I have been investing with Funding Societies since 2017. KUALA LUMPUR 30 August 2019 Funding Societies Malaysia the first and largest Peer-to-Peer P2P financing platform in the country has launched Dealer Financing the latest addition to its array of investment products for the purchase of used cars by identified used car dealers.

Western Asset Corporate Loan Fund Inc 2020 Proxy Soliciting Materials Defa14a

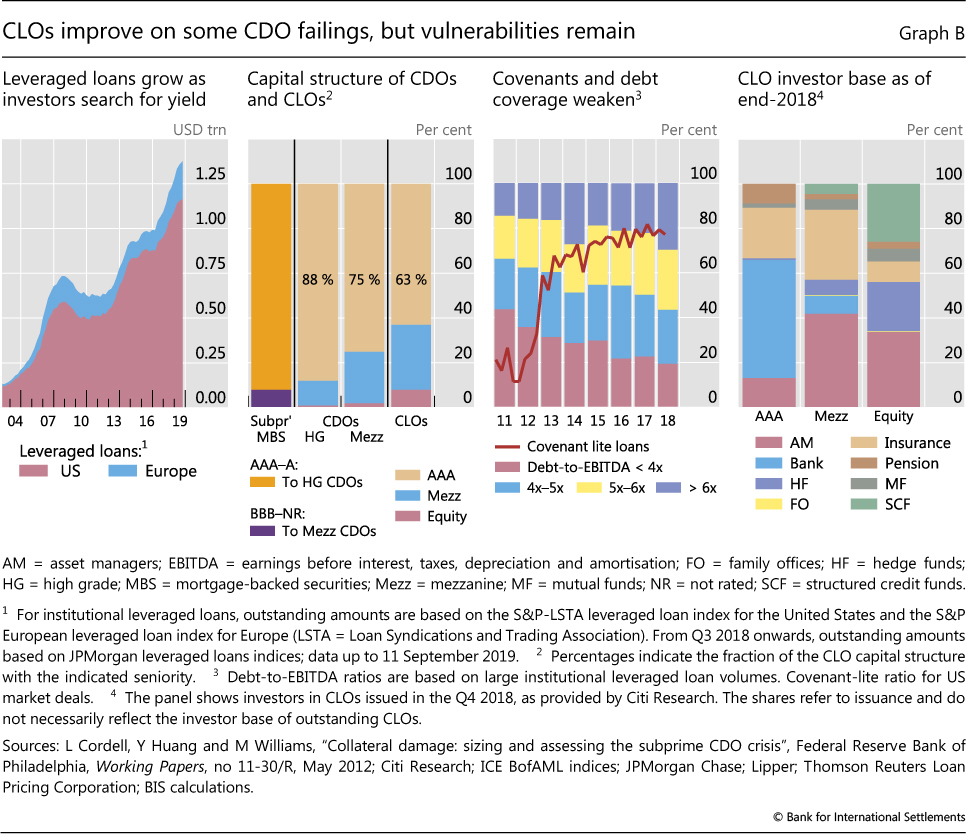

CFOs are a structured form of financing for diversified private equity portfolios layering several tranches of debt ahead of the equity holders.

Funding societies first collateralized. Presently it is also the largest P2P operator in our nation. The Secured Overnight Financing Rate SOFR is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. It was the first such platform in Singapore to engage an escrow agency to independently and safely manage investors funds.

Funding Societies First Collateralized P2P Investment in Malaysia Funding Societies Malaysia the first and largest Peer-to-Peer P2P financing platform in the country has launched Dealer Financing the latest addition to its array of investment products for the purchase of used cars by identified used car dealers. DBS is the first Singapore bank to collaborate with these lending platforms expanding the funding sources available to. ABL lenders can offer up to a 3rd position on the land or building and can fund within 3 weeks of applying.

Funding Societies was launched in February 2017 as the first P2P operator in Malaysia. E A collateralized fund obligation CFO is a form of securitization involving private equity fund or hedge fund assets similar to collateralized debt obligations. Funding Societies reported S 850 million appr.

Singapore 19 Apr 2016 - DBS Bank today announced it has signed cross-referral agreements with peer-to-peer p2p lending platforms Funding Societies and MoolahSense. FIRST Insurance Funding is one of the largest independent premium finance companies in North America and specializes in providing complete financial solutions to its customers. Asset Based Winery Loans.

The first step is to appoint a head of collateral management with a dedicated team that has a centralized enterprise-wide view and can deploy a strategy to optimize available collateral funding and liquidity. Asset based lending is a way for wineries to obtain operating capital by using the commercial real estate or the owners personal property as collateral. In Indonesia its known as Modalku which means My Capital in Bahasa.

We specialise in all forms of short-term financing for SMEs funded by individual and institutional investors. Paul Forrester1 Collateralized fund obligations CFOs emergedin the early 2000s as a means of applyingsecuritization techniques developed forcollateralized debt obligations CDOs toportfolios of hedge fund and private equity fundinvestments each an Investment. 640 million in disbursals last year meanwhile its platform default rate managed to stay below.

Funding Societies is Southeast Asias leading SME digital financing platform. Dealer Financing is not only the first P2P dealer financing product but it is also the first collateralized. Commercial real estate is a desired asset by secured business lenders because real estate is an immovable asset.

This is probably the key hurdle. Secured Overnight Financing Rate Data. Weve succeeded because of our dedication to our customers with superior service and constant innovation.

Therefore financing products of Funding Societies should not be constructed as business loan SME loan micro loan term loan or any other loans offered by banks in Malaysia and it is to be deemed as an investment note as defined in the Guidelines on Recognised Markets. Even if the US Dollar and Ether collapse a non-collateralized coin could survive them as a stable store of value. Funding Societies a peer-to-peer lending platform in Southeast Asia said today that it has raised a 25 million Series B led by Softbank Ventures Korea the.

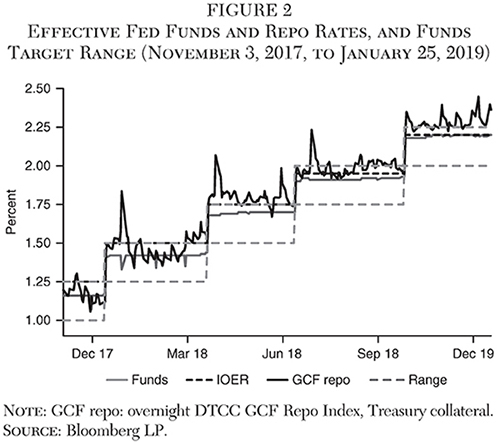

From Wikipedia the free encyclopedia Funding Societies is a South-East-Asia based SME digital financing platform headquartered in Singapore. A non-collateralized coin is independent from all other currencies. The SOFR includes all trades in the Broad General Collateral Rate plus bilateral Treasury repurchase agreement repo transactions cleared through the Delivery.

Using your companys real estate is probably the best type of collateral for obtaining a secured business loan. Since its launch Funding Societies has crowdfunded RM 3108 million regionally Malaysia Singapore an Indonesia. Collateralized fund obligations or CFOs were first given life in the early 2000s but the market for them has mostly been dormant since the financial crisis.

I remembered at that time P2P lending was still a relatively new concept and I was intrigued by its opportunities to earn 10 a year in cash yields safely securely and legitimatelyI chose Funding Societies as my preferred platform to invest in as it is the first P2P platform launched in Malaysia. We pride ourselves in speed and flexibility offering the widest range of term loan trade finance and micro loan products. Since commercial real estate is immovable fixed asset a lender wont have to do much work to get control of it during a default.

Investing Into Property Backed Secured Investment Funding Societies Blog

The Structure Of A Collateralized Loan Obligation Clo Tructured Download Scientific Diagram

Small Business Funding Sba Loans Small Business Funding Business Funding

Money Market Turmoil Cato Institute

Structured Finance Then And Now A Comparison Of Cdos And Clos

Counterparty Credit Risk Collateral And Funding With Pricing Cases For All Asset Classes Wiley

Demystifying Securitization Lending Times

497 1 S119638 497 Htm 497 Filed

Product Update Issue 5 Collateralized Debt Obligations Cdos And Union By Unn Finance Unn Finance Updates Ideas Medium

The Structure Of A Collateralized Loan Obligation Clo Tructured Download Scientific Diagram

Coinerium Business Analyst Financial Documents Moral Responsibility

Two Sigma Founders Turn Up Leverage For Private Equity Fund Bets Bloomberg

Use Of Federal Reserve Programs 12 02 2020 Yale School Of Management