She would pay federal income tax of 468125 plus 25 on her income over 34000. Form W-4 2010 Purpose.

Personal Income Tax Rate Schedule Portugal Download Table

Before the 2013 to 2014 tax year the bigger Personal Allowance was based on age instead of date of birth.

Income tax personal allowance 2010. First find your filing status then find your income level. Income Phase Outs for Itemized Deductions and Personal Exemptions for High-Income Taxpayers. From 2010 incomes above 150000 will be subject to a new 50 income tax rate.

Increases in the personal allowance since 2010. In April 2014 the personal allowance will be further increased from the 20132014 level of. Capital gains tax - Personal Allowance.

Personal Allowance for people aged 65 to 74. Changes were made to the rate at which CGT is paid in the coalition governments Emergency Budget. The 468125 covers taxes calculated on income that falls in the 10 and 15 brackets.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. All taxpayers are eligible for this tax-. The amount of itemized deductions and personal exemptions you can take are normally phased out as your income rises.

In 2010 however those income limits have been repealed and the recent tax relief act extends the repeal for two more years through 2012. Basic rate taxpayers will continue to pay at a rate of 18 while higher and 50 rate taxpayers will pay at a rate of 28. Deductions Adjustments and Additional Income.

For taxable years beginning in 2010 only however the taxable amount of a rollover or a conversion to a Roth IRA that would otherwise be includible in gross income for the taxable year beginning in 2010 is includible half in the taxable year beginning in 2011 and half in the taxable year beginning in 2012 unless the taxpayer elects to include. From 2010 the personal allowance will be tapered to zero for those with incomes over 100000. On 22 April 2009 the then Chancellor Alistair Darling announced in the 2009 Budget statement that starting in April 2010 those with annual incomes over 100000 would see their Personal allowance reduced by 1 for every 2 earned over 100000 until the Personal allowance was reduced to zero which in 2010-11 would occur at an income of 112950.

The standard Personal Allowance is 12570 which is the amount of income you do not have to pay tax on. Notes 1 From 201011 the personal allowance of any individual with income above 100000 is reduced by 1 for every 2 of income above the 100000 limit. In May 2010 the new Coalition Government announced that in its first Budget it would introduce a substantial increase in the personal tax allowance a first step to its longer-term objective to raise the allowance to 10000.

20102011 the income tax personal allowance the total amount of income that can be earned tax free stood at 6475. PRSI and relevant levies will also apply. The basic and higher income tax rates remain at 20 and 40 for 200910 and 20102011.

In May 2010 the new Coalition Government announced that in its first Budget it would introduce a substantial increase in the personal tax allowance a first step to its longer-term objective to raise the allowance to 10000. Enter an estimate of your 2010 itemized deductions. Your Personal Allowance may be bigger if you claim Marriage Allowance or Blind Persons.

2 Only available where at least one partner was born before 6 April 1935. To figure out the maximum allowances you should claim use the IRS tax withholding calculator or one of the following worksheets on your W-4 or the IRS tax. Consider completing a new Form W-4 each year and when your personal or financial situation changes.

These include qualifying home mortgage interestcharitable contributions state and local taxes medical expenses in excess of 75 of your income andmiscellaneous deductions11400 if married filing jointly or qualifying widower Enter8400 if head of household. Restriction of reliefs The restriction of income tax relief for high income earners is being amended for 2010 and subsequent tax years to achieve an effective rate of income tax of 30 for people who were subject to the full restriction. From 20112012 the personal allowance started to increase.

For example a single person earning 50000 would be in the 25 tax bracket in 2010. Generally you may claim head of household filing status on your tax return only if you are unmarried. The Income Tax and Personal Allowances are used to calculate the amount of Income tax due in the 2010 to 2011 Tax Year if you are an employee your income tax will typically be calculated and deducted from your salary as Pay As You Earn PAYE along with your other salary deductions like National Insurance Company Pension and student loans deductions etc.

Ordinary taxable income brackets for use in tax planning and filing 2010 tax returns due April 18 2011 the later date is due to a federal holiday in Washington DC.

The Top Rate Of Income Tax British Politics And Policy At Lse

Personal Income Tax Rate Schedule Spain Download Table

Income Taxation In Germany Gofrankfurttax

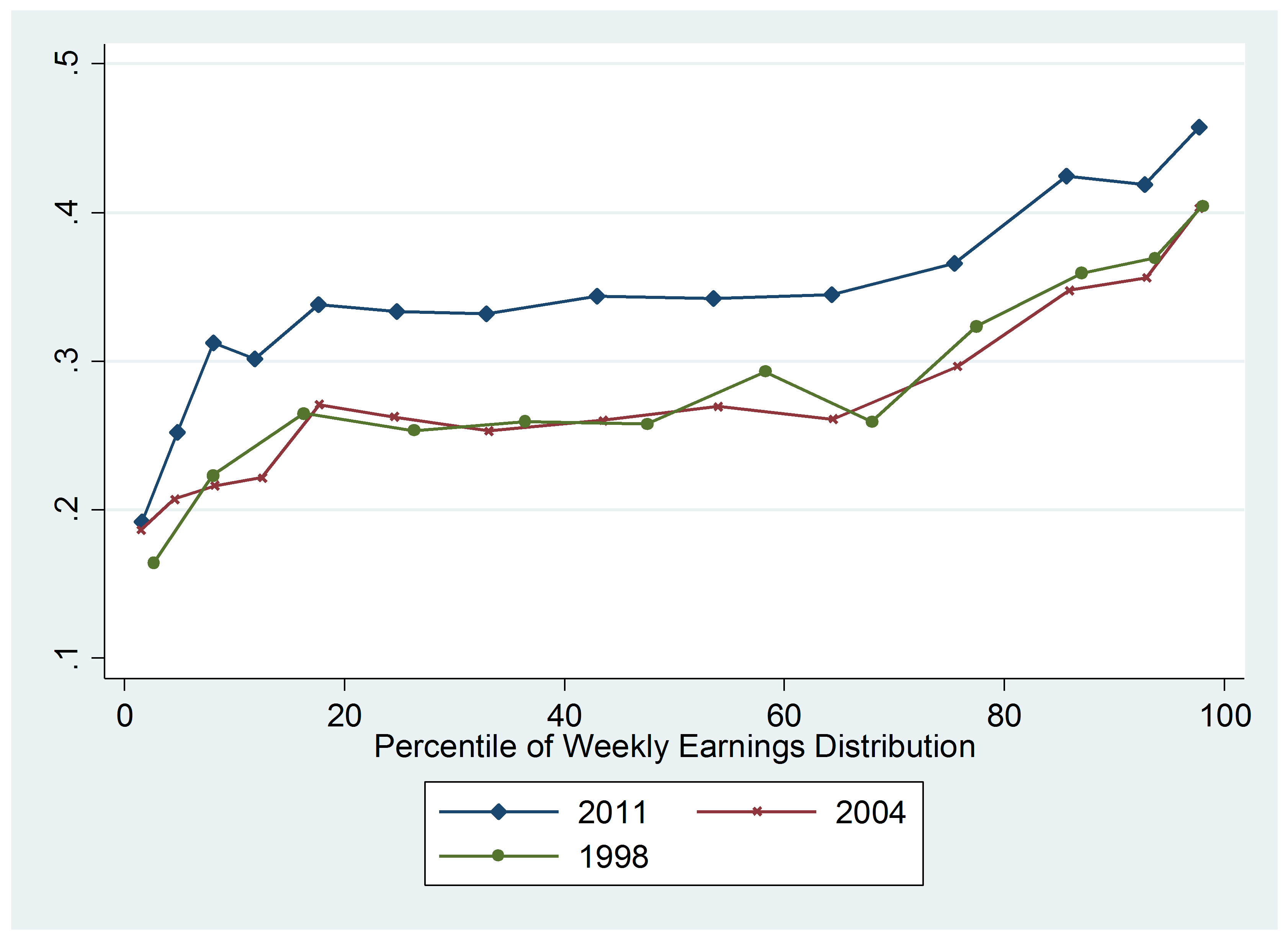

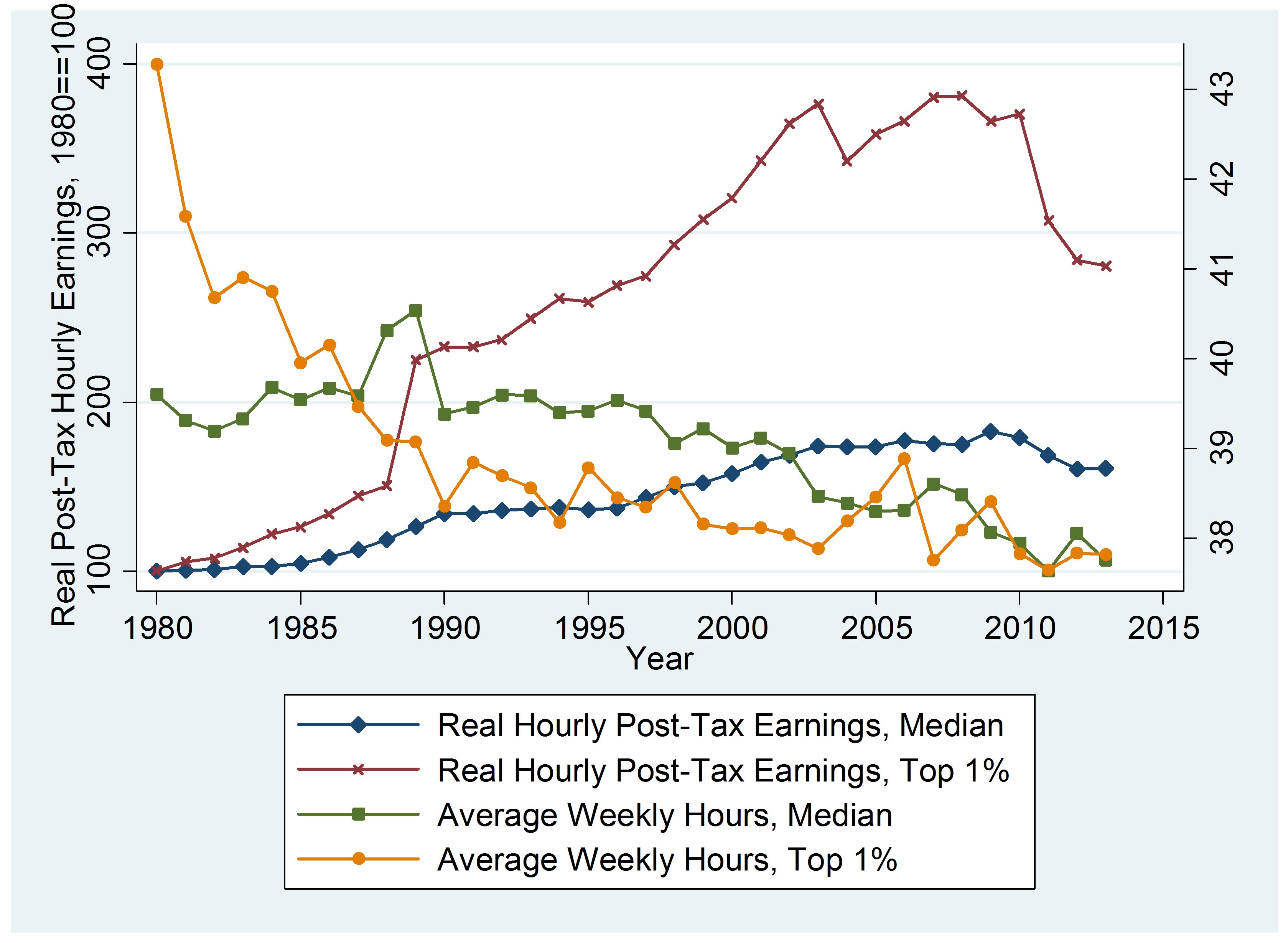

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

Personal Income Tax Rate Schedule Spain Download Table

Personal Income Tax Rate Schedule Spain Download Table

Income Tax And National Insurance Ni Basics Clear House Accountants

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

The Top Rate Of Income Tax British Politics And Policy At Lse

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Chart That Tells A Story Income Tax Rates Financial Times

Evolution Of German Personal Income Tax System Download Table

Effective Income Tax Rates After Budget 2021 Social Justice Ireland

Chart That Tells A Story Average Income Tax Rates Financial Times

Personal Income Tax Rate Schedule Portugal Download Table

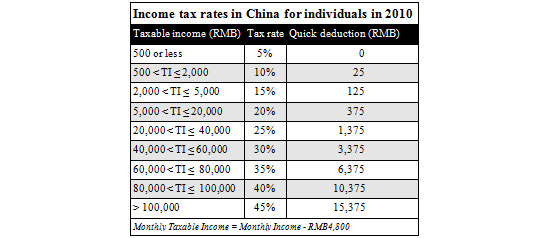

China Expatriate Annual Income Tax Reporting For 2010 Tax Year China Briefing News