UPDATE August 2015. Remedies for fraudulent claims.

Insurance Fraud Detection And Cost To Industry

The court was concerned with considering whether a reckless.

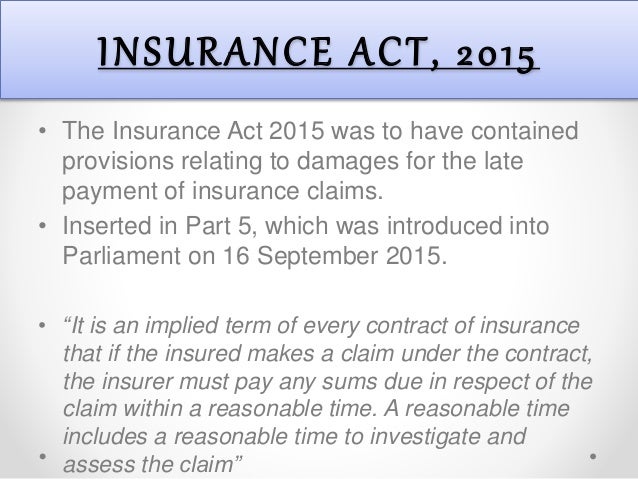

Fraudulent claims insurance act 2015. Insurance and fraudulent claims On October 7 2015 March 10 2016 By Professor Andrew Tettenborn In Insurance Fraud Insurance Law Marine Insurance Law Hard on the heels of legislation in the Insurance Act 2015 about fraudulent claims by the insured readers may like to know that insurers can now take comfort from s57 of the Criminal. Insurers remedies for fraudulent claims Late payment of insurance claims The majority of the Law Commissions proposals were enacted in the Insurance Act 2015. A Practical Guide to the Insurance Act 2015.

A Is not liable to pay the claim. PART 5 Good faith and contracting out. The Act makes clear as is currently the case that there is no liability on the part of the insurer to pay a fraudulent claim and it may recover any sums paid to the insured in respect of the fraudulent claim.

DOI link for A Practical Guide to the Insurance Act 2015. The Insurance Act 2015 has confirmed and therefore replaced the common law to a degree. Notify the insured that it is treating the policy as terminated.

A Practical Guide to the Insurance Act 2015 book. By David Kendall Harry Wright. The court was concerned with considering whether a reckless untruth proffered by the insureds employer to support a valid claim was a fraudulent device a collateral lie as Lord Sumption has now sought to.

A Practical Guide to the Insurance Act 2015. May give notice to terminate the insurance cover as from the date of the fraudulent act. Part 4 of the 2015 Act now sets out a clear statement of insurers remedies in the event of fraudulent claims brought by policyholders.

In Versloot Dredging the Supreme Court recently clarified what constitutes a fraudulent claim for the purpose of the Insurance Act 2015. In Versloot Dredging the Supreme Court recently clarified what constitutes a fraudulent claim for the purpose of the Insurance Act 2015. If a fraudulent claim is made the insurer will not have to pay the claim and can recover anything already paid to the insured in respect of the claim.

It holds that where there is a fraudulent claim by an insured the insurer may. Remedies for fraudulent claims. The provisions for late payment of insurance claims were not included in the Bill enabling it to.

And b May recover from the Insured any sums paid by the Insurer to the nsured in respect of the I claim. If the insurer finds that a claim is fraudulent the 2015 Act confirms what already takes place in case law that they can forfeit the claim and retain any premiums which have already been paid. The Insurance Act introduced a statutory regime for fraudulent claims which applies to both commercial and consumer insurance.

This reflects the previous legal position. Insurance Act 2015 - Fraudulent claims clause. The following guide was prepared in January 2012 following publication of the Law Commission consultation Insurance Contract Law.

Instead common law principles will determine their meaning. LMA5256 Insurance Act 2015 - Fraudulent claims clause LMA5257 Insurance Act 2015 Contracting out of section 82 and Schedule 1 - Avoidance as the sole remedy for breach of the duty of fair presentation LMA5258 Insurance Act 2015 - Contracting out of Section 10 All warranties. The Act is intended to materially change the way in which the business of insurance is conducted and to extend the reforms made to consumer contracts in 2009 to non-consumer insurance contracts to make it harder for insurers to avoid claims for technical.

If the insurer finds that a claim is fraudulent eg claiming for more than the actual loss the 2015 Act confirms that the insurer can reject the claim ie not pay our anything and keep any premiums which have already been paid. 1 If the Insured makes a fraudulent claim under this insurance contract the Insurer. Post Contract Duties and other Issues and provides information on the consultation process around insurers remedies for fraudulent claimsThis consultation and the other Law Commission consultations and reports led to the.

Will not be liable to pay the fraudulent claim. The Act does not define fraud or fraudulent claim. The Insurance Act 2015 which comes into force on 12 August 2016 is the most significant reform of UK insurance contract law for a century.

Refuse all liability in respect of events occurring after the time of the fraudulent act. An option to terminate the contract at the time of the fraudulent act. If cover is terminated the insurer may retain the premium paid under the contract.

Previously in the event of fraud an insured party would forfeit the whole claim and insurers could also avoid the whole contract.

Insurance Fraud Detection And Cost To Industry

Criminal Investigation Report Template Calep Midnightpig Co In Private Investigator Surveillance Report Template Professional Templates Report Card Template

Insurance Contract Law Law Commission

The Insurance Act 2015 Explained Summary Guide Simply Business Uk

Hipaa For Dummies Hipaa Compliance Hipaa Healthcare Compliance

Insurance Fraud Detection And Cost To Industry

Https Www Handbook Fca Org Uk Handbook Icobs 8 1 Pdf

The Uk Insurance Act 2015 And Its Impact On The Hong Kong Insurance Market Hong Kong Lawyer

Insurer S Duty Of Good Faith And Remedies In The Case Of A Breach Leiden Law Blog

18 Hipaa Identifiers Hipaa Health Insurance Infographic Hipaa Compliance

Https Www Clydeco Com Clyde Media Fileslibrary Admin Cc010256 Insurance Act 2015 26 07 16 Web Pdf

Insurance Fraud Detection And Cost To Industry

Infographic About Car Insurance Fraud Auto Fraud Infographic Insurance

Broker Operational Issues British Insurance Brokers Association

Netherlands Health Insurance Premium 2007 2020 Statista

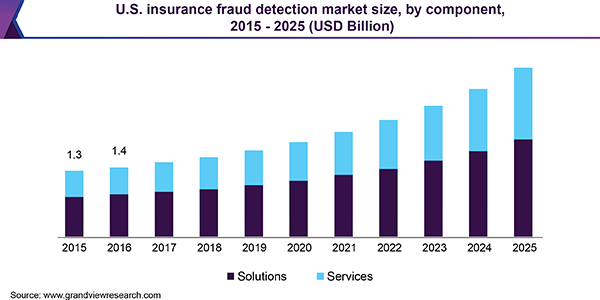

Insurance Fraud Detection Market Size Industry Report 2019 2025

General Principles Of Insurance Contract Law Legal Guidance Lexisnexis