New York State withholds 685 for taxes and the IRS withholds an additional 10. Tax at more favorable rates than those held for the short-term.

Pin By Bastien Gueux On Anywhere But Here Investment Property New York New York City

Long-term capital gains.

Real estate capital gain tax rate nyc. Assuming the owner has owned the property for more than 1 year capital gains tax ranges from 22 percent if property is held individually to 30 percent if property is held through an entity or company. If the transaction is taxed as a capital gain the government will take 20 percent of profits or 10 million. Property Tax Bills Payments.

Sellers in New York City pay ordinary state and city income tax rates on any real estate capital gains. How long the property was in your name your income and your tax filing status. However its possible that you qualify for an exemption.

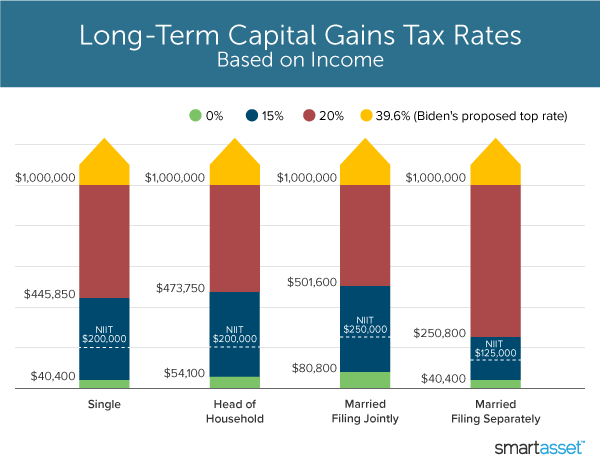

Most recently industry executives are warning that the Biden administrations plans to. This is due to Foreign Investment in Real Property Tax Act which holds these taxes off from the sales proceeds in order to ensure that any non-resident pays taxes on a real estate transactionNew York State holds back 685 while the IRS withholds 10. This type of capital gain tax is ranked at numerous percents 0 15 or 20 which depend on your filing status as well as taxable income.

With proper structuring capital gain taxes from the sale of New York real estate can be reduced to less than 20. When it comes to tax obligations on genuine estate sales. The tax rate would increase to 15 percent for total income between 40401 and 445850 and 20 percent for income above 445850.

Assessed Value History by Email. Long-term capital gains are gains on assets you hold for more than one year. Capital Gains Tax Obligations On Real Estate.

As far as the effect the length of time youve owned a home is concerned any real estate in New York that is purchased and sold within a year is subject to being taxed as ordinary income at the applicable 35 rate. Exemptions Abatement Lookup. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0.

Theyre taxed at lower rates than short-term capital gains. Generally speaking capital gains taxes are around 15 percent for US. If you were to sell a property the capital gains tax you would owe depends on three main factors.

Now trade organization and industry leaders vow to fight back. If its taxed as ordinary income at 40 percent of profits thats 20 million. Residents living in the State of New York.

This means that any sale profits will be taxed both by New York City and New York. The rules of Long Term Capital Gains Tax Rate 2021 Nyc are instead various for real estate assets. Data and Lot Information.

If the hose is located within New York City you have to account for another 10 in NYC taxes. Capital gains tax is the taxes levied on the profit arising from sale of the property. Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20.

For instance if the foreign clients investment in NYC real estate is improperly structured a combined Federal New York State and New York City tax rate on gains realized from selling the property could be as high as 65. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains. There are no separate capital gains tax rates for NYC or New York State.

Find Property Borough Block and Lot BBL Payment History Search. While short-term tax rates are the same as ordinary income tax rates which top out at 396 long-term capital gains range from 0 to a top of 20. A capital gain rate of 15 will apply should your taxable income be at least 80000 but less than 441450 for single filers 496600 for married filing jointly or qualifying widow er 469050 if you plan to file as head of household and 2483000 if you are married filing separately.

Upon the occasion of the real estate being sold the buyer or the seller has to file a Statement of Withholding on Disposition by Foreign Persons of United States Real Property Interests form with the IRS. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40000 and 441500 married filing jointly earning between 80001 and 486600 or. If you file taxes jointly with.

When the real estate is sold the buyer or seller must file a Statement. What Are The Taxes On Selling a House In New York.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Avoid Capital Gains Taxes When Selling Your House 2020

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

Google Capital Gains Tax Capital Gain Financial Literacy

What S In Biden S Capital Gains Tax Plan Smartasset

Long Term Capital Gain Tax Rate For 2018 19 Capital Gains Tax Capital Gain What Is Capital

The States With The Highest Capital Gains Tax Rates The Motley Fool

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains 101 A Simple Guide To Understanding A Complicated Tax Code Mint Com Blog Capital Gain Career Motivation Understanding

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

Capital Gains Tax For Us Citizens Living Abroad Myexpattaxes

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Tax Implications For Foreign Nationals Buying Property In The U S New York Casas