A few banking institutions assume systemic importance due to their size cross-jurisdictional activities complexity lack of substitutability and interconnectedness. The assessment methodology for a D-SIB should reflect the potential impact of or externality imposed by a banks failure.

Too Big To Fail Measures Remedies And Consequences For Efficiency And Stability Barth 2017 Financial Markets Institutions Amp Instruments Wiley Online Library

SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs.

Domestic systemically important banks are required to live up to. The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from April 1 2016 and became fully effective from April 1 2019. Domestic Systemically Important Banks July 2018 Section DS-11. Domestic Systemically Important Banks CHAPTER DS-1.

Conventional Banks MODULE DS. - means banking institutions that are critical for the uninterrupted availability of essential banking services to the countrys real economy even during crisis. On 11 October 2012 the Bank for International Settlements BIS published a framework for identifying and dealing with domestic systemically important banks D-SIBs.

They will thus have to establish a risk-weighted capital ratio requirement equaling a 1 per cent common equity surcharge. What is a domestic systemically important bank and why is it important. Define Domestic Systemically Important Banks.

When Systemically Important Banks SIBs were in danger of failure in the past only one. The framework text sets out the Basel Committees framework for dealing with domestic systemically important banks. According to the RBI some banks become systemically important due to their size cross-jurisdictional activities complexity and lack of substitute and interconnection.

Undertake an assessment of the degree to which banks are systemically important in the domestic context. D-SIB means that the bank is too big to fail. Moreover based on Article 33d5 of the Banking Act NBS may decide to set an O-SII buffer requirement of up to 2 of the institutions total risk exposure amount.

In line with this principle the Bank has established a framework to identify D-SIBs in the banking sector and to require these banks to have the capacity to. Following this designation as domestic systematically important banks the above-mentioned banks will need to comply with stricter financial standards in order to expand their capacity to absorb unexpected losses. 6 rows The Reserve Bank of India has recently stated that the banks namely State Bank of India ICICI.

National authorities should establish a methodology for assessing the degree to which banks are systemically important in a domestic context. This module provides guidance on the CBBs assessment methodology for identifying D-SIBs and the Higher Loss Absorbency HLA DS-A12 DS-A13. Last week the Reserve Bank of India RBI declared HDFC Bank Ltd to be a domestic systemically important bank D-SIB.

Recovery and Resolution Planning DS. Domestic systemically important banks that are to be designated as other systemically important institutions O-SIIs and to publish the list on its website from 1 January 2016. The purpose of the framework is to reduce the probability of D-SIB failure compared to.

National authorities should establish a methodology for assessing the degree to which banks are systemically important in a domestic context. 4 Attorney Advertisement Appendix Assessment Methodology Principle 1. BCBS and the Financial Stability Board FSB to develop a framework for Domestic Systemically Important Banks D-SIBs1 in addition to the Global Systemically Important Financial Institutions G-SIFIs.

The other two such banks are State Bank of India SBI and ICICI Bank Ltd. The rationale for focusing on the domestic context is outlined in SCO5010. Banks whose assets exceed 2 of GDP are considered part of this group.

The G20 leaders endorsed these rules at their November 2011 meeting and asked the Basel Committee and the Financial Stability Board to work on extending the framework to domestic systemically important banks. Page 1 of 1 DS-11 Overview DS-111 The objective of the D-SIBs framework is to identify banks. A starting point for the development of principles for the assessment of D-SIBs is a requirement that all national authorities should undertake an assessment of the degree to which banks are systemically important in a domestic context.

The assessment methodology for a D-SIB should reflect the potential impact of or externality imposed by a banks failure. The Domestic Systemically Important Banks D-SIBs Module sets out the Central Bank of Bahrains CBBs framework applicable to Bahraini conventional banks identified as D-SIBs. In November 2011 the Basel Committee issued final rules for global systemically important banks G-SIBs.

A Framework For Macroprudential Bank Solvency Stress Testing In Imf Working Papers Volume 2013 Issue 068 2013

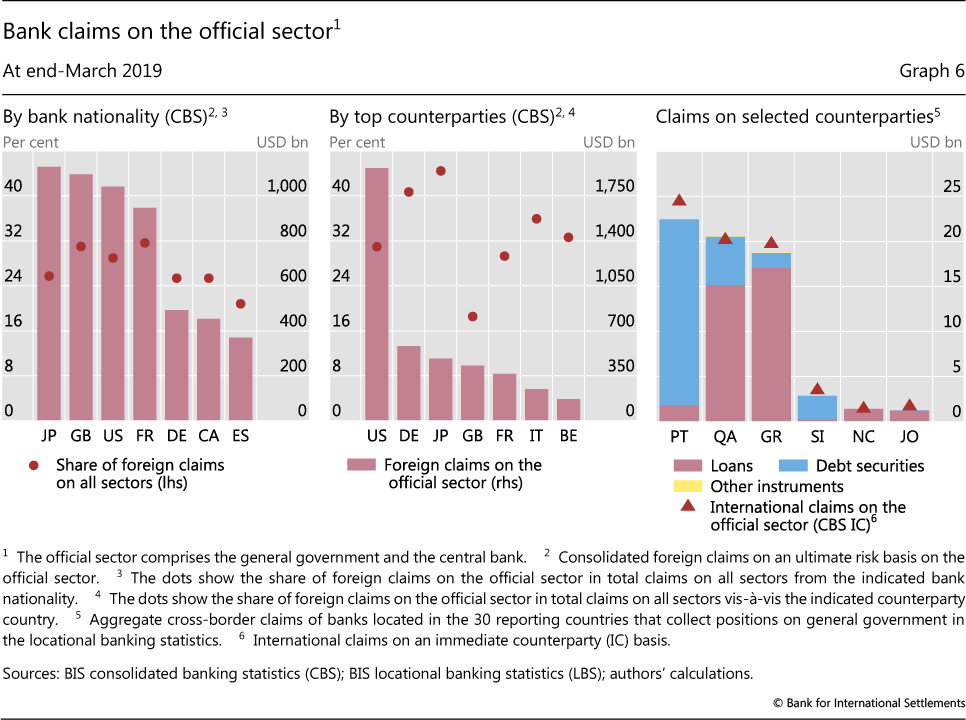

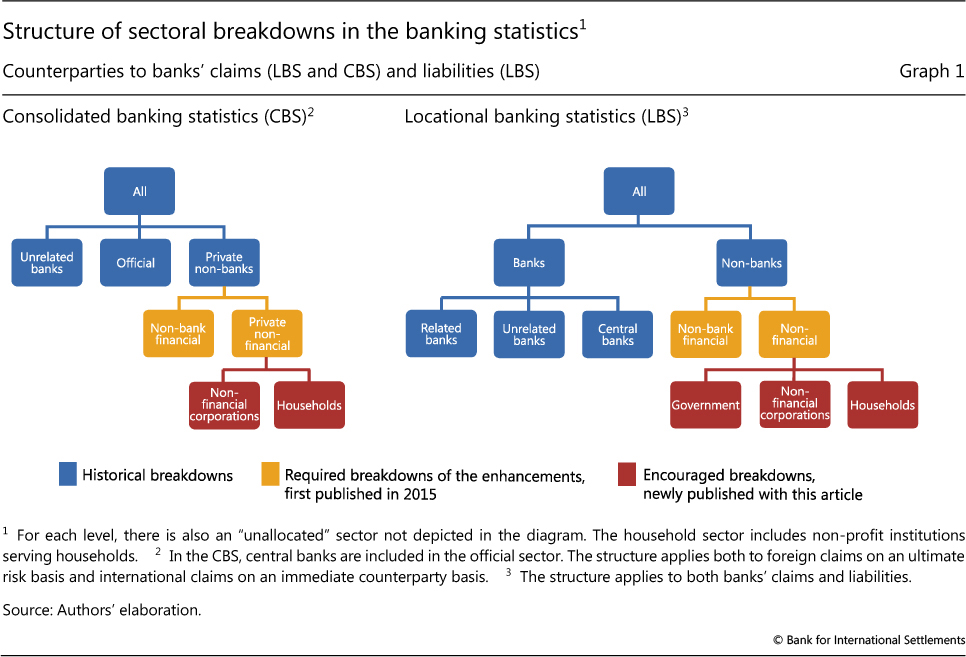

Non Bank Counterparties In International Banking

Regulators And The Quest For Coherence In Finance The Case Of Loss Absorbing Capacity For Banks Quaglia 2019 Public Administration Wiley Online Library

Banking Laws And Regulations Usa Laws And Regulations Gli

Non Bank Counterparties In International Banking

How Covid 19 Is Affecting Bank Ratings S P Global Ratings

Education What Is The Fed Supervision And Regulation

Infographic The Changing Face Of Poverty Single Parenting Poverty Infographic

Education What Is The Fed Supervision And Regulation

Too Big To Fail Measures Remedies And Consequences For Efficiency And Stability Barth 2017 Financial Markets Institutions Amp Instruments Wiley Online Library

Vati Rn 2nd Comprehensive Predictor Focused Review Cardiovascular Disorders Case Management Nursing School Survival

The Worst Style Etfs 1q18 Question Why Are There So Many Etfs The Post The Worst Style Etfs 1q18 Business Worsts Value Investing Investing Things To Sell

Rbi Relaxes Leverage Ratio In A Boost To Bank Lending

Sell Off In Itc Negative Global Cues Pushes Sensex 0 92 Lower Social News Xyz Yes Bank Stock Exchange Bse Sensex

Bank Branch Expansion In Rural Areas Farmdoc Daily

Community Snapshot Infographics On Behance Infographic Snapshots Health Services

/new-york-cityscapes-and-city-views-145720464-e764a5fbd37a4bc2b5eff52ab6630df4.jpg)

Systemically Important Financial Institution Sifi Definition

Bank Branch Expansion In Rural Areas Farmdoc Daily

Svb Asset Management Market Insights Banking It S Different This Time Silicon Valley Bank