The standard rates of SST are 10 and 6 with different rates or exemptions for certain goods and services. SST usage creates value for the customer eg.

The Move From Gst To Sst Mcmillan Woods

Social Security disability benefits can provide for your family when an injury illness or disability prevents you from working and earning an income.

What is implication of sst on financial. This guide will explain how Social Security disability benefits. Swiss Re and SAP recently announced the start of a multi-year innovation project focused on addressing the increasingly complex demands from regulators on reporting and financial steering. Manufacturers will be forced to be more cost-effective in order to remain competitive.

One expected benefit from the SST is a lower cost of living as sales tax is charged just once by the manufacturer at the point of sale. We focus on resultant effects on the Swiss capital market concerning bond real estate stock foreign exchange markets and the situation in case of a capital market crisis. While the proportion made on and after 1 Sept 2018 is subject to 6 service tax.

The consideration of SST focuses on quantitative impacts and as a result assessing the results depends on the structure of the firm and the resources allocated. Using the theoretical lens of Service-Dominant Logic an analysis of SST experiences indicates that customers undertake a variety of SST roles such as that of convenience. The result of the project will be a new solution that streamlines and standardises these processes.

The proposed rates of tax will 5 and 10 or a specific rate. Applying for these benefits is often seen as a cumbersome process however requiring several steps a slew of complicated paperwork and even in-person hearings. Receipts from the SST depend on the strength of private consumption and business spending activities.

Financial services- proposed 1199A-5b2ix Because IRC 1202e3A includes the term financial services and banking is separately listed in section 1202e3B proposed 1199A-5b2ix limits the definition of financial services to services typically performed by financial advisors and investment bankers including. Types of SSTs on base of interface Meuter Ostrom Roundtree Bitner 2000. The reintroduction of the sales and services tax SST in September this year will see lower prices of goods in general but there could be a potential spike in the prices of some items including the cost or charges for services rendered.

Up to 10 cash back Second we investigate the SSTs major economic implications due to altered asset and liability management based on the study by Schmeiser et al. Scope and frequency of SST exercises see Element 1ii. One of the most familiar examples of SST is using ATM automated teller machine for various bank transactions.

Is the tax implication on the service provided. What do stakeholders consider to be the benefits or other implications from a multi-CCP SST. Sales tax is charged on taxable goods that are manufactured in or imported into Malaysia.

Goods are taxable unless specifically listed as being exempt from sales tax. SST is a one-stage output tax and is governed under two separate laws namely. May 20 2009 2.

The existing Sales and Services Tax SST contributes only 77 of total revenue. Sales Tax mainly for manufacturers and importers Service Tax mainly for service providers such as accounting IT FB Company For this illustration I would focus on sales tax where the rate is fixed at 10 on manufactured goods. Paul Dorsey Dulcian Inc.

Manufactured goods exported would not be subject to sales tax. Will I be charged RM25 on my existing credit or charge card on 1 September 2018. Audit Implications of Integrated Financial Management Information Systems 1.

Audit Implications of Integrated Financial Management Information Systems IFMISs Dr. A perception of lack of control over the SST encounter. Once results are prepared they are considered by the Board who then discuss the output and agree on actions to be taken if necessary.

SST Sales and Service Tax is comprised of two components The first is the service tax to be levied and paid in conjunction with taxable services provided in and supported by. Remaining cognisant of confidentiality concerns and the potential need for aggregation and anonymisation of test results how do stakeholders anticipate using the results of SST exercises. A sense of accomplishment or destroys value eg.

GST should be charged at 0 on the proportion of the supply made before 1 Sept 2018. SST is a single-stage tax which means that it is levied only once during the entire supply chain either at the time of manufacture or at the time of importation into Malaysia The cost of living will probably fall consumption will increase and companies will be able to sell their products at competitive prices.

Gst Better Than Sst Say Experts

Pdf Goods And Services Tax Gst Transition To Sales And Services Tax Sst Impact On The Welfare Of B40 And M40 Households In Malaysia

Comparing Sst Vs Gst What S The Difference Comparehero

Pdf Customer S Choice Amongst Self Service Technology Sst Channels In Retail Banking A Study Using Analytical Hierarchy Process Ahp

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Pdf Impact Of Self Service Technology Sst Service Quality On Customer Loyalty And Behavioral Intention The Mediating Role Of Customer Satisfaction

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Sst Will Property Prices Come Down Edgeprop My

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

How Will Sst Impact Prices 5 Things Consumers Should Know Iproperty Com My

Tax Only A Few Issues To Iron Out With Sst Say Experts The Edge Markets

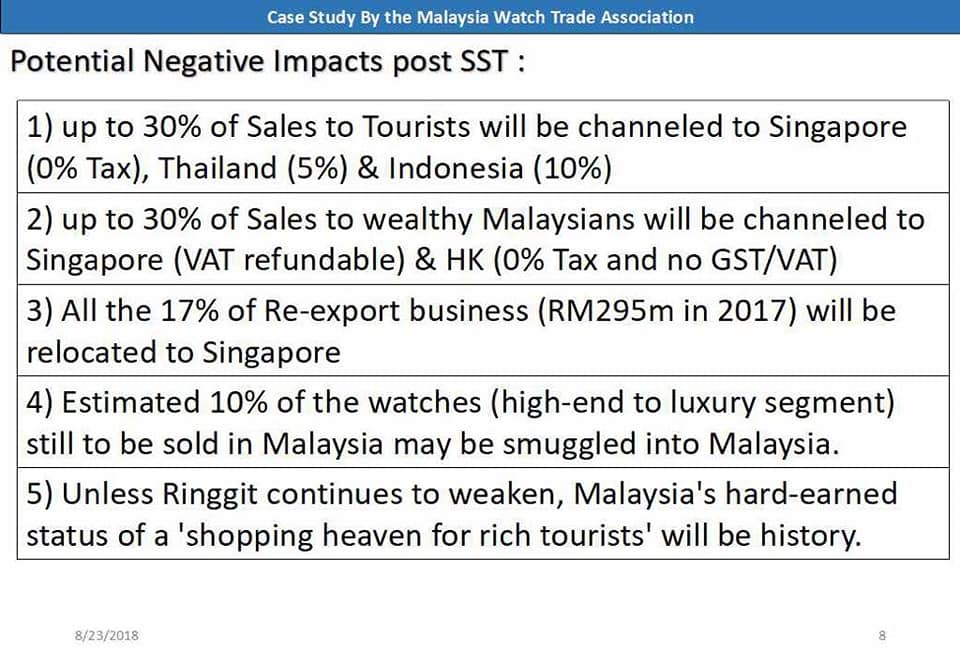

Malaysia Sales And Services Tax Sst Mwta

Impact Of Sst On Consumers In Malaysia Money Compass

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Pdf Goods And Services Tax And Sales And Services Tax In Malaysia A Review Of Literature

Sst Vs Gst Here Are 5 Things That You Need To Know

Pdf Review On Global Implications Of Goods And Service Tax And Its Indian Scenario

What Is Gst Goods And Services Tax Or Gst Is A Consumption Tax Based On Value Added Concept Unlike The Present Sales Tax Or Service Tax Which Is A Single Stage Tax Gst Is A Multi Stage Tax Payment Of Tax Is Made In Stages By Intermediaries In The