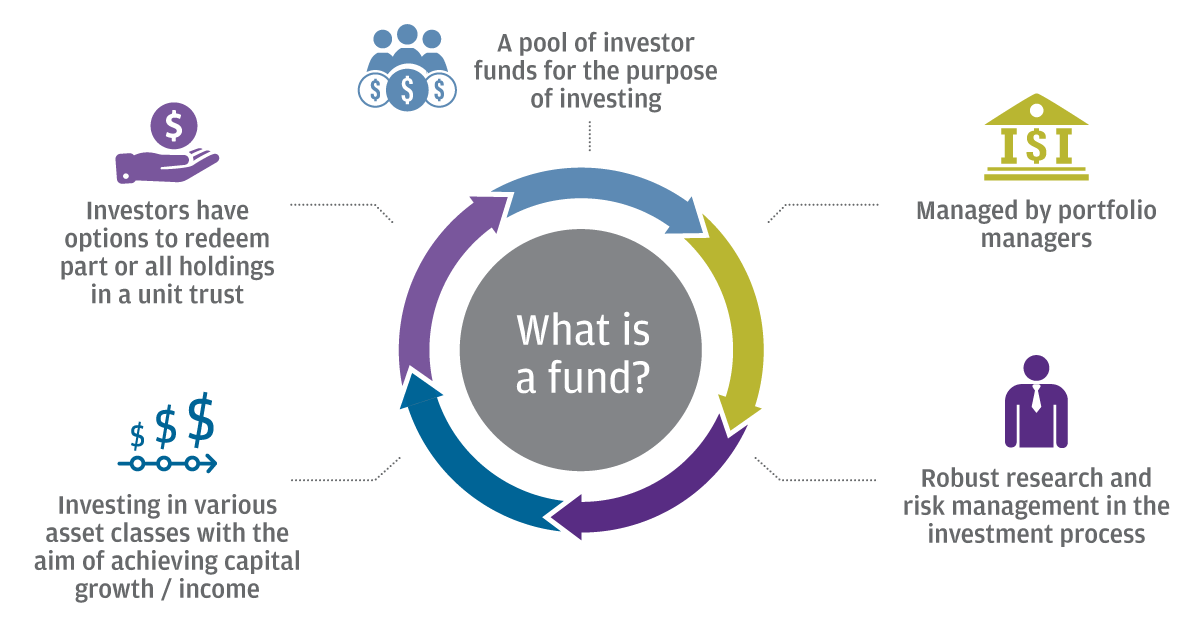

Unit trusts are designed for ordinary income earners. The NAV of a unit trust may be higher or lower than the initial price paid for the units.

/GettyImages-616128044-e7ff49f037074c9682f52d0e5a8a4842.jpg)

Undertakings Collective Investment In Transferable Securities Ucits Definition

For simplicity sake - any non-US.

Tax benefits of unit trusts you must. You can invest in lump sums or monthly debit orders. Tax Benefits of Unit Trusts YOU Must Know Due to Malaysian Governments efforts to promote unit trusts most of the income received by unit trusts will be exempt from income tax. Ways to invest in unit trusts.

When preparing wills and trusts it is essential to have good professional advice. The tax Benefits in Unit trUsts R ecent years has seen a significant growth in the number of unit trust funds includ-ing REITs also known as property trust funds in Malaysia. Basically the income of unit trust may consist of dividends interest or profit.

The beneficiary has to pay income tax on the proportional profits they derive from the trust. However it may be tax free if it falls within one of the allowances dividend allowance or starting rate for savingspersonal savings allowance. Similar to a mutual fund a unit trust fund is an investment by a group - which own the assets underlying the trust.

The income from unit trusts and OEICs is always taxable regardless of the share class or whether the income is actually taken or reinvested. An open-ended fund allows for new contributions and withdrawals to and from the pool. This growth is at-tributable in part to the strong commitment by the Govern-ment in introducing relevant tax incentives and increasingly lib-eralised measures to enhance the competitiveness of the unit trust.

The latter usually start at around R500month. Tax Benefits of Unit Trusts YOU Must Know. These prices directly influence.

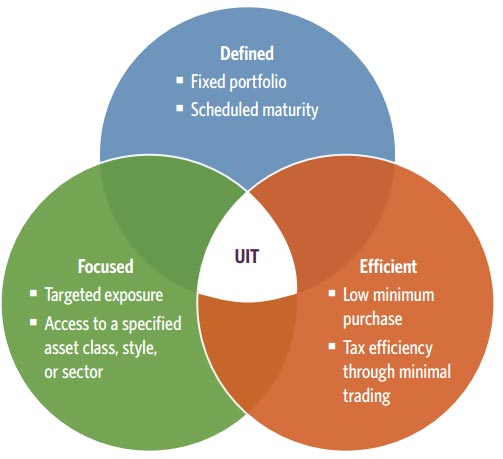

Ignore the trust in Unit Trust. The sponsor of a unit investment trust is required to buy back units of investors who want to sell their units. Trusts are not normally taxed at all.

Similarly trusts enjoy a 50 Capital Gains Tax discount regarding disposal of assets that can be passed on to the beneficiaries if the trust is structured accordingly. This is in contrast to closed-end funds which can trade at deep discounts to the NAV. Basically the income of unit trust may consist of dividends interest or profit and gain from sale of investments and returns on bonds.

Unit Trusts are PFICs. Unit trusts can access the 50 CGT discount but the unitholder must be an eligible entity to retain that concession. The units will be bought back at the current net asset value -- NAV -- of the units without any additional fees or commissions.

Unit trusts are open-ended and are divided into units with different prices. Although the name may imply as such they are not foreign trusts in the eyes of the IRS. Tax Benefits of Unit Trusts YOU Must Know Due to Malaysian Governments efforts to promote unit trusts most of the income received by unit trusts will be exempt from income tax.

Basically the income of unit trust may consist of dividends interest or profit. As with income distributions you are entitled to an annual tax-free allowance which for the current tax year 202122 is 12570. If units are owned via family trusts the various income tax asset protection and estate planning advantages connected to family trusts are also available to unit holders.

Due to Malaysian Governments efforts to promote unit trusts most of the income received by unit trusts will be exempt from income tax. Wills and trusts need to be updated as circumstances and tax laws. Tax Benefits of Unit Trusts YOU Must Know Due to Malaysian Governments efforts to promote unit trusts most of the income received by unit trusts will be exempt from income tax.

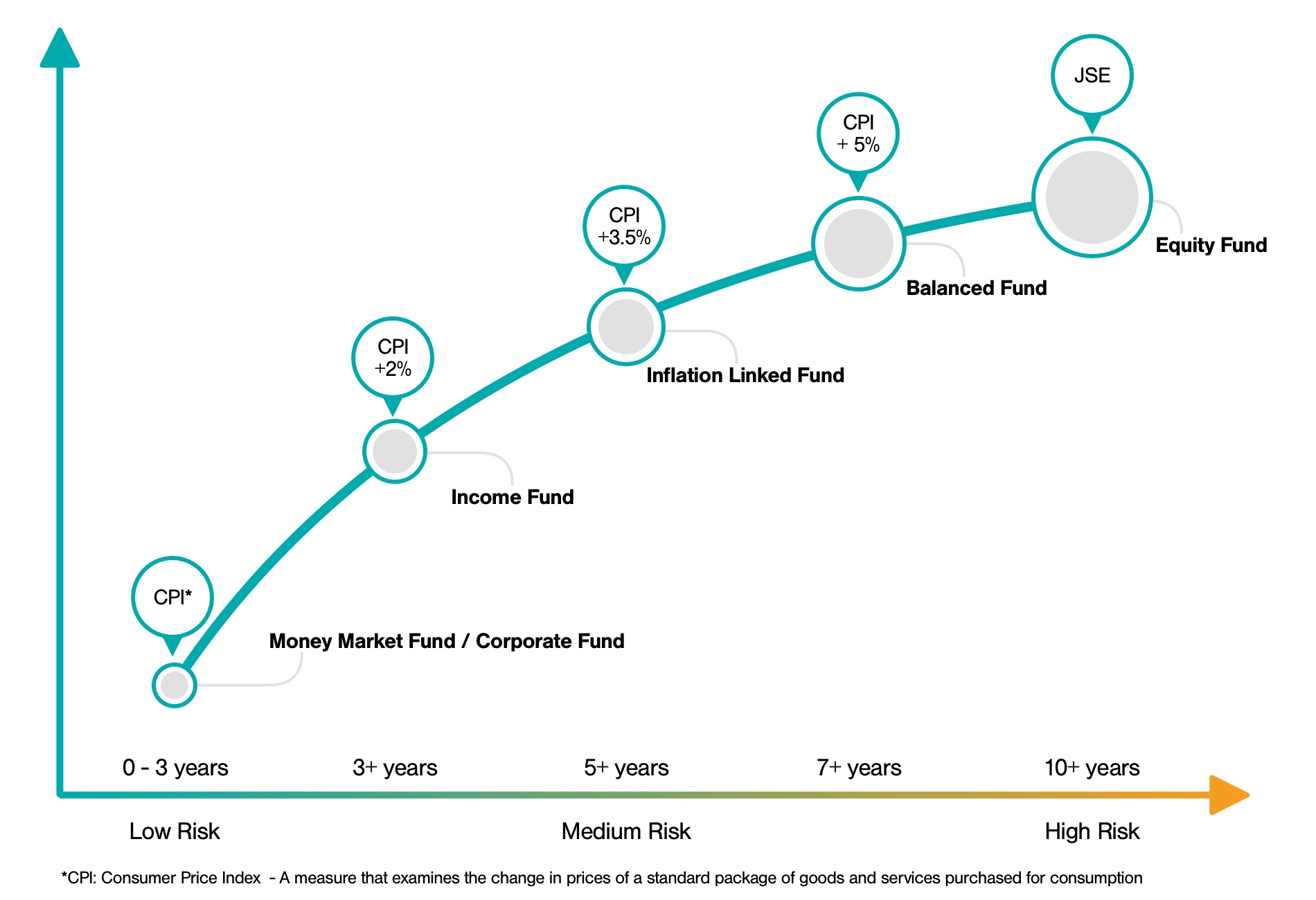

In order to gain the most from your unit trust investment equity unit trusts should ideally be kept for a period of three. This means you are only liable for overall gains which exceed this amount. Or they may decide to distribute the tax liability to the beneficiaries at their marginal rate of tax.

Calculating capital gains tax on unit trusts examples. The rules differ from companies to trustees. UIT units are also more liquid than many individual bond issues.

Lump sums are often in the region of R50 000. Capital Gain Tax Advantages On disposal of any asset of the trust it is entitled to a 50 discount factor on capital gains if assets are disposed after one year this discount flows throw to unit holders on distribution. Although there are a number of benefits to investing in a unit trust such as the fact that a unit trust may be purchased for less than R100 a month it is vital to remember that economic markets fluctuate.

Unit trusts provide a way for you to invest in shares bonds. Trusts also can be worded to avoid assets going to spouses of family members during a divorce. As discussed above - Non-US.

Monthly investing makes it possible to build a large amount slowly on a limited income. Tax rates can be high on income kept within a trust so it may be tax efficient to distribute most of the income but keep the principal within the trust. Switching between unit trust investment funds.

Income tax is 18 to 45 or capital gains tax 72 to 18 thereby paying much less tax. Unlike a company a Unit Trust does not have to pay any tax. Basically the income of unit trust may consist of dividends interest or profit and gain from sale of investments and returns on bonds.

The best way to invest in. Basically the income of unit trust may consist of dividends interest or profit. Franking credits will generally only pass through a unit trust if it meets the rigid definition of a fixed trust.

Tax Benefits of Unit Trusts YOU Must Know Due to Malaysian Governments efforts to promote unit trusts most of the income received by unit trusts will be exempt from income tax. Rather the unitholders are taxed on their share of the trust income. Pooled investment would be subject to PFIC reporting requirements.

Trustees can decide to pay the income tax- which is 45 or capital gains tax- 36 in the hands of the trust.

Chapter 12 Unit Trust Ppt Video Online Download

Why Unit Trusts And Not Etf Moneyowl

Unit Trust Investment Sharetrading Tax Free Offshore Investments Sanlam

Why Unit Trusts And Not Etf Moneyowl

Unit Trust Malaysia Everything You Need To Know Before Investing

About Unit Investment Trusts Uit Guggenheim Investments

Unit Trust Success Tax Professionals

What Is Unit Trust Investment Dbs Singapore

Why Unit Trusts And Not Etf Moneyowl

A Dummies Guide To Unit Trusts Andreyev Lawyers

What Is Unit Trust Investment Dbs Singapore

Investing In Funds What S The Difference Between A Unit Trust And Oeic Shares Magazine

What Is A Unit Trust Money Co Uk

Know About Tax On Mutual Fund And Taxation Rules Mutual Funds Investing Mutuals Funds Investing

Mutual Funds For Beginners J P Morgan Asset Management

What Is A Trust Trust Law In Singapore Singaporelegaladvice Com