These principles insurance also known as principle of indemnityprinciples of insurance indemnity. The principles commonly used in healthcare ethicsjustice autonomy nonmaleficence and beneficence provide you with an additional foundation and tools to use in making ethical decisions.

Important Document Storage Life Insurance Companies Estate Planning Nursing Home Care

In addition this chapter.

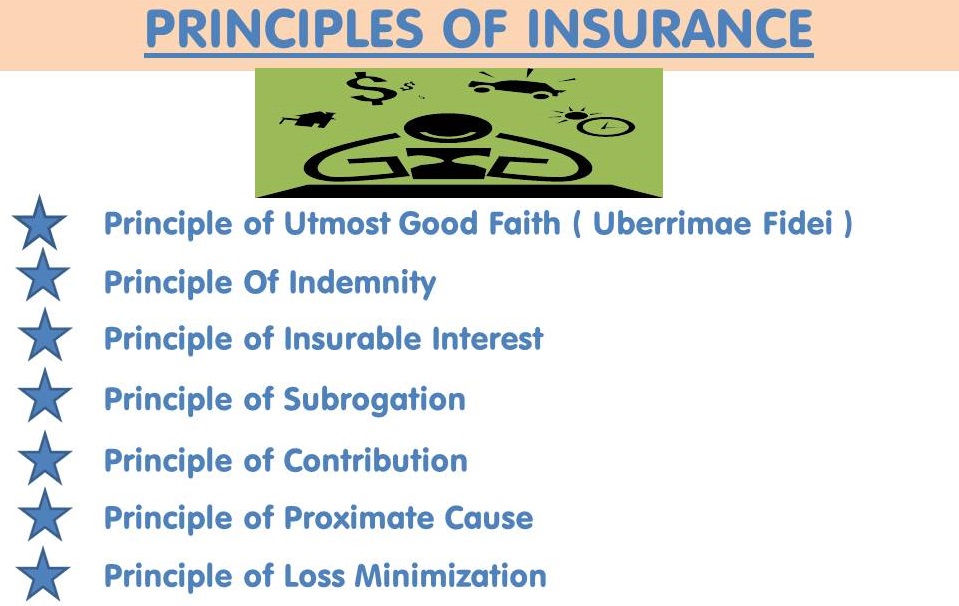

What is the most important insurance principle. Utmost good faith or uberrima fides in Latin is the primary principle of insurance. What is insurance. In this the nominee will get the policy amount upon the death of the insurer.

Millions of people have used our financial advice through 22 books including 12 national bestsellers published by Ramsey Press as. The principle of indemnity states that the insured should not profit from a covered loss but should be restored to approximately the same financial position that existed prior to the loss. Insurance revolves around the Principle of Indemnity which is to compensate or secure the policyholder in the same financial position prior to the event of a loss.

Indemnity The principle of indemnity ensures that an insurance contract protects you from and compensates you for any damage loss or injury. It is important to check if your health insurance provides coverage for such treatments. Death of the insured is certainThe payment of the policy amount on the maturity will be made in one shot lump sum or periodical instalments ie.

CHAPTER FOUR LEGAL PRINCIPLES OF INSURANCE CONTRACTS PRINCIPLE OF INDEMNITY The principle of indemnity is one of the most important. Principle of Insurable Interest Under this principle of insurance the insured must have interest in the subject matter of the insurance. However there are many diseases where alternate treatment options like ayurveda homeopathy etc may seem more relevant.

Each of these principles is reviewed here. Essentially this principle states that both parties involved in an insurance contract should act in. The principle of indemnity is one of the most important legal principles in the field of insurance.

Ramsey Solutions has been committed to helping people regain control of their money build wealth grow their leadership skills and enhance their lives through personal development since 1992. Protecting your most important assets is an important step in creating a solid personal financial plan and the right insurance policies will go a long way toward helping you safeguard your. If this happens insurance will pay out an agreed amount or an amount to cover the damage as appropriate.

Your health insurance usually covers your medical treatments in hospitals. In other words the purpose of insurance is to help make the named insured financially whole again after a peril. This is also called as an Assurance as the event ie.

The principle of indemnity is one of the fundamental principles of insurance because it is the part of an insurance contract that ensures the insured has the right to compensation and sets limits on how much they can get. Principle of Uberrimae fidei a Latin phrase or in simple english words the Principle of Utmost Good Faith is a very basic and first primary principle of insurance. The critical precept of insurance are as follows.

Insurance is defined due to the fact the equitable switch of risk of loss from one entity to each other in exchange for a top price. - Insurance is away of protecting yourself and your belongings against a particular adverse event for example a burglary or losing your income because of illness. Of course it may not happen but you have to decide whether youre willing.

The insurance that covers the risk of the life of the insured is called Life insurance. If one person is providing for his own losses it cannot be strictly insurance because in insurance the loss is shared by a group of persons who are willing to co-operate. According to this principle the insurance contract must be signed by both parties ie insurer and insured in.

View Chapter 4doc from ACFN 3162 at Wollo University. The purpose of an insurance contract is to make you whole in the event of a loss not to allow you to make a profit. In fact many would argue that utmost good faith is the most important insurance principle.

The insurance is based upon i Principles of Co-operation and ii Principles of Probability. I Principles of Co-operation. The precept motive of coverage is cooperation.

Insurance is a co-operation device. The concept of justice is presented last because it is the most complex.

Five Principles Of A Better Argument Principles Therapy Counseling Problem Solving

Life Insurance Is Based On The Fundamental Mathematical Principle Of Probability Powerphraseofth Life Insurance Quotes Life Insurance Facts Financial Quotes

Principles Of Insurance Basic Essential Principles Of Insurance Principles Insurance General Insurance

Advantages And Disadvantages Of Life Insurance Policy Life Insurance Policy Insurance Policy Life Insurance

When Is The Best Time To Buy Life Insurance Insurance Investments Life Insurance Insurance

Technofunc Principles Of Insurance

Technofunc Principles Of Insurance

Pin By Debbie Hanley On Words Have Power Amazing Quotes Business Quotes Quotes

The 80 20 Rule In Action Life Insurance Facts Business Rules Business Management

Step Up In Basis What You Need To Know The Step Up In Basis Is An Important Financial Principle To Understand To A Life Insurance Policy Need To Know Step Up

Pin On Principles Of Insurance

Insurance Contract Principles Re Austin Tx Crash Or Accident Injuries

Top 10 Insurance Companies In Vietnam 2019 Life Insurance Companies Top Life Insurance Companies Best Life Insurance Companies

Principle Of Indemnity Definition And How It Works In Insurance

Advantages And Disadvantages Of Life Insurance Policy Life Insurance Policy Life Life Insurance

Teaching Kids Some Basic Financial Principles Should Ideally Form Part Of Their Upbringing Short Term Insu Child Advice Latest Tech Gadgets How To Make Shorts

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)