Previously the relief was limited to RM1000 in YA 2019. Malaysia Personal Income Tax Guide 2020 Ya 2019.

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

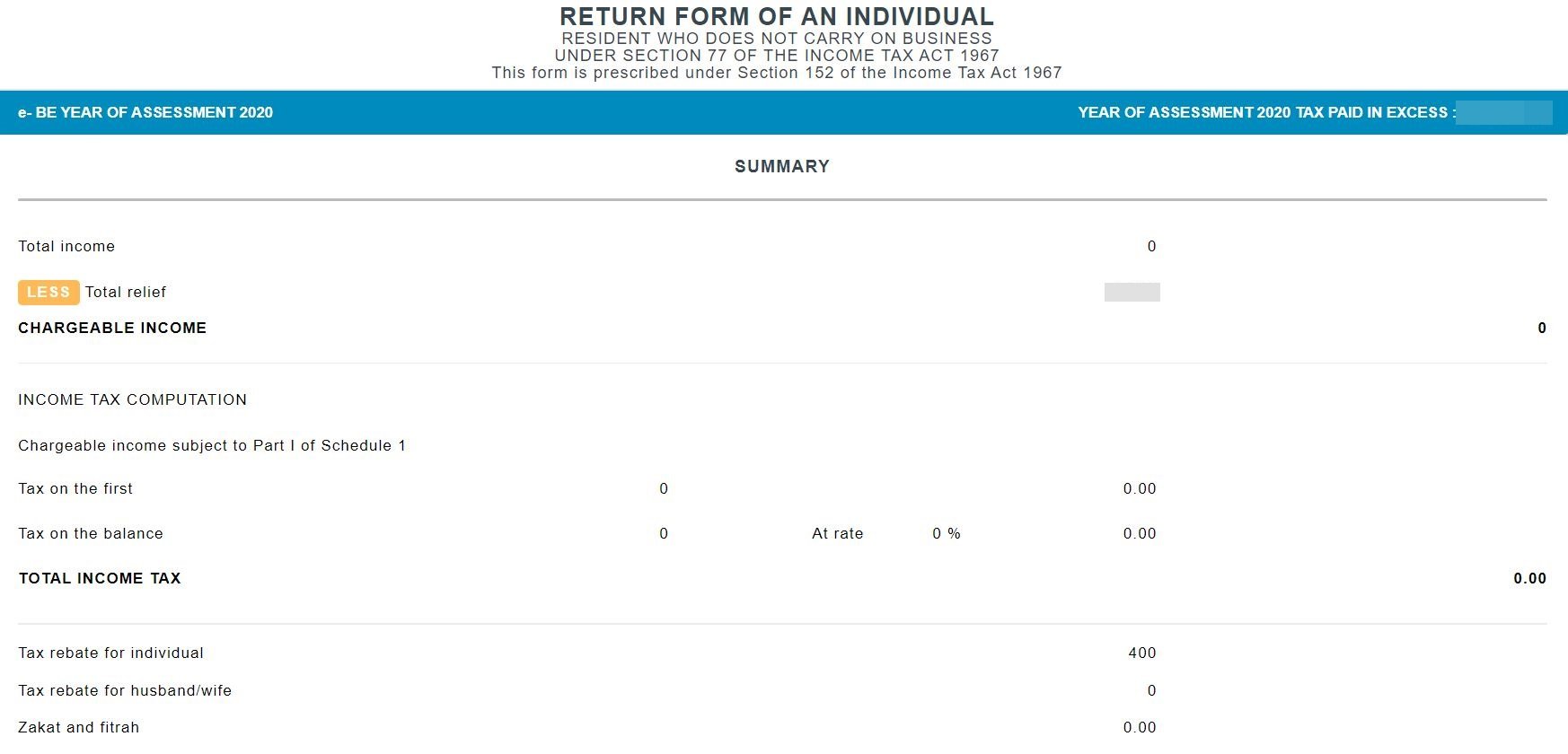

A calculation is done to determine if you have tax to pay or are indeed eligible for a rebate.

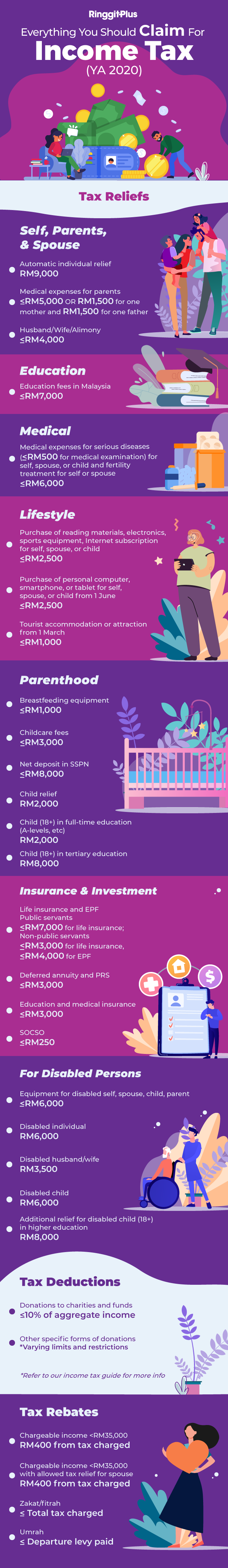

Personal income tax relief ya 2020 malaysia. Previously limited to RM3500 in YA 2020. Previously limited to RM5000 in YA 2020. Malaysia Personal Income Tax Relief 2021.

Personal tax relief malaysia 2020. Malaysia Personal Income Tax Rates 2021 YA 2020 Top 5 Project List. Malaysia Budget 2020 Huge Boons For Workers And Smes Hr Asia.

Residence rules For the purposes of taxation how is an individual defined as a resident of Malaysia. A tax deduction reduces the amount of your aggregate income which the sum of your total income for the year put together. For YA 2020 and YA 2021.

If your chargeable income does not exceed RM 35000 after the tax reliefs and. Personal tax relief Malaysia 2020. Nre Vs Nro Vs Fcnr Which Savings Or Fixed Deposit Account Nri Should Open Nri Saving And Investment Tips Savings And Investment Investment Tips Investing.

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com In 2020 Tax Guide Income Tax Tax Refund. Malaysia Budget 2020 Highlights Of Winners And Losers. Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com In 2020 Tax Guide Income Tax Tax Refund.

The relief amount you file will be deducted from your income thus reducing your taxable incomeMake sure you keep all the receipts for the payments. Previously limited to RM6000 in YA 2020. Ya 2020 rm self.

For expenses incurred between 1 March 2020 until 31 December 2021. Agile Mont Kiara RM1700000. This would bring your chargeable income down to RM35000 and the amount of tax you have to pay is RM600.

24 rows Personal Tax Reliefs 2020 Malaysia. Bayu Height 2 RM793000. For purchases made between 1 June 2020 until 31 December 2020.

Tax rebate for Self. Tax reliefs which can be claimed by resident individuals in malaysia for ya 2019 and 2020. Below is the list of tax relief items for resident individual for the assessment year 2019.

Malaysian personal tax relief 2021. Disabled spouse additional spouse relief. Below is the list of.

Personal tax relief malaysia 2020. Your First Look At 2020 Tax Rates Projected Brackets Standard Deduction Amounts And More. From Year of assessment 2020 not applicable for 201920182017 couples seeking fertility treatment such as in-vitro fertilisation IVF intrauterine insemination IUI or any other fertility treatment approved by a medical practitioner registered under the Malaysian Medical Council MMC can also claim under this income tax relief in Malaysia.

Personal Tax Reliefs 2020 Malaysia. For example say your employment income is RM50000 a year and you have claimed RM15000 in tax reliefs. A tax rebate reduces your amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2020.

19 rows Additional relief for expenditure related to cost of purchasing sports equipment. Income Tax Relief Ya 2020 Malaysia. Zakat and fitrah can be claimed as a tax rebate for the actual amount expended up until the total tax amount.

2020 Summary Personal Income Tax Relief 2020 Malaysia. For income tax Malaysia tax reliefs can help reduce your chargeable income and thus your taxes. Malaysian should pay attention if their.

Things to do now to maximise income tax relief. Personal Income Tax Relief 2020 Malaysia. Agile Bukit Bintang RM1100000.

The income of a non-resident individual is subject to income tax at 28 percent 30 percent with effect from Year of Assessment 2020 without personal relief. There are various items included for income tax relief within this category which are. If planned properly you can save a significant amount of taxes.

Ultimate Tax Relief Guide For Malaysians Free Malaysia Today Tax Guide Tax Debt Relief Relief. Found On Bing From Www Imoney My Income Tax Income Income Tax Return. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually.

The prime minister announced that personal income tax relief in the amount of myr 1 000 on travel expenses incurred from 1 march 2020 to 31 august 2020 is to be extended to 31 december 2021. Education fees individual 5 000 limited 6. Books journals magazines printed newspapers.

22 rows In the event the total relief exceeds the total income the excess cannot be carried forward to.

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2021 Homage Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

Income Tax 2020 Everything You Should Claim As Income Tax Relief News Rojak Daily

You Can Claim These Tax Reliefs For Year Of Assessment 2020

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Income Tax A Quick Guide To The Tax Reliefs You Can Claim For 2020 Buro 24 7 Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

Income Tax 2020 Everything You Should Claim As Income Tax Relief News Rojak Daily

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Deadline To File Income Tax 2019 Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

Pemerkasa Assistance Package Crowe Malaysia Plt

Maximising Your Individual Tax Reliefs Crowe Malaysia Plt

Malaysia Personal Income Tax 2021 Major Changes Youtube

Malaysia Income Tax A Quick Guide To The Tax Reliefs You Can Claim For 2020 Buro 24 7 Malaysia