A low LTV may improve your odds at getting a better mortgage. The loan-to-value LTV ratio is the percentage of your homes appraised value or purchase price if it is lower that you are borrowing.

A Guide To Loan To Value Ratio Rocket Mortgage

Generally for every 5 increase in loan to value above 70 the interest rate increases by 18 of a percent.

What does 70 loan to value mean. This means our hypothetical borrower has a loan for 70 percent of the purchase price or appraised value with the remaining 30 percent the home equity portion or actual ownership. The loan-to-value is the ratio between the value of the loan you take out and the value of the property as a whole expressed as a percentage. This is the maximum size of your loan compared to the value of the car youre buying.

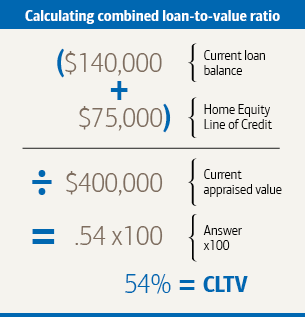

The ratio is the loan amount relative to a homes value. A loan-to-value LTV ratio is a financial term used by lenders to describe the ratio between the value of your home loan and the homes value and represent the first mortgage line as a percentage of the total appraised value of your home. For a simple example.

If a lender provides a loan worth half the value of the asset for example the LTV is 50. More specifically the ratio measures the relationship between the loan amount and the market value of the car that youre buying. Its often the wholesale or trade-in price of a used car.

To calculate your LTV divide your loan amount by the homes appraised value or purchase price. What does LTV mean. It describes the amount of the mortgage loan expressed as a percentage of the homes value.

Then multiply by 100 to turn the ratio into a percentage. NerdWallets loan-to-value calculator helps determine your LTV ratio for a home purchase refinance or home equity loan. In addition most lenders require private mortgage insurance premiums or PMI on.

For new cars its usually the invoice price or MSRP. The lower your LTV the less risky a mortgage application appears to lenders. To calculate your LTV ratio take your mortgage amount and divide it by the purchase price or appraised value of the home whichever is lower.

Loan-to-value LTV ratio is a number lenders use to determine how much risk theyre taking on with a secured loan. This is the amount you plan to borrow. Multiply the result by 100 to get your LTV which is 80.

It also shows how much equity a. Obviously the lower the percentage the better. First subtract your down payment 30000 from the total selling price 150000 to get 120000.

It is one of the main factors that your bank or building society will assess when. Different lenders have different ways of determining a cars value. Published on November 2 2020.

The remaining value is paid as a deposit. Say you want to buy a house worth 300000 and you have 60000 in. Quite simply loan-to-value is a way of expressing the difference between the value of the house youre buying and the amount of money youre borrowing to pay for it.

Your loan to value ratio LTV compares the size of your mortgage loan to the value of the home. It measures the relationship between the loan amount and the market value of the asset securing the loan such as a house or car. Loan to Value Definition In simple terms LTV is a risk assessment ratio that mortgage companies banks and other lenders look at to determine whether or not to approve a mortgage loan.

A loan-to-value LTV ratio is the relative difference between the loan amount and the current market value of a home which helps lenders assess risk before approving a mortgage. The loan-to-value ratio is a simple formula that measures the amount of financing used to buy an asset relative to the value of that asset. If youre planning to purchase a car worth 100000 and your loan amount is 90000 then your LTV would be 90 percent.

Then divide your loan amount 120000 by the value of the property 150000 to get 80.

Explainer What Is Loan To Value Ratio And Why Is It Important

Explaining The Loan To Value Ltv Ratio Valuechampion Singapore

Why Loan To Value Ratio Matters For Your Mortgage Unbiased Co Uk

How To Calculate Your Home S Equity Loan To Value Ltv Tips

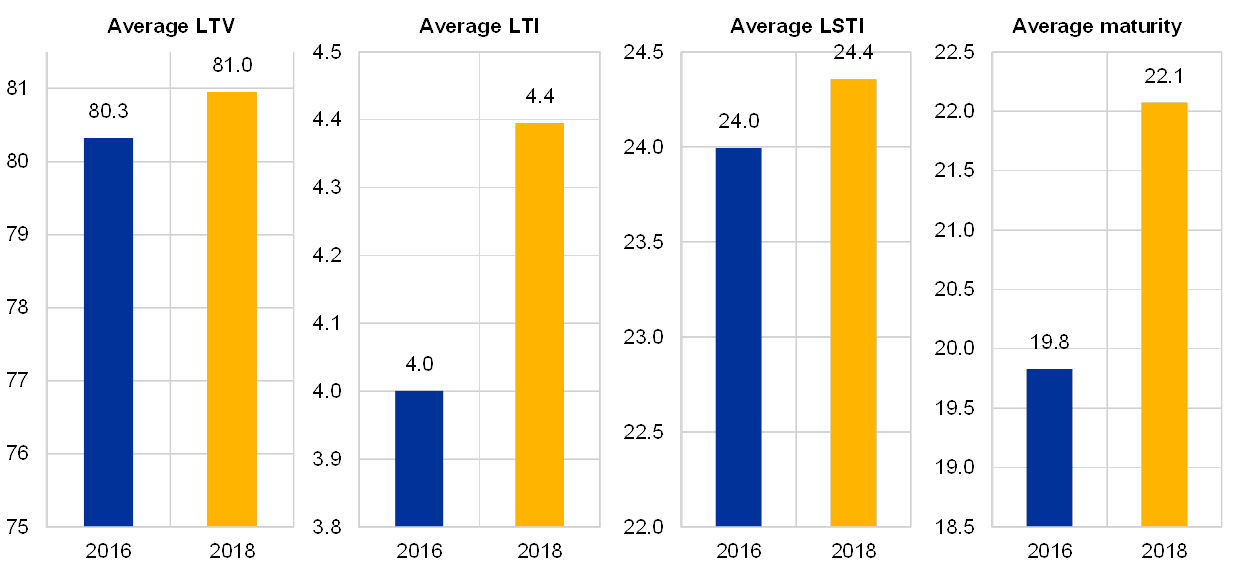

Trends In Residential Real Estate Lending Standards And Implications For Financial Stability

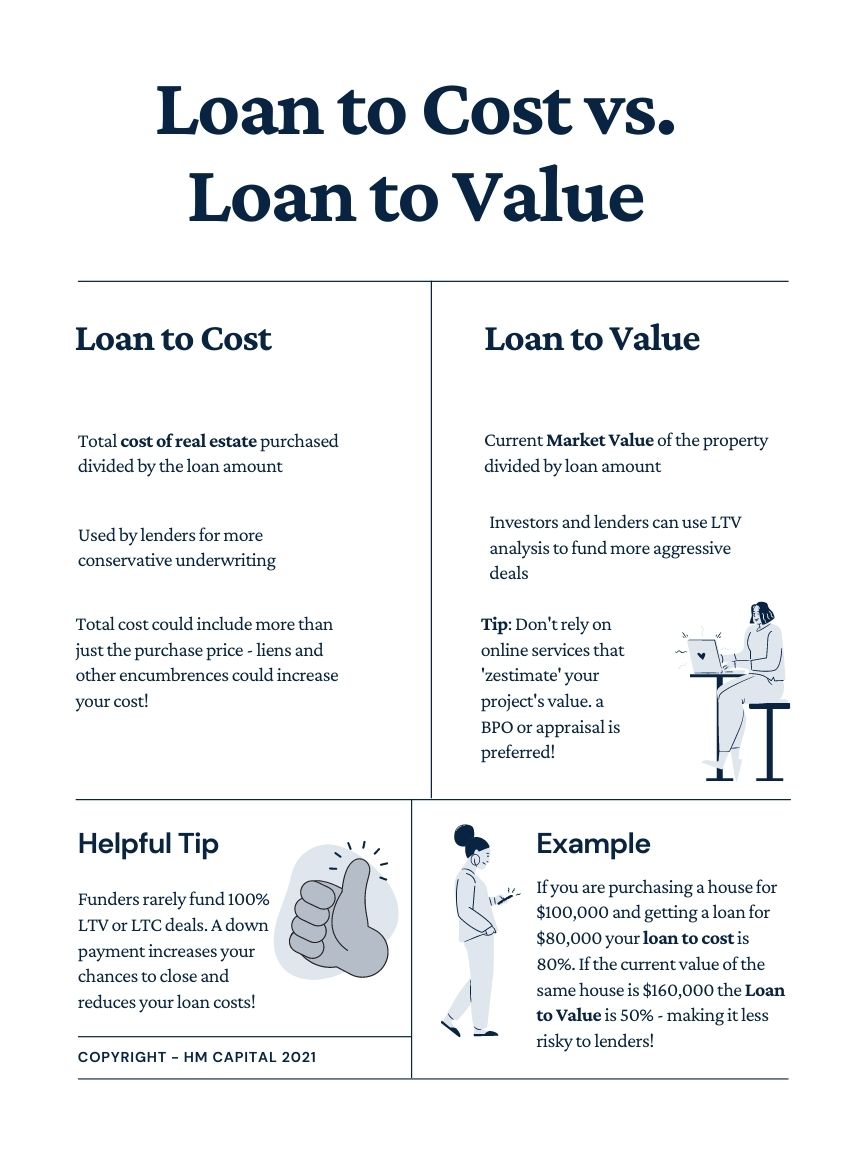

Loan To Cost Vs Loan To Value Definitions

Trends In Residential Real Estate Lending Standards And Implications For Financial Stability

Depending On Location Market Conditions The Length Of Time A Home Has Been Owned And Other Factors That Can Mean Maki Home Equity Divorce Cash Out Refinance

Trends In Residential Real Estate Lending Standards And Implications For Financial Stability

Trends In Residential Real Estate Lending Standards And Implications For Financial Stability

Top 10 Money Investment Strategies Investing Money Investing Buying Investment Property

How To Calculate Your Home S Equity Loan To Value Ltv Tips

What Is A Good Loan To Value Ltv Ratio Smartasset

Why Do You Need A Home Appraisal In 2021 Home Appraisal Reverse Mortgage Residential Real Estate

What Is Loan To Value Ltv Ratio In Malaysia Propertyguru Malaysia

Trends In Residential Real Estate Lending Standards And Implications For Financial Stability

Loan To Value Ltv How To Increase The Loan Quantum For Your Property Property Blog Singapore Stacked Homes

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Loan Advisors 714 271 8524 Reverse Mortgage Mortgage Loans Mortgage