Personal Tax Relief for YA2014. 5000 Restricted OR 3000 Restricted 3.

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

Tax tax relief YA2014.

Personal tax relief for ya2014. You automatically get tax relief at source on the full 15000. 6360 2 x 3180 3080 2 x 1540 YA 2013 Normal. You put 15000 into a private pension.

If planned properly you can save a significant amount of taxes. Amount of Relief for Various Years of Assessment YAs 4. Total Levy Paid in 2013.

Individual Relief Types Amount RM 1. Not much changes from YA2013 except on the following items. No tax relief is available for non-tax residents.

Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference. I accommodation expenses at premises registered with the Ministry of Tourism Arts and Culture Malaysia. For YA 2019 a Personal Tax Rebate of 50 of tax payable up to maximum of 200 is granted to tax residents.

Of Months Levy Paid in 2012. Non-residents are not eligible to claim personal tax reliefs and income is assessed to tax depending on the types of income. Personal Tax Relief for YA2014.

If you are a non-resident your employment income is taxed at 15 per cent or the resident rate whichever gives rise to a higher tax amount. Not much changes from YA2013 except on the following items. Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference.

The total tax relief is slightly less than my tax relief for the assessment year 2017 which was RM24335. Generally rule is a person is a Malaysia tax resident if heshe stays more than 180 days in Malaysia. You should continue to claim the personal reliefs if you have met the qualifying conditions.

For YA 2017 a Personal Tax Rebate of 20 of tax payable up to maximum of 500 is granted to tax residents. There are various items included for income tax relief within this category which are. Tuition fees paid for third level education.

Differences between tax credits reliefs and exemptions. Stay and Spend Scheme. There are some other rules a person can be qualified as tax resident in Malaysia.

Not much changes from YA2013 except on the following items. Individual and dependent relatives. My estimated tax relief for YA 2018 is RM2146085 RM1846085.

Not much changes from YA2013 except on the following items. Ii entrance fees to tourist attractions these are yet to. Personal Income Tax Relief Cap.

So the estimated total amount of my personal tax relief for YA 2018 is RM2146085 RM1846085. Of Months Levy Paid in 2013. NO more special tax relief of RM2000 ONLY available for YA2013.

Personal tax relief involves the alleviation of tax debt that is offered to certain individuals who are having problems paying their government taxes. For income tax Malaysia tax reliefs can help reduce your chargeable income and thus your taxes. There are four main kinds of personal tax relief most of them being based primarily on income.

Things to do now to maximise income tax relief. Personal Tax Relief for YA2014 April 25 2015 Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief. Director fees consultant fees and all other incomes are taxed at 20 per cent.

Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner OR Parent Restricted to 1500 for only one mother Restricted to 1500 for only one father. You earn 60000 in the 2020 to 2021 tax year and pay 40 tax on 10000. Currently personal tax relief of up to MYR 1000 is given to resident individuals for the following domestic travel expenses incurred from 1 March 2020 to 31 August 2020.

3180 265 X 12 months 1540 170 X 2months 120 X 10 months Maximum FML Relief for YA 2014. The amount of money a person can likely contribute will help determine how much if any tax money. April 25 2015 Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference.

Books journals magazines printed newspapers. Tax rates bands and reliefs. Personal Tax Relief for YA2014 Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference.

Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference. A personal income tax relief cap of 80000 applies to the total amount of all tax reliefs claimed for each Year of Assessment. Individual personal tax relief is only available for individuals who are considered tax resident in Malaysia.

Not much changes from YA2013 except on the following items. Personal Tax Relief for YA2014. Claiming a tax refund if you are unemployed.

This Is The Responsive Grid System A Quick Easy And Flexible Way To Create A Responsive Web Site

Things To Do If You Miss The Tax Filing Deadline In Singapore Visual Ly

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Cover Story The Case For Tax Reform The Edge Markets

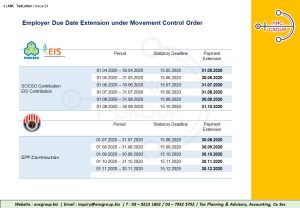

2015 Malaysian Tax Business Booklet

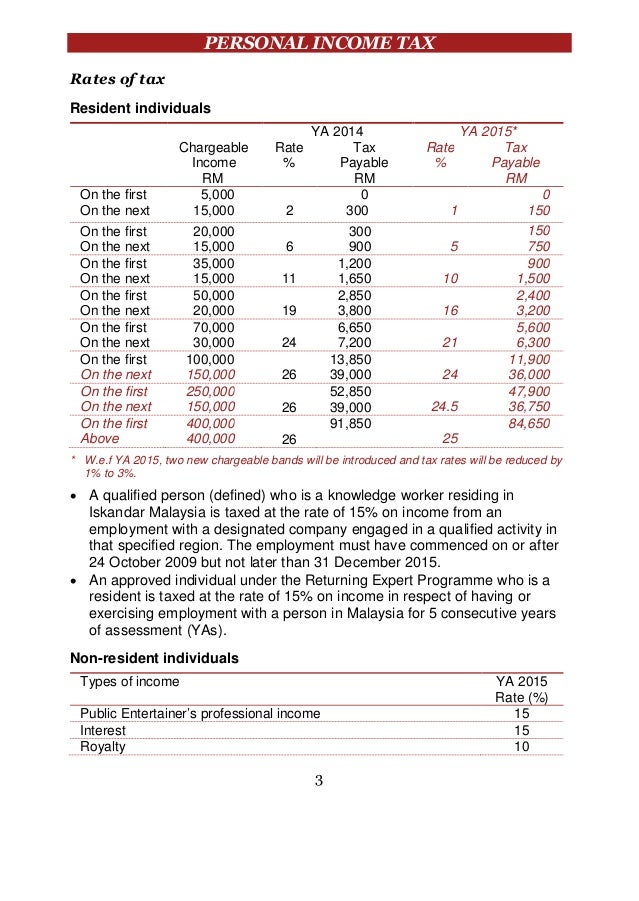

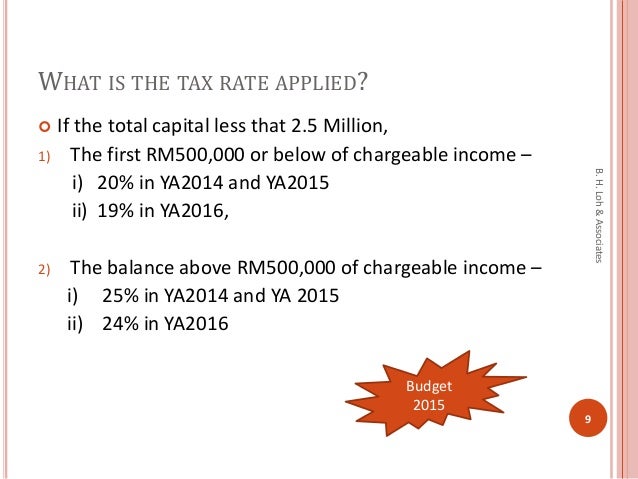

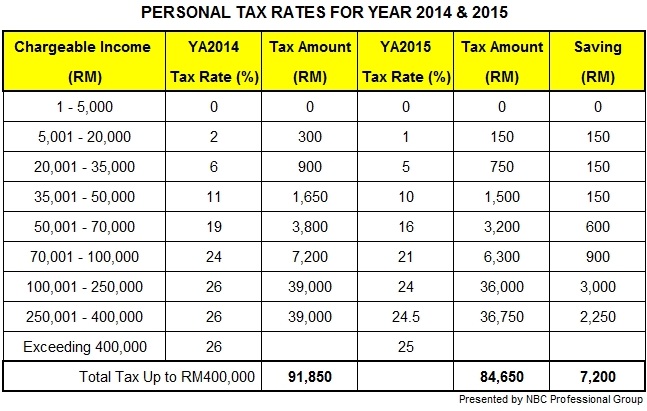

Budget 2015 New Personal Tax Rates For Individuals Ya2015 Tax Updates Budget Business News

Acura Tl 2012 8500 Hialeah Negocialo Ya Acura Tl Acura Hialeah

Guidelines On Tax Treatment Related To The Implementation Of Mfrs 121 Or Other Similar Standards Pdf Free Download

Paper F6 Sgp Taxation Singapore Specimen Exam Applicable From June Fundamentals Level Skills Module Pdf Free Download

Tax On Limited Liability Partnership

Budget 2015 New Personal Tax Rates For Individuals Ya2015 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Budget 2013 Personal Tax Rate Reduced By 1

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News