An LTV of 80 or lower is an ideal target not only does this mean youll be eligible for preferable loan options with better rates but you can avoid paying mortgage insurance saving hundreds of dollars on your mortgage payments. 80 loan to value is used as a threshold to determine the amount of risk for financial lenders.

Loan To Value Ltv Ratio Explained Quicken Loans

VA loan guidelines allow for 100 percent LTV which means that no down payment is required for a VA loan.

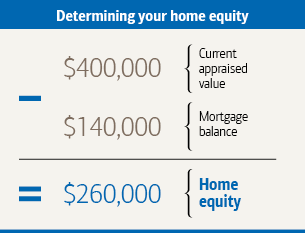

What does 80 percent loan to value mean. 80 or less is considered to be reasonable. Say you want to buy a house worth 300000 and you have 60000 in your account that you can use as a deposit. Current balance on home equity line or home equity loan.

The loan-to-value is the ratio between the value of the loan you take out and the value of the property as a whole expressed as a percentage. If youre buying a house with a conventional loanthat is a mortgage thats not backed by a federal programan LTV ratio greater than 80 may mean youre required to buy private mortgage insurance PMI which covers the lender against loss if you fail to repay your loan. On a conventional loan once the loan to value reaches 78 percent the lender has to cancel the.

An 80 loan-to-value means that the loan is 80 of the value of the collateral. If your LTV is higher than 80 that can mean youll have to pay for mortgage insurance. Youll need a loan of 240000 in order to purchase the property and so your LTV will be.

Any other liens on the property tax liens mechanics liens etc First mortgage loan-to-value 2857. This helps the lender as the insurer pays out to mitigate their risk. For example a borrower who provides a 20 down payment has an LTV of 80.

It may even enable borrowers with poor credit scores to qualify for finance. Your LTV ratio would be 80 because the dollar amount of the loan is 80 of the value of the house and 80000 divided by 100000 equals 080 or 80. You can find LTV ratio calculators online to help you figure out more complicated cases such.

80 80000 10000 100000 09. If Jane buys a house worth 200000 and puts down 40000 and seeks a loan for 160000 her loan is 80. If you get a loan for 80 of the value of your house thats equivalent to buying a house with a 20 down payment assuming the appraised value is what youd buy it for.

Once the loan-to-value falls below 80 percent either the borrower or lender can cancel the policy. The remaining value is paid as a deposit. You will pay a higher interest rate and probably have to pay PMI for a high LTV loan.

Most mortgages where the LTV is over 80 will require PMI or Private Mortgage Insurance to be taken out. An 80-percent LTV is considered standard and. Mortgage insurance allows the lender to take greater risks to lend you the money by protecting the lender in case you default on the loan.

The loan-to-value ratio is the amount of the mortgage compared with the value of the property. LTV is important because. Thats the minimum down payment for Fannie Mae backed loans without PMI mortgage insurance.

PMI typically costs between 05 to 1 of the loan amount every year and must be paid until your LTV ratio drops to 78. As a loan applicant you are in a better position if you have invested a lot in the transaction. If you get an 80000 mortgage to buy a.

A mortgage loan-to-value ratio or LTV represents the relationship between a home loan balance and a homes value. LTV is the inverse of a borrowers down payment. It is expressed as a percentage.

80 Percent LTV Mortgage Guidelines. Basically your loan-to-value LTV ratio is the flip side of your down payment assuming that the purchase price equals the appraised value of the home.

How To Calculate Your Home S Equity Loan To Value Ltv Tips

Loan To Value Ratio Overview Importance Formula

How To Calculate Your Home S Equity Loan To Value Ltv Tips

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Loan Advisors 714 271 8524 Reverse Mortgage Mortgage Loans Mortgage

5 Types Of Private Mortgage Insurance Pmi

Kentucky Rural Housing Usda Loans Usda Loan Conventional Loan Fha

Loan To Value Ratio Overview Importance Formula

A Guide To Loan To Value Ratio Rocket Mortgage

Loan To Value Ltv Ratio Or Loan To Cost Ltc Ratio Youtube

Maximum Loan To Value Ratio Definition

Loan To Value Calculator Nerdwallet

Explainer What Is Loan To Value Ratio And Why Is It Important

Alandistro Buying First Home Home Buying Process Buying Your First Home

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance6-afd72524ae714573bab8c3e5e32f895e.png)

How To Outsmart Private Mortgage Insurance

Loan To Value Ratio Why It Matters Credit Karma

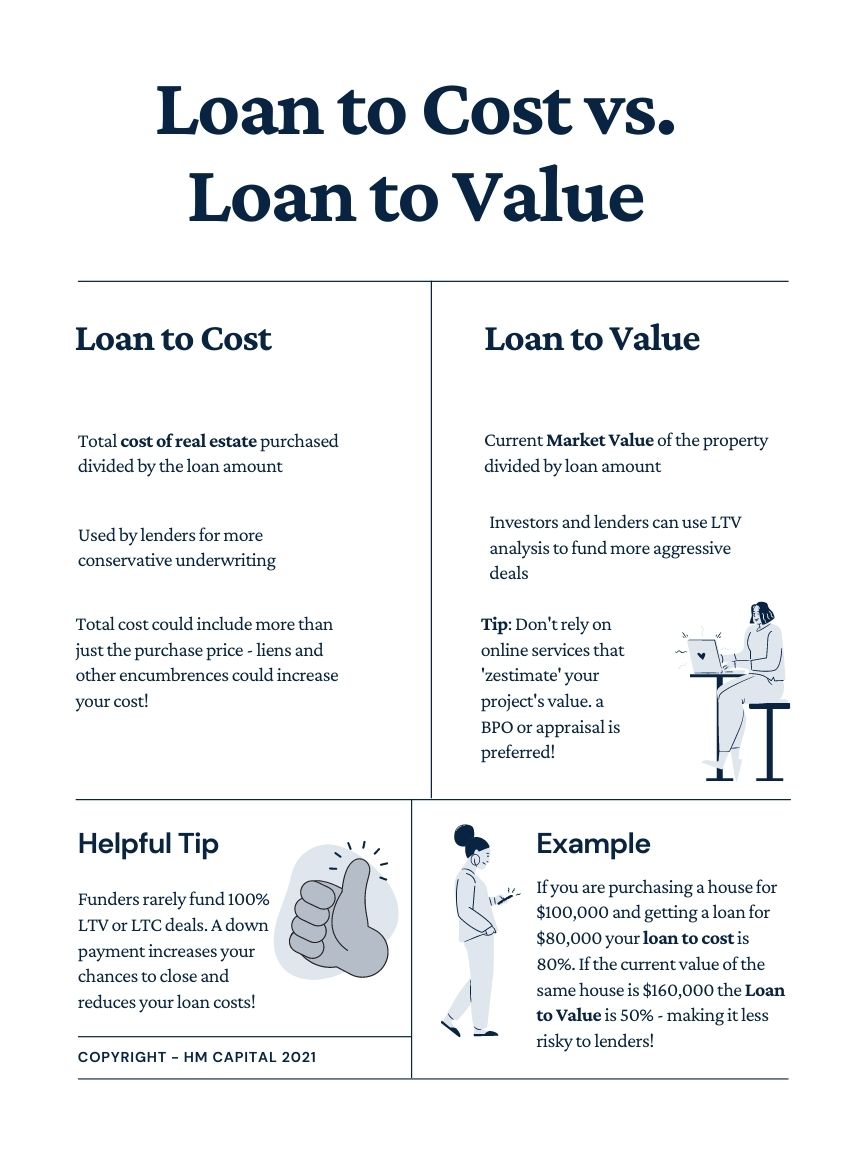

Loan To Cost Vs Loan To Value Definitions

What Is A Good Loan To Value Ltv Ratio Smartasset

Debt To Income Ratio Explained Debt To Income Ratio Debt Income