This decision means that those earning more than 9500 a year will be 78 better off if you are self employed or 104 if you are employed. For the coming year statutory sick pay will be available to more people and so will some other social security benefits.

Union Budget 2021 Explained Decoding The 137 Per Cent Increase In Health Expenditure News

Rishi Sunak lays out UK coronavirus response in budget video highlights Furlough The chancellor says unemployment will peak at 65 down from a forecasted peak of 119 last July.

Uk budget 2020 key highlights. A fund to transform cities was also announced in the Budget allocating 1billion to a range of schemes in the coming two to three years. Tax highlights and key measures are as follows. Business rates in England will be abolished for firms in the retail leisure and hospitality sectors with a rateable value below 51000 6bn in extra NHS funding over five years to pay for staff.

Unsurprisingly the focus of the Budget was on emergency measures surrounding the minimisation of the economic impact of Covid-19. Business rates in England will be abolished for firms in the retail leisure and hospitality sectors with a rateable value below 51000 6bn in extra NHS funding over five years to pay for staff. News LBV Hub Financial Services DTE Business Advisers Budget 2020.

At a glance summary will follow later today. Business rates abolished for half of UK. In March 2019 the most recent official growth forecasts from the Office for Budget Responsibility OBR the UK economy was expected to grow.

Amid all the tensions in and around coronavirus outbreak the new government and Chancellor Rishi Sunak delivered their first budget ie. Business Rates will be reduced or even eliminated for some smaller businesses at least in the short term. While the personal tax slab has been revised DDT has been slashed.

The budget focusses on agriculture education healthcare infrastructure and social development. The newly appointed chancellor Rishi Sunak announced a spirited budget with a repeated emphasis on getting things done echoing the recent election campaign. Chancellor Rishi Sunak presented the UKs Budget 2020 on 11 March 2020.

These are aimed at boosting areas such as Bournemouth Christchurch and Poole which will see 79 million for new cycle freeways and bus infrastructure. UK Budget 2020 predictions and highlights. The income limit for the age-related married couples allowance increases from 29600 to 30200.

In order to be transparent it informs. What are the other key points of note in the Budget. It is the Governments ambition to increase this threshold to 12500.

No changes to income tax rates or to the basic personal allowance. However there were numerous tax-related announcements including some new and potentially significant developments. The Governments coronavirus three-point plan in full.

On 11 March the Chancellor delivered the 2020 Budget. Budget 2020 sees cuts to personal income tax. This document details all of the data sources used throughout the Budget 2020 document.

The government has set aside 30 billion to provide direct support to businesses worth 12 billion and the remaining 18 billion in additional government spending to offset the temporary slowdown in the. Ahead of his speech the Chancellor promised to level up the UK ensuring everyone has the same chances and opportunities in life wherever they live by investing historic amounts in British innovation and world-class infrastructure. Budget 2020 news.

The government aims to boost the economic growth up to 6 to 65 in the coming financial year with the budgetary announcements. It highlights main areas of additional uncertainty. Our Budget 2020.

UK Budget 2020 on 11th March 2020. The point at which employees start paying National Insurance contributions will rise from 8632 to 9500 from April 2020. Chancellor pledges 5bn to support NHS through coronavirus outbreak.

Your summary of key highlights. From 6 April 2020. What the Budget 2020 announcements mean for capital gain taxes business tax payroll and employee incentives VAT and indirect taxes.

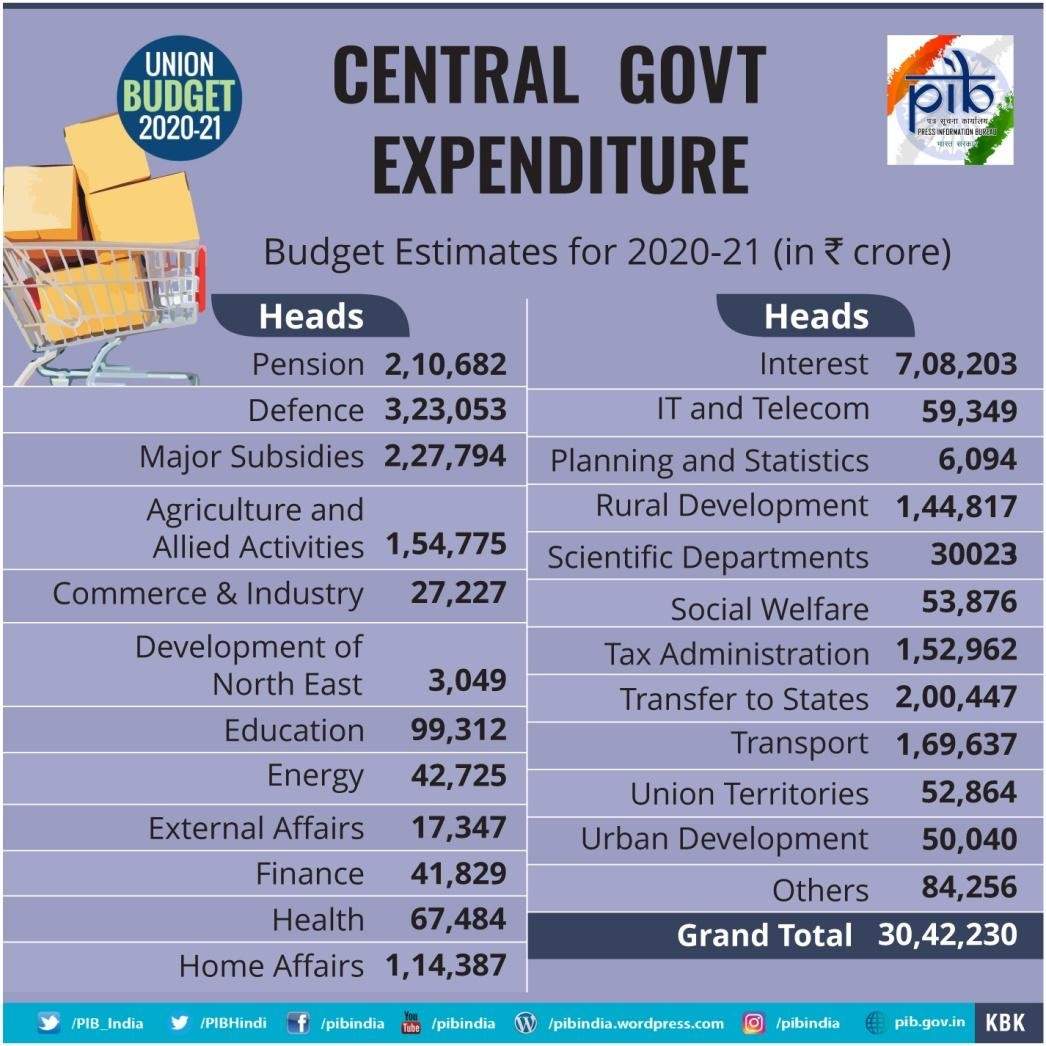

Union Budget 2020 Key Highlights Of Fm Nirmala Sitharaman S Speech Telecom News Et Telecom

Union Budget 2020 Key Highlights Of Fm Nirmala Sitharaman S Speech Telecom News Et Telecom

Union Budget 2020 Key Highlights Of Fm Nirmala Sitharaman S Speech Telecom News Et Telecom

Influencer Marketing Statistics In 2021 Trends Key Takeaways

Union Budget 2020 Key Highlights Of Fm Nirmala Sitharaman S Speech Telecom News Et Telecom

Spring Budget 2021 A Summary House Of Commons Library

Budget 2020 Payroll Hr Highlights Budgeting Payroll Human Resources

Budget 2020 Union Budget 2020 Key Highlights Income Tax Slab Fy 2020 Budgeting Income Tax Highlights

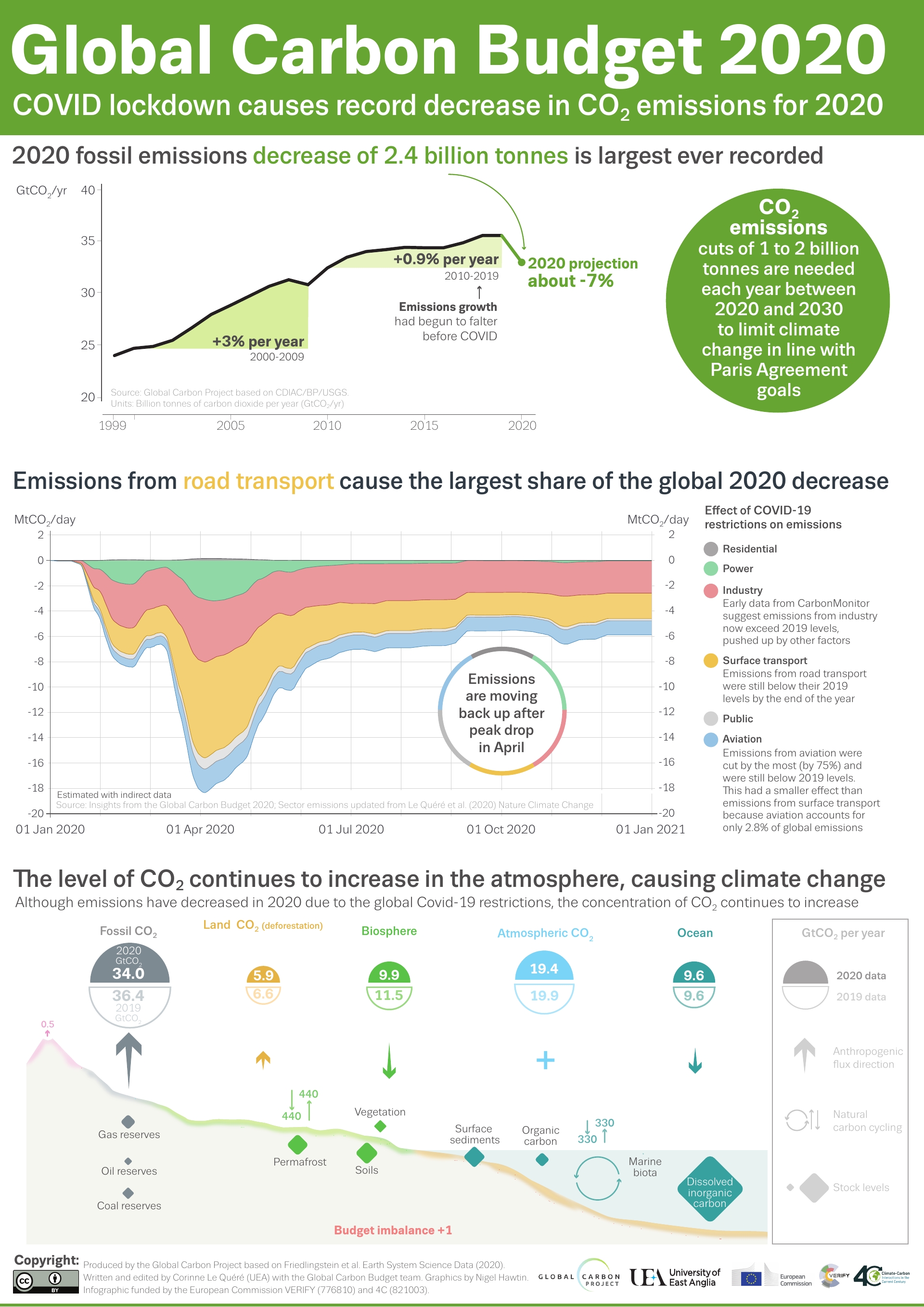

New Global Carbon Budget 2020 Released United States Carbon Cycle Science Program

Union Budget 2020 Key Highlights Of Fm Nirmala Sitharaman S Speech Telecom News Et Telecom

Post Brexit Guide Five Years Since Uk Vote Where Are We Now And How Did We Get Here Euronews

Spring Budget 2021 A Summary House Of Commons Library

Dow Jones Enters Bear Market As Coronavirus Pandemic Declared

Union Budget 2021 Explained Decoding The 137 Per Cent Increase In Health Expenditure News

Austerity And Brexit Intereconomics

An Overview Of The Impact Of Proposed Cuts To Uk Aid Center For Global Development

Union Budget 2020 Key Highlights Of Education Budget Of India 2020 Careerindia

Dow Jones Enters Bear Market As Coronavirus Pandemic Declared