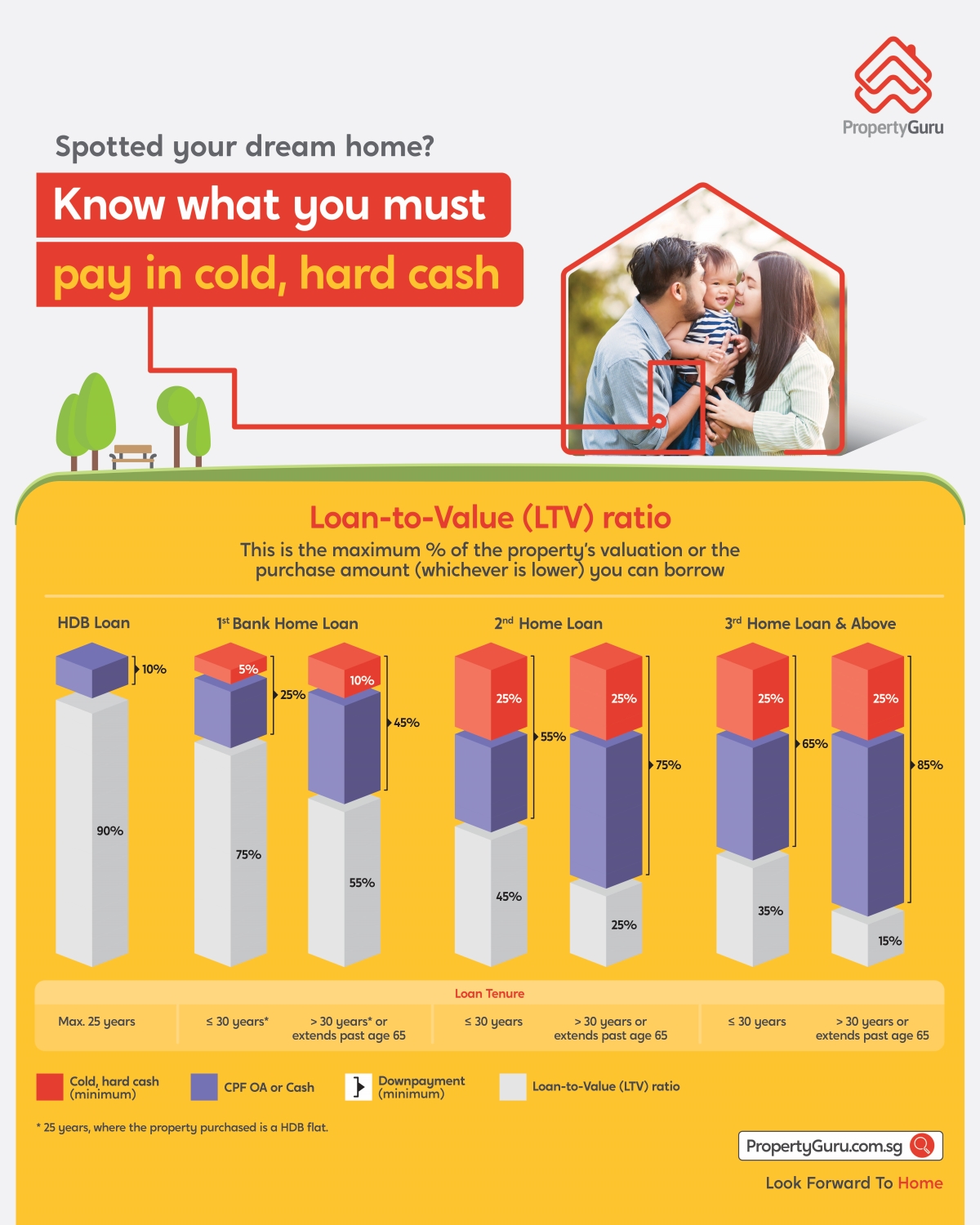

Loan To Value Ratio Ltv For Singapore Property A Complete Guide Propertyguru Singapore

Coverage Ratio Of Non Performing Loans Europe 2020 Statista

All You Need To Know About Loan To Value Ratio Ltv Meaning Eligibility

What Is A Good Loan To Value Ltv Ratio Smartasset

Maximum Loan To Value Ltv Ratio For The Fha Mortgage Program Fhahandbook Com

Credit Memo Tips For Credit Committee Presentations Presentation Tips Finance Binder Free Finance Quotes Inspiration