With average credit card interest rates currently ranging from about 13 to 23. Among the other types of debt this is the one with the highest rate.

4 Ways To Write A Letter To Reduce Credit Card Interest Rates

The higher the likelihood a borrower cant cover his debt the higher the interest rate goes to help offset the cost of unpaid bills.

Why is the interest rate on my credit card so high. Because thats the way weve always done this is about as good of a reason as any when youre dealing with entrenched ideas. 5 Credit Cards You Cant Afford A credit card interest rate of 2299 percent isnt unheard of these days. Credit card interest isnt a one-time thing either.

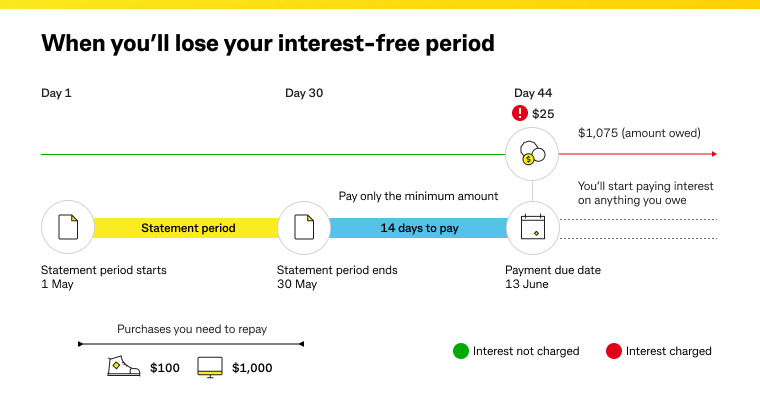

Each month you carry a balance over from the previous month youll have a finance charge added to your balance. According to the New York Federal Reserve many credit card consumers were paying an average interest rate of 17 on credit cards in. If you continually carry over your growing credit card balance from the previous month your credit issuer may increase your APR.

Below is only one court decision in the. The high credit card interest rates come about even as the Federal Reserve maintains its target Fed funds rate to which the interest on variable-rate credit cards is tied in the 0 percent to. The banks have always charged high rates on credit cards so thats what theyve continued to do.

Nobody likes paying credit card interest and as unsecured debt credit cards will typically have higher interest rates than other types of loans such as a mortgage or a car loan. High-interest-rate cards are usually for customers who have poor credit. Many credit cards will charge a higher interest rate if you become 60 days delinquent on payments.

And unlike a mortgage or a student loan credit card interest is never tax-deductible. Although it probably wont pinch too much. While car house and school loans tend to have interest rates in the single digits credit card APRs typically fall in a range between 12-29.

Most credit cards carry double-digit interest rates so if youre carrying a balance these charges are getting tacked onto your minimum every month. The penalty APR that may apply after youre 60. The credit card interest rate is notorious for being too high.

The other reason credit card rates remain so high has to do with plain old inertia. The reason for the seemingly high rates goes beyond. You wont be charged interest if a 0 promotional rate applies to your.

Why Credit Card Companies Charge Such High Interest Rates The short answer is because corporate profits and corporations in general are favored over protecting the individual from harm these days. Credit card interest rates might seem outrageous some stretching beyond a 20 annual percentage rate far higher than mortgages or auto loans. Your credit card issuer will charge interest whenever you carry a balance beyond the grace period.

Credit card interest rates hit a record high. Your income also may be a factor in determining your interest rate and especially your borrowing limit. If you recently got a new credit card and saw an increase in your interest rates your promotional low-interest period may have ended.

Lending money through credit cards is riskier than for mortgages for example. Your promotional period ended. Cards can stretch your dollar a little further too if you take advantage of rewards or cash back cards.

There are several factors that play a role in determining how high a credit card interest rate will be and a majority of these factors have nothing to do with your personal creditability as a borrower. A more complete answer is that banks charge interest based on the perceived risk of lending money. But credit cards may also come with high interest rates that make carrying balances expensive for cardholders.

High credit card balance. The interest rate your card issuer charges you is typically a function of your credit score with higher scores usually resulting in lower interest rates. If you are 60 days late with a credit card payment the bank can bump you up to a penalty rate of around 30 percent.

This is the reason why you need to understand it carefully so you do not waste money paying interest on all your credit card transactions. Banks can also raise your rate when a promotional rate ends after youve had a card for more than a year or after your credit score drops.

Best Credit Card For July 2021 Cnet

What Is The Average Credit Card Interest Rate

Platinum 20 Month 0 Purchase 18 Month 0 Balance Transfer Barclaycard

Why Are Credit Card Interest Rates So High Nerdwallet

Credit Card Interest Rates Types Current Rates

4 Reasons Why You Should Use A Credit Card Instead Of A Debit Card

:max_bytes(150000):strip_icc()/how-and-when-is-credit-card-interest-charged-960803_final-a8011c78570a428aaf59f9e39011575b.png)

How And When Is Credit Card Interest Charged

How Does Credit Card Interest Work

What Is The Average Credit Card Interest Rate

What Is The Average Credit Card Interest Rate

How To Lower Your Credit Card Interest Rate Credit Karma

:max_bytes(150000):strip_icc()/how-your-credit-score-influences-your-interest-rate-960278_fin2-6e9a6586481946a4a418afa6d7e2522e.png)

How And When Is Credit Card Interest Charged

8 Alternatives To A Credit Card Cash Advance

4 Ways To Write A Letter To Reduce Credit Card Interest Rates

Credit Card Against Fd Sbm India Paisabazaar Sbi Kotak Axis Top 19 July 2021

How To Get Lower Interest Rates On Credit Cards Chase

What Is A Good Apr For A Credit Card Rates By Score