However non-MSME large exporters who export the 416 eligible products will continue to receive interest subvention at 3 per cent. Interest Subvention Scheme for Incremental credit to MSMEs 2018 will be implemented over 2018-19 and 2019-20.

Big News For Msmes And Trading Concerns Interest Subvention Scheme Extended Till 31 03 2021 Youtube

Exporters get subsidy under the Interest Equalisation Scheme for pre and post shipment Rupee Export Credit.

Interest subvention scheme for exporters 2018-19. The rate of subvention was fixed at 3 from 152015 however for MSME sector the rates has been increased to 5 with effect from 2 nd November 2018. Interest Subvention Schemefor Incremental credit to MSMEs2018 will be implemented over 2018-19 and 2019-20 with an allocation of Rs975crare. Government of India has announced INTEREST SUBVENTION SCHEME for both manufacturing and service enterprises to increase productivity while reducing the cost of credit.

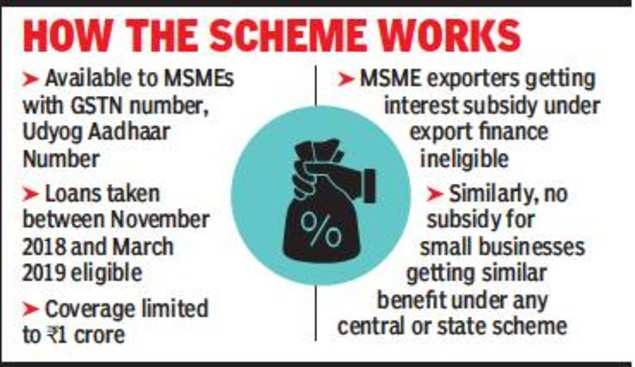

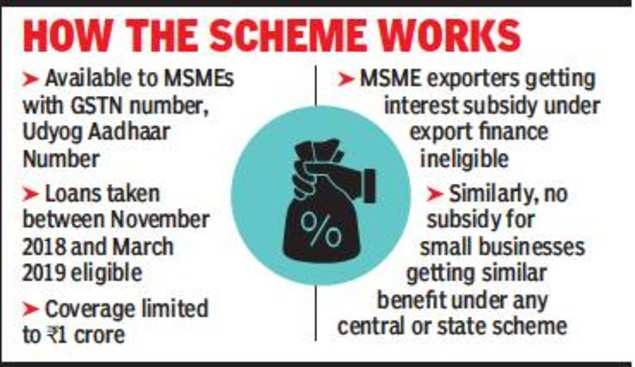

The scheme for MSME Interest Subvention Scheme for Incremental credit to MSMEs 2018 has to be implemented from 2018-19 and 2019-20 as has been decided by The Ministry of MSME. MSME by an eligible institution interest subvention would be made available for a maximum financial assistance of 100 lakh. All GST registered MSMEs will be eligible for 2 interest subvention on fresh or incremental loan amount under this scheme for the financial year 2018-19 2019-20.

January 2 2019 under the ongoing Interest Equalisation Scheme for Pre and Post Shipment Rupee Export Credit and allow them interest equalisation at the rate of 3 on credit for export of products covered under 416 tariff lines identified under the Scheme. 2 nd November 2018. Seeking to encourage exports the government has increased allocations towards interest subsidy scheme in the Budget to Rs 2500 crore for 2018-19.

The scheme earlier called Interest Subvention Scheme was announced by the government in November 2018 for all exports of MSME and 416 tariff lines. During April-November 2018-19 the Indias merchandise exports grew by 1158 to 2175 billion. Interest subvention for allGSTregistered MSMEson freshor incremental loans.

Earlier this week the government announced its plan to extend the benefit of its Interest Subvention Scheme to merchant exporters. 15000 crore for this scheme in FY 2018-19. The interest Equalisation Scheme IES for pre and post shipment rupee export credit is being implemented by Directorate DGFT through commercial banksThe scheme came into effect from 01042015 and is for a period of 5 yearsThe scheme was earlier called as interest subvention scheme which was existing for the period from August 2010 to 31032015.

The rate for Large manufacturer and Merchant exporters remains at 3. RBI in its notification reveals that the Interest Subvention Scheme ISS 2018-19 will be settled under Plan Scheme. Ministry of MSME hasdecided that a new scheme viz.

January 2 2019 under the ongoing Interest Equalisation Scheme for Pre and Post Shipment Rupee Export Credit and allow them interest equalisation at the rate of 3 on credit for export of products coveredunder 416 tariff. Reserve Bank of India RBI will implement Interest Subvention Scheme 2018-19 for Short Term Crop Loans. However merchant exporters were largely left out of the ambit of export credit schemes.

In this regard it has been decided by the Government of India to include merchant exporters also wef. Subsequently the Interest Equalisation rate was increased from 3 to 5 in respect of exports by manufacturers of MSME sector wef. The interest subsidy scheme is applicable for loans taken during 2018-19 and 2019-20.

Vi MSME exporters availing interest subvention. WEF 2 nd January 2019 merchant exporters were included under this scheme allowing equalisation rate of 3 per annum for exports of products covered under 416 tariff lines identified under the scheme. Plan Scheme is for Scheduled Caste SC Scheduled Tribe ST and North East Region NER etc.

In November 2018 the interest subsidy was. Interest Subvention Central government has allocated a provision of Rs. Farmers paying the loans promptly will be eligible for another three per cent discount on the interest rateThis also implies that the farmers repaying promptly would get short-term loans at the rate of 4 per cent per annum during 2018-19 and 2019-20.

The scheme covers mostly labour intensive and employment generating sectors like processed agriculturefood items handicrafts readymade garments glass and glassware medical and scientific instruments and auto. 2 interest subvention for all GST registered MSMEs on fresh or incremental loans. Purpose of the Interest Subvention Scheme for MSME.

Salient Features of the Scheme. What is the rate of IES. Under this scheme farmers can avail loans upto 3 lakhs at subsidized interest rate of 7 which could go down to 4 on prompt repayment.

Subsequently in January 2019 another change in policy was. Eligibility for Coverage i All MSMEs who meet the following criteria shall be eligible as beneficiaries under the Scheme.

Interest Equalisation Scheme Everything Indian Exporters Should Know Drip Capital

Interest Equalisation Scheme Everything Indian Exporters Should Know Drip Capital

Interest Subvention Scheme For Msme Extended Up To March 2021

Interest Equalisation Scheme Everything Indian Exporters Should Know Drip Capital

Msmes Get Only Rs 40 Crore Of Rs 625 Crore Interest Subsidy Times Of India

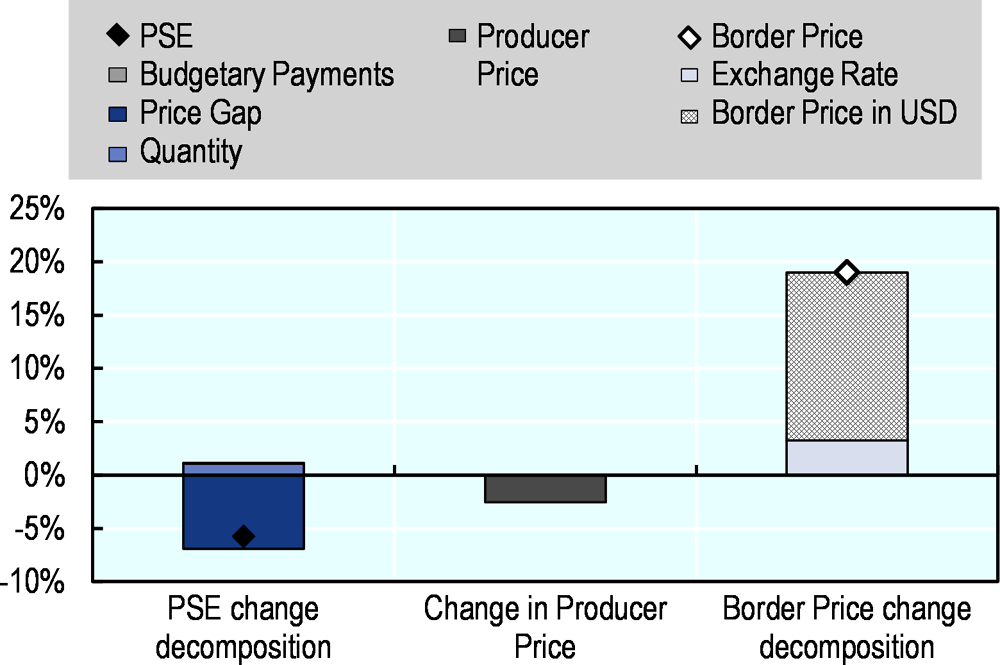

Russian Federation Agricultural Policy Monitoring And Evaluation 2020 Oecd Ilibrary

Interest Subvention Scheme 2019 What Is It And How Can Merchant Exporters Benefit From It Vakilsearch

Interest Equalisation Scheme Everything Indian Exporters Should Know Drip Capital

Msmes Get Only Rs 40 Crore Of Rs 625 Crore Interest Subsidy Times Of India

Msme 2 0 A Policy Prescription For Inclusive Economic Growth Policy Circle

How A Technical Glitch Is Costing Indian Exporters Dearly Businesstoday

Reliance Tatas Control 20 Of Smartphone Electronics Retailing Together Notch Up Rs 50 000 Cr Sales In Fy20 In 2021 Digital Retail Reliance Electronics Retail

Rbi Extends Interest Subsidy Scheme For Exporters Till March 31 2021 Deccan Herald

Banks Asked To Provide Bill Discounting Facility To Msmes Against Payments Due From Large Corporates Facility Bills Large

Foreign Trade And Customs 2018

Understanding The Interest Subvention Scheme Introduced For Msme Lexology

Interest Equalisation Scheme Everything Indian Exporters Should Know Drip Capital

Which Country Is The Biggest Market For India S Textile And Clothing Exports Quora

The Gambia First Review Of The Staff Monitored Program And Request For A 39 Month Arrangement Under The Extended Credit Facility In Imf Staff Country Reports Volume 2020 Issue 102 2020