Interest SubventionIncentive for prompt repayment as advised by Government of India and or State Governments. The farmers repaying promptly as above would get short term loans 4 per annum after an additional interest subvention of 3 per annum during the years 2018-19 and 2019-20.

How Interest Subvention Schemes In Real Estate Work Businesstoday

Interest subvention is to be provided on a maximum limit of Rs 2 lakh short term loan to farmers involved in animal husbandry and fisheries.

Interest subvention scheme for farmers rbi. 2018-19 and 2019-20 with the following stipulations. April 14 2015 Dear All Welcome to the refurbished site of the Reserve Bank of India. Accordingly to ensure that farmers do not have to pay penal interest and at the same time continue getting the benefits of interest subvention scheme Government has decided to continue the availability of 2 IS and 3 PRI to farmers for the extended period of repayment upto 31052020 or date of repayment whichever is earlier for short term.

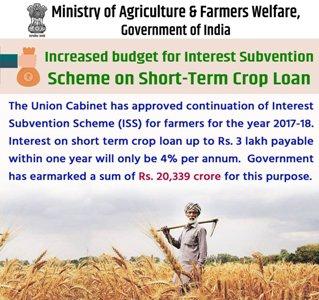

The Central Government provides to all farmers for short term crop loan upto one year for loan upto Rs. The Centre has already approved the scheme. RESERVE BANK OF INDIA.

In order to provide short-term. Major Item Group Principal Commodity Commodity Code Description HS code Description 1 Leather Leather manufactures 42 LEATHER GOODS 42032910 GLOVES FOR USE IN INDUSTRY 2 Jute Mfg. Subsidy on Short Term Agriculture Loans by DBT.

The Interest Subvention Scheme is being implemented by NABARD and RBI. In this regard it is advised that Government of India has now issued the operational guidelines of the Interest Subvention Scheme for Kisan Credit Card facility to fisheries and animal husbandry farmers for a period of two years ie. With this interest subvention such farmers will get short-term loan of up to Rs 2 lakh at a concessional rate of 7 per cent.

Iv To provide relief to farmers affected by natural calamities the interest subvention of two percent will continue to be available to banks for the first year on the restructured amount. Such restructured loans may attract normal rate of interest from the second year onwards as per the policy laid down by the RBI. The KCC holder should have the option to take benefit of Crop Insurance Assets Insurance.

An additional 3 per cent interest subvention is provided to farmers who pay their loans promptly. The details of the Scheme are as follows. B The scheme would be applicable wef 01042015 for 5 yearsGovernment however reserves the right to modifyamend the Scheme at any time.

In this regard it is advised that Government of India has now issued the operational guidelines of the Interest Subvention Scheme for Kisan Credit Card facility to fisheries and animal husbandry farmers a period of two for syearie. Under the scheme an additional 2 per cent interest subvention is provided to farmers repaying loans promptly. The Reserve Bank of India RBI Thursday notified the norms for banks with regards to two per cent interest subvention or subsidy for short-term crop loans during 2018-19 and 2019-20.

Under this scheme the farmers can avail concessional crop loans of upto Rs3 lakh at 7 per cent. Including Floor Covering. In this regard it is advised that Government of India has approved the implementation of the Interest Subvention Scheme with modifications for the years 2018-19 and 2019-20 for.

The bankers will make the farmers aware of this facility. 3 lakhs borrowed by them. To ensure hassle-free benefits to farmers under Interest Subvention Scheme the banks are advised to make Aadhar linkage mandatory for availing short-term crop loans in 2017-18.

LIST OF SECTORSSUB-SECTORS ON WHICH INTEREST SUBVENTION IS TO BE EXTENDED Sl. RBI Interest Subvention Scheme ISS 2018-19. Interest subvention of 2 to banks and 3 to farmers towards Prompt Repayment incentive is extended on short-term loans up to Rs2 lakh to animal husbandry and fisheries farmers apart.

The GoI has extended the Interest subvention Scheme on KCC issued to crop loan farmers to the KCC issued to Animal Husbandry and Fisheries farmers from 2018-19. For such farmers the effective interest rate is 4 per cent. 2018-19 and 2019-20 with the following stipulations.

Two a much improved search well at least we think so but you be the judge. The interest subsidy scheme is applicable for loans taken during 2018-19 and 2019-20. Farmers paying the loans promptly will be eligible for another three per cent discount on the interest rate.

One in addition to the default site the refurbished site also has all the information bifurcated functionwise. To ensure hassle-free benefits to farmers under Interest Subvention Scheme banks are advised to make Aadhar linkage mandatory for availing short-term crop loans in 2018-19 and 2019-20. Under this scheme farmers can avail loans upto 3 lakhs at subsidized interest rate of 7 which could go down to 4 on prompt repayment.

Interest subvention for short term crop loans. In order to provide short-term crop loans up to Rs 3 lakh to farmers at an interest rate of 7 per cent per annum the government offers interest subvention of 2 per cent per annum to banks. A The rate of interest equalisation 3 per annum will be available on Pre Shipment Rupee Export Credit and Post Shipment Rupee Export Credit.

To ensure hasslefree benefits to farmers under- Interest Subvention Scheme banks are advised to make Aadhar linkage mandatory for availing short-term crop loans in 2018-19 and 2019-20. Further from 201-19 the I8 nterest Subvention Scheme is being put on DBT. All lending banks are requested to send to us the eligible pending audited claims of 2015-16 latest by August 31 2017 as already advised vide our email dated August.

Interest Subvention Scheme for Short Term Crop Loans during the years 2018-19 and 2019-20 RBI conveying continuation of Interest Subvention Scheme on the interim basis. Reserve Bank of India RBI will implement Interest Subvention Scheme 2018-19 for Short Term Crop Loans. The two most important features of the site are.

Further from 2018-19 the Interest Subvention Scheme is being put on DBT mode on In Kindservices basis and all short term crop loans processed in 2018.

Jagan Launches Zero Interest Subvention Scheme For Farmers The Hindu

Fact Checking Government Claims On Affordable Credit To Farmers

Cabinet Approves Interest Subvention On Short Term Crop Loans Here S Are Its Features Zee Business

Govt Approves 2 Interest Subvention Scheme For Small Mudra Borrowers Business Standard News

Exporters Hope For Interest Subvention Scheme To Help Msmes Counter Coronavirus Crisis

Rbi Extends Interest Subvention Scheme For Msmes Till 31st March 2021

India Announces Interest Subvention Scheme For Farmers

Govt Extends Interest Subvention But It S A Flawed Solution For Farm Woes Business News Firstpost

Farm Subvention Scheme On Crop Loans To Continue At 7 The Financial Express

Interest Subvention Scheme Subsidy Indiafilings

Parshottam Rupala Interest Subvention Scheme For Short Term Crop Loans Of Rs 3 Lakh

Pfms Public Financial Management System All About Pfms Financial Management Managing Finances E Payment

Interest Subvention Scheme Agri Exam

From Aadhaar Linkage To Farm Loans Upto Rs 3 Lakh Here S What Interest Subvention Scheme 2017 18 Is About Zee Business

How Interest Subvention Schemes In Real Estate Work Businesstoday

Banks To Seek Repayment Relaxation Under Kisan Credit Scheme

Government Approves Interest Subvention Scheme For Farmers